Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

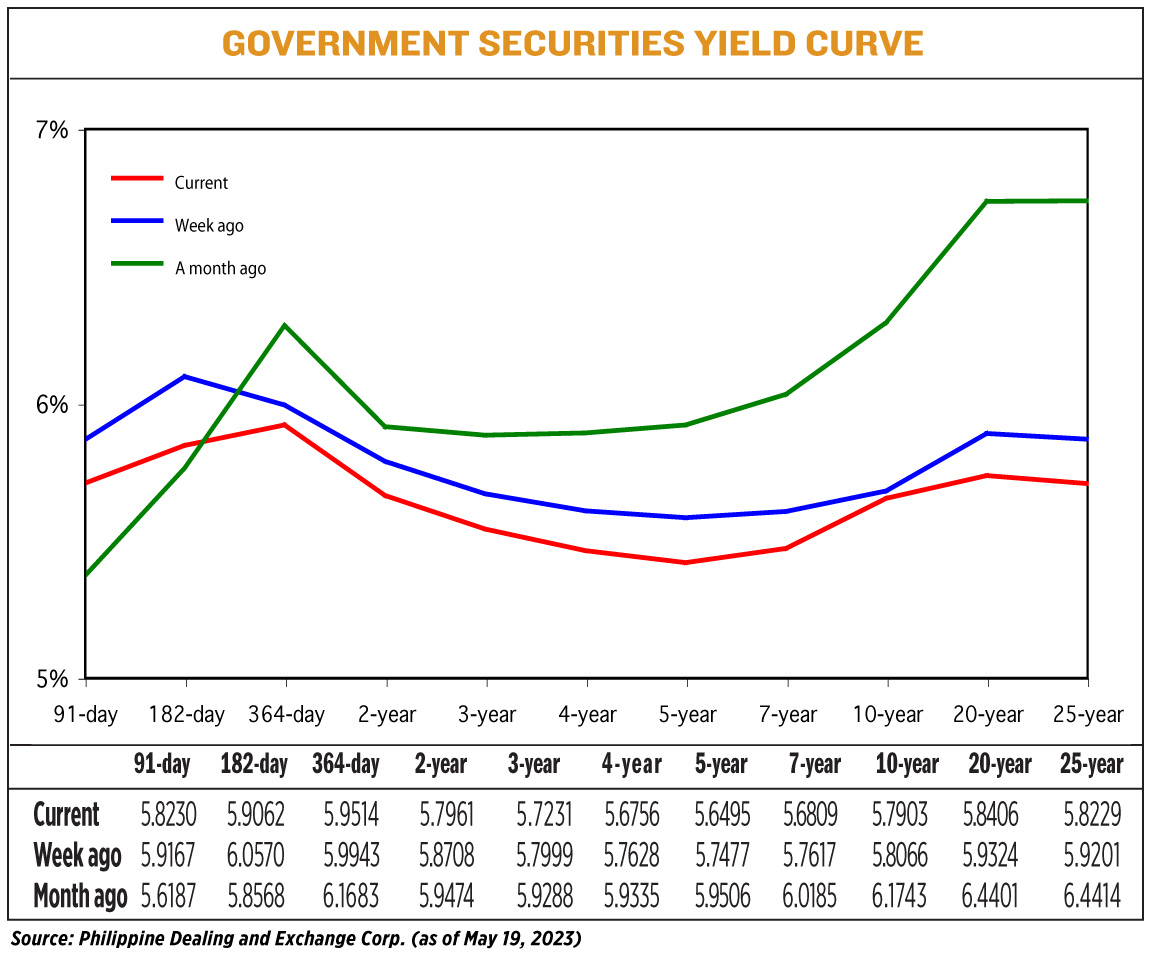

Gov’t debt yields go down

GOVERNMENT SECURITIES (GS) rallied last week after the Bangko Sentral ng Pilipinas (BSP) decided to keep its benchmark interest rate unchanged amid easing inflation.

GS yields, which move opposite to prices, at the secondary market went down by 8.28 basis points (bps) on average week on week, based on the PHP Bloomberg Valuation Service Reference Rates as of May 19 published on the Philippine Dealing System’s website.

Rates fell week on week across the board at the end of trading on Friday. The yield curve remained inverted.

Yields on the 91-,182- and 364-day Treasury bills declined by 9.37 bps, 15.08 bps, and 4.29 bps, respectively, to 5.8230%, 5.9062%, and 5.9514%.

At the belly, the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) saw their rates drop by 7.47 bps (to 5.7961%), 7.68 bps (5.7231%), 8.72 bps (5.6756%), 9.82 bps (5.6495%), and 8.08 bps (5.6809%), respectively.

Yields on the 10-, 20-, and 25-year papers likewise decreased by 1.63 bps, 9.18 bps, and 9.72 bps, respectively, to 5.7903%, 5.8406%, and 5.8229%.

Total GS volume reached PHP 17.08 billion on Friday, higher than the PHP 15.74 billion seen on May 12.

Strong gross domestic product (GDP) growth and the BSP’s policy decision drove yield movements last week, Security Bank Corp. Chief Investment Officer for Trust and Asset Management Group Noel S. Reyes said in a Viber message.

“Yields came off strong initially from added buying, as sustained strong GDP amid the trending lower of inflation and the BSP pause was a good combination to generate more positive sentiment,” Mr. Reyes said.

“However, the last two trading days of the week saw some profit taking given that Fed may yet still have a chance to raise policy rates in the US that could affect fixed income markets elsewhere,” he added.

Local bonds rallied on expectations of a tightening pause from the BSP, ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa likewise said in an e-mail.

“Yields are impacted by both the outlook on policy rates and inflation. Shorter dated bonds are more sensitive to policy rates and less to inflation while long-end bonds are more reactive to inflation and less to policy direction,” Mr. Mapa said.

The Philippine economy grew by 6.4% in the first quarter, the slowest in two years as elevated inflation and rising interest rates dampened consumer spending.

GDP expanded by 6.4% in the January-to-March period, slower than the revised 7.1% growth in the previous quarter and the 8% expansion in the first three months of 2022.

Still, this was within the government’s 6-7% target for the year.

Meanwhile, the BSP last week paused its tightening cycle and signaled that borrowing costs could remain unchanged at its next two to three meetings as inflation continues to ease.

The Monetary Board on Thursday kept its policy rate unchanged at 6.25%. Interest rates on the overnight deposit and lending facilities were also maintained at 5.75% and 6.75%, respectively.

This is the first time the BSP left rates untouched after nine meetings. Since it began its aggressive monetary tightening cycle in May 2022, the central bank has raised borrowing costs by a total of 425 bps.

Headline inflation eased to an eight-month low of 6.6% in April from 7.6% in March.

For the first four months, inflation averaged at 7.9%, higher than the 3.7% seen a year ago. This is still well above the BSP’s 2-4% target and 5.5% forecast for the year.

For its part, the US Federal Reserve has raised borrowing costs by 500 bps since March 2022, with its target interest rate now at 5-5.25%.

Market players expect the Fed to start keeping rates on hold at its next meeting on June 13-14.

For this week, yields may move sideways amid a lack of catalysts, Security Bank’s Mr. Reyes said.

“Yields could correct [this] week after the sharp moves we have seen of late with market participants watching the US debt talks for more direction,” ING Bank’s Mr. Mapa said.

“The favorable inflation in April and the BSP prudent pause contributed to the better outlook for rates… Interest rates are seen to continue to move sideways to down in the near term,” Jonathan Ravelas, managing director of eManagement for Business and Marketing Services, said in a Viber message. — Lourdes O. Pilar

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld