Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Gov’t debt yields drop on slower Nov. inflation bets

Yields on government securities (GS) ended lower last week as investors expect slower November inflation at home and the US Federal Reserve to keep rates steady for the rest of the year.

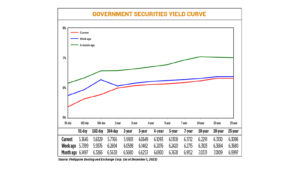

GS yields at the secondary market fell by an average of 16.64 basis points (bps) week on week, based on the PHP Bloomberg Valuation (BVAL) Service Reference Rates of Dec. 1 published on the Philippine Dealing System’s website.

Rates went down across all tenors. The 91-, 182-, and 364-day Treasury bills (T-bills) declined by 37.54 bps, 30.47 bps and 49.28 bps to yield 5.3645%, 5.6329%, and 5.7766%, respectively.

At the belly of the curve, the rates of the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) went down by 6.97 bps (5.9901%), 8.33 bps (6.0649%), 9.83 bps (6.1093%), 11.12 bps (6.1308%), and 10.03 bps (6.1712%), respectively.

At the long end, yields on the 10-, 20-, and 25-year T-bonds dropped by 8.12 bps (to 6.2291%), 5.54 bps (6.313%), and 5.82 bps (6.3098%), respectively.

Total GS volume traded amounted to PHP 9.3 billion on Friday, lower than the PHP 23.25 billion recorded on Nov. 24.

“Expectations of slowing inflation have fueled yields to fall. This is supported by bets that the US Fed may be at the end of its tightening cycle,” Jonathan L. Ravelas, senior adviser at Reyes Tacandong & Co., said in a Viber message.

A BusinessWorld poll of 15 analysts yielded a median estimate of 4.4% for November headline inflation, at the midpoint of the 4-4.8% forecast of the Bangko Sentral ng Pilipinas (BSP) for the month.

If realized, the November consumer price index (CPI) would ease from the 4.9% print in October and the 8% recorded in the same month last year.

However, this would mark the 20th straight month that inflation exceeded BSP’s 2-4% annual target.

The November CPI report will be released on Tuesday.

Meanwhile, US Treasury yields and the dollar fell on the day as investors were encouraged by Federal Reserve Chair Jerome H. Powell’s vow to move “carefully” on interest rates, Reuters reported.

Treasury yields fell after Mr. Powell said the risks of hiking interest rates too much and slowing the economy more than necessary have become “more balanced” with the risks of not hiking enough to control inflation.

The Fed kept its target rate steady at the 5.25%-5.5% range for a second straight time during its Oct. 31-Nov. 1 meeting.

It has hiked borrowing costs by a cumulative 525 bps since it began its tightening cycle in March last year.

The Federal Open Market Committee will next meet on Dec. 12-13 to review their policy stance.

“Investors were keen on loading up local bonds across the curve as supply declined significantly especially on the T-bills space. At the same time, the upcoming inflation print for November pushed investors to bet on a lower headline CPI by adding up long end bonds for duration,” Alessandra P. Araullo, chief investment officer at ATRAM Trust Corp., said in a Viber message.

For this week, the auction of 10-year T-bonds and the November CPI data release will be the main GS trading drivers, Ms. Araullo said.

“These events may pull yields lower given the recently announced supply of bonds for the month of December which is significantly lower (only PHP 60 billion for the whole month), and Bangko Sentral ng Pilipinas’ November CPI indicative range at 4-4.8% (lower from previous print at 4.9%),” she said.

“Despite these developments’ movements, equity markets remain cautious as upside risks to inflation remains. Continue to be expect rates to move sideways in the week ahead,” Mr. Ravelas added. — Lourdes O. Pilar with Reuters

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld