Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Gov’t debt yields drop on inflation data

YIELDS on government securities (GS) mostly went down last week after headline inflation slowed further in November.

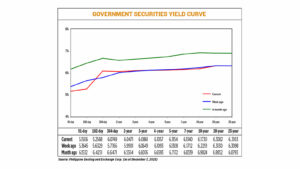

GS yields, which move opposite to prices, went down by an average of 3 basis points (bps) week on week, based on the PHP Bloomberg Valuation (BVAL) Service reference Rates as of Dec. 7 published on the Philippine Dealing System’s website.

Yields on the 91-day and 182-day Treasury bills (T-bills) dropped by 21.39 bps (to 5.1506%) and 37.61 bps (5.2568%), respectively. Meanwhile, the 364-day T-bill saw its rate rise by 29.83 bps week on week to 6.0749%.

Rates at the belly of the curve were likewise mixed, Yields on the two- and three-year Treasury bonds (T-bonds) rose by 5.7 bps (to 6.0471%) and 2.12 bps (6.0861%), respectively, while the rates of the four-, five-, and seven-year bonds fell by 0.36 bp (6.1057%), 1.54 bps (6.1154%), and 3.72 bps (6.1340%).

At the long end of the curve, the 10- and 20- year debt papers went down by 5.61 bps and 0.48 bp to yield 6.173% and 6.3082%, respectively. Meanwhile, the rate of the 25-year bond inched up by 0.05 bp to 6.3103%.

Total GS volume reached P8.67 billion on Thursday, lower than P9.3 billion on Dec. 1, BVAL data showed.

The slower November inflation print pushed yields on most benchmark tenors down last week, Reyes Tacandong & Co. Senior Adviser Jonathan L. Ravelas said in a Viber message.

“GS yields declined as the lower-than-expected Philippine inflation solidified prospects of further easing in domestic prices,” a bond trader likewise said in an e-mail.

Headline inflation eased to its slowest pace in 20 months in November amid easing prices of food as well as restaurant and accommodation services, the Philippine Statistics Authority (PSA) reported last week.

Preliminary data from the PSA showed headline inflation climbed 4.1% annually in November, slower than 4.9% in October and 8% in November 2022.

This was the slowest rate in 20 months or since the 4% seen in March 2022.

It was also slower than the median estimate of 4.4% in a BusinessWorld poll of 15 analysts conducted last week, and at the lower end of the 4-4.8% forecast range of the Bangko Sentral ng Pilipinas (BSP).

For the first 11 months, headline inflation averaged 6.2%, faster than 5.6% in the same period a year ago. This was still above the BSP’s baseline forecast of 6% and 2-4% target for 2023.

For this week, GS yields may move sideways to lower, depending on the results of the policy meetings of the US Federal Reserve and the BSP, Mr. Ravelas said.

The slower November inflation print has supported views that the BSP could keep its rates steady at its meeting this week, the bond trader said.

“For this week, bond yields might continue to head south as major central banks, including the BSP, are expected to maintain their policy rates on hold,” the trader added.

The BSP’s policy-setting Monetary Board will hold its last meeting for the year on Thursday.

A BusinessWorld poll last week showed 15 out of 17 analysts expect the BSP to keep its target reverse repurchase rate steady this week amid lingering upside risks to prices despite easing inflation recently.

The BSP last month kept its policy rate at a 16-year high of 6.5%. It has raised benchmark interest rates by a cumulative 450 bps since May 2022 to help tame inflation.

Meanwhile, the Federal Open Market Committee will meet on Dec. 12-13 to review policy. Markets expect the US central bank to keep rates steady for a third straight time this week.

The Fed kept its target rate steady at the 5.25%-5.5% range for a second straight time during its Oct. 31-Nov. 1 meeting.

The US central bank has hiked rates by a cumulative 525 bps since it kicked off its tightening cycle in March 2022. — AMCS

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld