January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

Gov’t debt hits record high PHP 13.86T

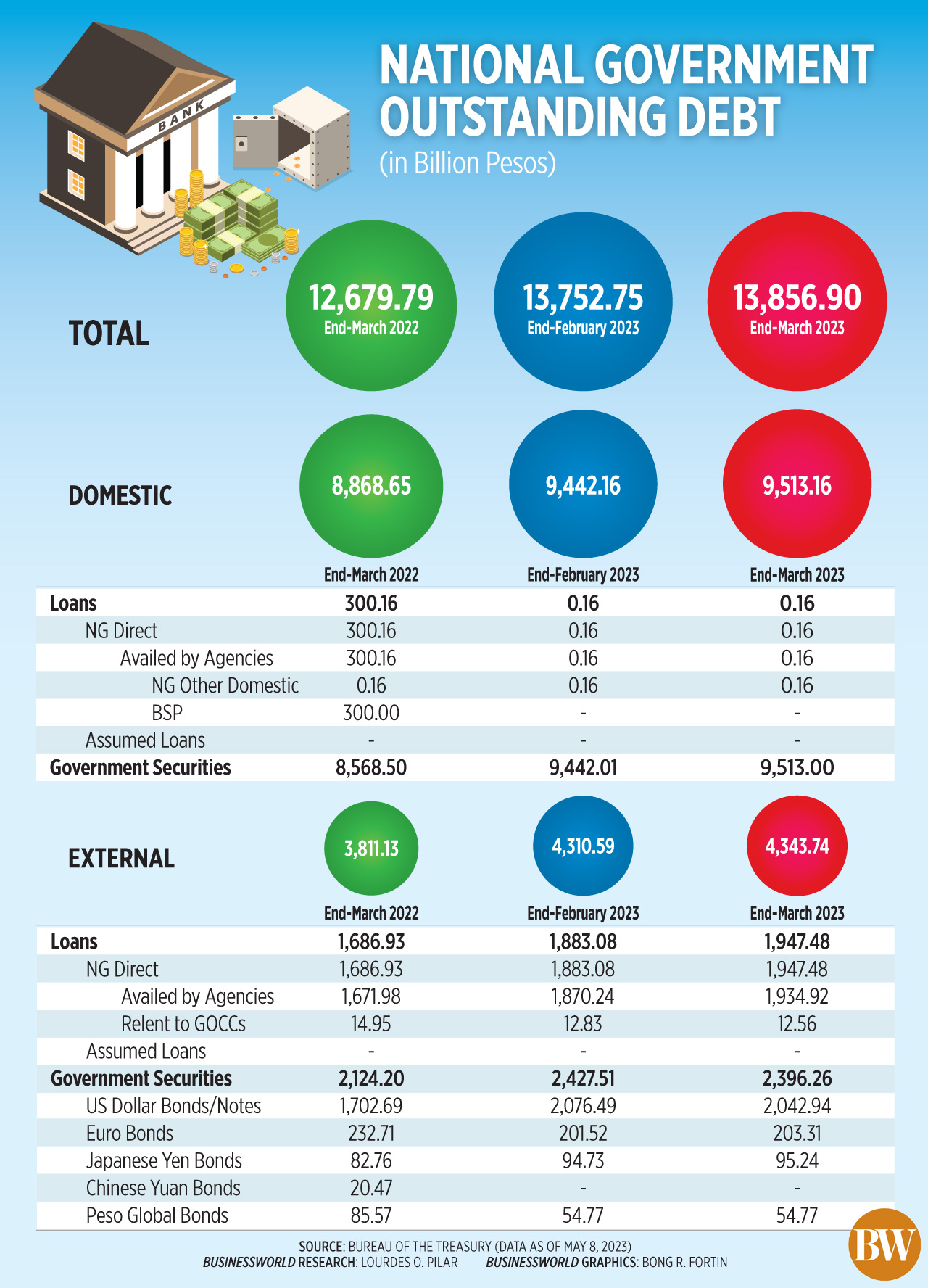

THE NATIONAL Government’s (NG) outstanding debt reached a record-high PHP 13.86 trillion as of end-March, the Bureau of the Treasury (BTr) said on Monday.

Data from the BTr showed that outstanding debt inched up by 0.8% or PHP 104.15 billion from the PHP 13.75 trillion at the end of February, “primarily due to the net issuance of domestic and external debt.”

Year on year, the debt stock rose by 9.3% from PHP 12.68 trillion. Overall debt increased by 3.3% from the PHP 13.42 trillion as of end-December 2022.

Over half or 68.7% of total debt came from domestic sources, while the rest was owed to foreign creditors.

Over half or 68.7% of total debt came from domestic sources, while the rest was owed to foreign creditors.

At end-March, domestic debt rose by 7.3% to PHP 9.51 trillion from PHP 8.87 trillion a year ago. Month on month, it edged up by 0.8% from PHP 9.44 trillion at end-February.

“In March, the PHP 72.87-billion net issuance of domestic securities outweighed the PHP 1.87-billion effect of local currency appreciation against the US dollar on onshore foreign currency denominated securities,” the BTr said in a statement.

Based on figures from the BTr, the peso appreciated by 1.6% to PHP 54.318 as of end-March versus the US dollar from PHP 55.21 as of end-February.

The government mainly borrows from domestic sources to mitigate foreign currency risk.

Meanwhile, foreign debt climbed by 14% to PHP 4.34 trillion at end-March from PHP 3.81 trillion in the previous year. Month on month, it went up by 0.8% from PHP 4.31 trillion.

Broken down, external debt consisted of PHP 1.95 trillion in loans and PHP 2.4 trillion in global bonds.

“The increment in NG’s external obligation for the month was attributed to the PHP 84.26-billion net availment of foreign loans and PHP 18.53-billion impact of third-currency adjustments against the US dollar. These more than offset the PHP 69.64-billion effect of local currency appreciation against the US dollar,” the BTr said.

As of end-March, the NG’s overall guaranteed obligations slipped by 0.8% to PHP 384.12 billion from PHP 387.19 billion in the prior month. Year on year, it declined by 6.6% from PHP 411.04 billion.

“The latest net borrowings of the National Government may reflect the need to finance the budget deficits in recent months,” Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

The government’s budget deficit narrowed by 14.51% to PHP 270.9 billion in the January-to-March period, lower than the PHP 298.705-billion programmed deficit set by Development Budget Coordination Committee (DBCC).

This year, the government has set a budget deficit ceiling of PHP 1.499 trillion, equivalent to 6.1% of gross domestic product.

“Recent trends in tax collections may have influenced more borrowing, but this is expected since the economy is also normalizing.

Nevertheless, debt management should really be top priority making sure it is sustainable and manageable,” Union Bank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion added in a Viber message.

Mr. Ricafort also said the implementation of lower individual tax rates at the start of this year also reduced government revenues, which prompted more borrowings.

He added that outstanding debt may continue to rise ahead of government dollar bond offerings.

National Treasurer Rosalia V. de Leon last month said that the government is planning to launch a retail dollar bond offering this May. The government might sell USD 1.5 billion worth of 5.5-year debt, she said.

As of end-December, the country’s debt-to-gross domestic product (GDP) ratio stood at 60.9%, improving from the 63.7% ratio as of end-September.

This is lower than the 61.8% target under the medium-term fiscal framework, but still above the 60% threshold considered manageable by multilateral lenders for developing economies.

The government aims to cut the debt-to-GDP ratio to less than 60% by 2025, and further to 51.5% by 2028.

This year, the government’s borrowing plan is set at PHP 2.207 trillion. — By Luisa Maria Jacinta C. Jocson, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld