February Economic Update: Cut to the chase

DOWNLOAD

DOWNLOAD

Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Government debt yields drop on dovish Fed bets

YIELDS on government securities (GS) mostly declined last week as the collapse of two banks in the United States may cause the US Federal Reserve to opt for a smaller rate hike at its meeting this week.

YIELDS on government securities (GS) mostly declined last week as the collapse of two banks in the United States may cause the US Federal Reserve to opt for a smaller rate hike at its meeting this week.

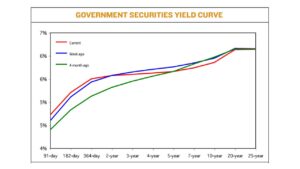

GS yields, which move opposite to prices, declined by an average of 1.96 basis points (bps) week on week, based on the PHP Bloomberg Valuation Service (BVAL) Reference Rates as of March 17 published on the Philippine Dealing System’s website.

The short end of the curve rose as yields on the 91-, 182-, and 364-day Treasury bills (T-bills) increased by 15.09 bps (to 4.8621%), 11.61 bps (5.4456%), and 8.45 bps (5.8005%), respectively.

Meanwhile, papers at the belly dropped, with rates of the two-, three-, four-, five-, and seven-year Treasury bonds declining by 0.38 bp (to 5.8852%), 6.08 bps (5.9157%), 9.93 bps (5.9497%), 12.01 bps (5.9891%), and 12.60 bps (6.0859%), respectively.

The long end of the curve likewise fell, with the 10-, 20-, and 25-year papers declining by 11.01 bps, 3.25 bps, and 1.41 bps to yield 6.2274%, 6.5565%, and 6.5673%, respectively.

GS volume reached PHP 5.13 billion on Friday, lower than the PHP 14.60 billion recorded on March 10.

Security Bank Corp. Chief Investment Officer for Trust and Asset Management Group Noel S. Reyes attributed last week’s yield movements to global market volatility amid issues surrounding the US banking sector.

“Though market sentiment has reverted to an inflation focus, the growing concern over more banks getting affected remains in the air and volatility is expected to continue. We could see similar swings that we have seen [last] week,” Mr. Reyes said in a Viber message.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a text message that “long-term PHP BVAL yields were again lower week on week by more than -0.10 after the benchmark 10-year US Treasury yield declined by -0.15 week on week amid some fund shifts to the safest assets such as US Treasuries amid increased market volatility recently.”

US government bond yields fell steeply last week, with some durations marking their biggest drops in decades, as investors bet the Fed would likely curb its aggressive rate hike trajectory to avoid exacerbating financial system stress following the failures of Silicon Valley Bank and Signature Bank, Reuters reported.

The volatility in fixed-income markets has unsettled investors, and falling yields can reflect expectations that the Fed will cut rates because of a hit to growth.

The yield on benchmark 10-year Treasury notes fell to 3.423% versus 3.583% previously. The two-year yield, which rises with traders’ expectations of higher Fed fund rates, fell to 3.8354% from a previous close of 4.13%.

The US central bank raised the fed funds rate by 25 bps to 4.5-4.75% last month, bringing cumulative increases since March 2022 to 450 bps.

The Fed’s next policy review is on March 21-22.

For this week, Mr. Ricafort said rates on shorter tenors may increase amidst an expected 25-bp hike by the Fed.

“Short-term tenors are still slightly rising as seen in recent weeks amid some possible +0.25 Fed rate hike on March 22, that could be matched on the following day,” Mr. Ricafort said.

The Bangko Sentral ng Pilipinas (BSP) will hold its own policy meeting on March 23.

BSP Governor Felipe M. Medalla earlier said they could consider raising borrowing costs by 25 bps or 50 bps at this week’s review.

The Monetary Board last month hiked benchmark rates by 50 bps for a second straight meeting, bringing its policy rate to 6%.

It has raised borrowing costs by 400 bps since May 2022 to help bring down elevated prices. — M.I.U. Catilogo with Reuters

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld