February Economic Update: Cut to the chase

DOWNLOAD

DOWNLOAD

Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

GDP growth slowed in Q1—poll

PHILIPPINE annual economic growth likely slowed in the first quarter, as elevated inflation and higher interest rates may have dampened consumer spending.

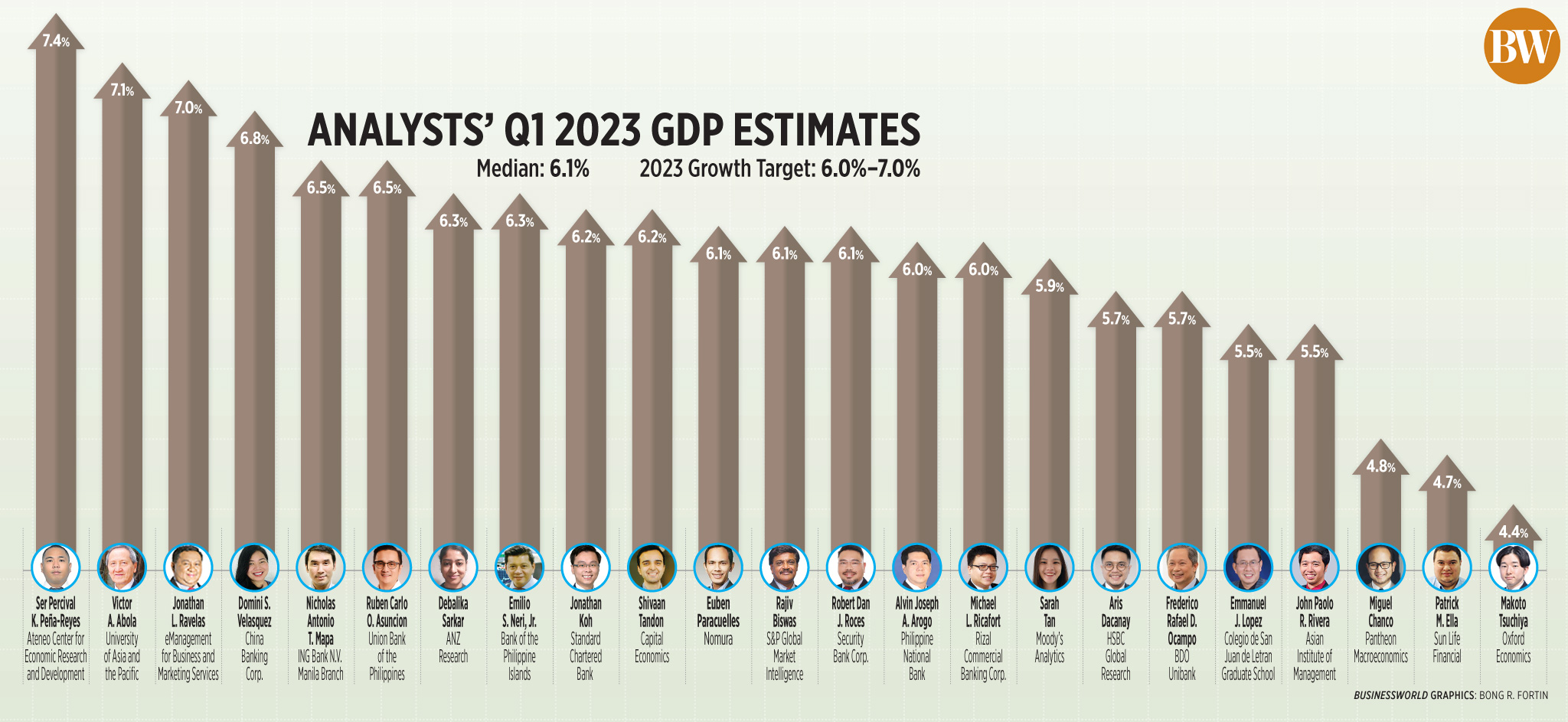

A BusinessWorld poll of 23 economists conducted last week yielded a median estimate of 6.1% gross domestic product (GDP) growth for the first three months of 2023.

If realized, this would be slower than the revised 7.1% growth in the previous quarter, and the 8% growth in the first quarter of 2022.

The median estimate is within the economic managers’ target range of 6%-7% for the year.

The Philippine Statistics Authority (PSA) is scheduled to report the first-quarter GDP growth data on May 11.

First-quarter GDP growth may have slowed due to base effects and lower household spending amid high inflation and rising rates, economists said.

“First, consumers’ purchasing power will likely be negatively affected by high inflation especially as pandemic savings are used up. Second, capital formation should be dampened by higher interest rates,” Philippine National Bank economist Alvin Joseph A. Arogo said.

Inflation hit a 14-year high of 8.7% in January, before easing to 8.6% in February and 7.6% in March. Average inflation in the first quarter stood at 8.3%.

To tame inflation, the Bangko Sentral ng Pilipinas (BSP) has raised borrowing costs by 425 basis points since May last year. This brought the key policy rate to a near 16-year high of 6.25%.

Economists expect slower GDP data due to base effects, since household spending rose by 10% in the first quarter of 2022.

Consumer spending, which historically contributes about 75% of the country’s output, eased to 7% in the fourth quarter of 2022 from 8% in the third quarter.

“We think the sequential momentum for private consumption, the biggest component of GDP, to have slowed amid fading reopening boost, higher interest rates as well as inflation,” Makoto Tsuchiya, assistant economist at Oxford Economics, said in an e-mail note.

Mr. Tsuchiya said higher lending rates likely affected sentiment as well as Filipinos’ ability to borrow, while elevated inflation shrank households’ real purchasing power.

Miguel Chanco, chief emerging Asia economist at Pantheon Macroeconomics, noted the surge in household borrowings that drove the economy’s strong growth last year “appears clearly to have peaked.”

Domini S. Velasquez, chief economist at China Banking Corp., said the economy may have expanded by 6.8% in the first quarter.

“Agriculture probably held up in Q1, driven by palay and corn production, as the weather was favorable during the quarter. However, challenges such as the African Swine Fever and some bird flu outbreaks mitigated the growth of livestock and poultry,” she said via e-mail.

Government spending was also muted in the first quarter “due to fiscal consolidation efforts and might have been hampered by the devolution of some services to the local government units (i.e., implementation of the Mandanas ruling),” Ms. Velasquez added.

HSBC ASEAN economist Aris Dacanay said the lackluster global demand may have also affected trade figures in the January-to-March period.

“The low import figures in February could have hinted that domestic demand might have moderated from the highs of the previous quarters. Although growth was supported by the recovery of tourism, we do not think that its recovery was enough to offset the challenges seen elsewhere in the economy,” Mr. Dacanay said in an e-mail.

Outlook

Meanwhile, economists expect GDP growth to slow for the rest of the year.

“We think the outlook for the rest of the year is clouded. One-off reopening boost won’t be available again, and high albeit declining inflation will continue to reduce real income for much of the year,” Mr. Tsuchiya said.

Moody’s Analytics economist Sarah Tan said they project 5.7% Philippine GDP growth for the full year of 2023, slower than the 7.6% growth in 2022.

“A weak export outlook will be a key drag as slowing global growth will squash demand for the country’s goods. Further, domestic demand is likely to gradually slow as households feel the pinch from BSP’s whopping 425 basis points of rate hike. Monetary policy typically works with a lag and households could feel the pain for longer,” Ms. Tan said.

Standard Chartered Bank economist for Asia and the Philippines Jonathan Koh said muted growth throughout 2023 would set the stage for BSP rate cuts starting in the fourth quarter.

Philippine annual inflation slowed for a third straight month in April to 6.6% from 7.6% in March. Core inflation, which discounted volatile prices of food and energy items, eased to 7.9% in April from its 22-year high of 8% in March.

Reuters quoted Bangko Sentral ng Pilipinas (BSP) Governor Felipe M. Medalla as saying the month-on-month inflation trends “present an even stronger argument” for keeping interest rates unchanged at the central bank’s meeting on May 18.

Bank of the Philippine Islands Lead Economist Emilio S. Neri, Jr. said China’s reopening will be key to helping the economy hit its growth targets this year.

“Travel and leisure as well as domestic supply chains are likely to benefit the most. Government’s target will be difficult to achieve if China performs below expectations,” he said.

Mr. Neri also flagged signs of slower overall business expansion, such as less corporate fundraising and a drop in imports of office machines and vehicles.

“Hopefully this is just a soft patch and some catch-up will be seen in the last nine months of the year to allow the government to achieve its annual target,” he said.

Robert Dan J. Roces, chief economist at Security Bank Corp., maintained a full-year forecast of 6.3% on the back of resilient private spending and positive capital formation.

“Despite the challenges posed by sticky inflation and elevated rates, the Philippines is not expected to experience stagflation or recession scenarios,” he added. — By Bernadette Therese M. Gadon

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld