Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

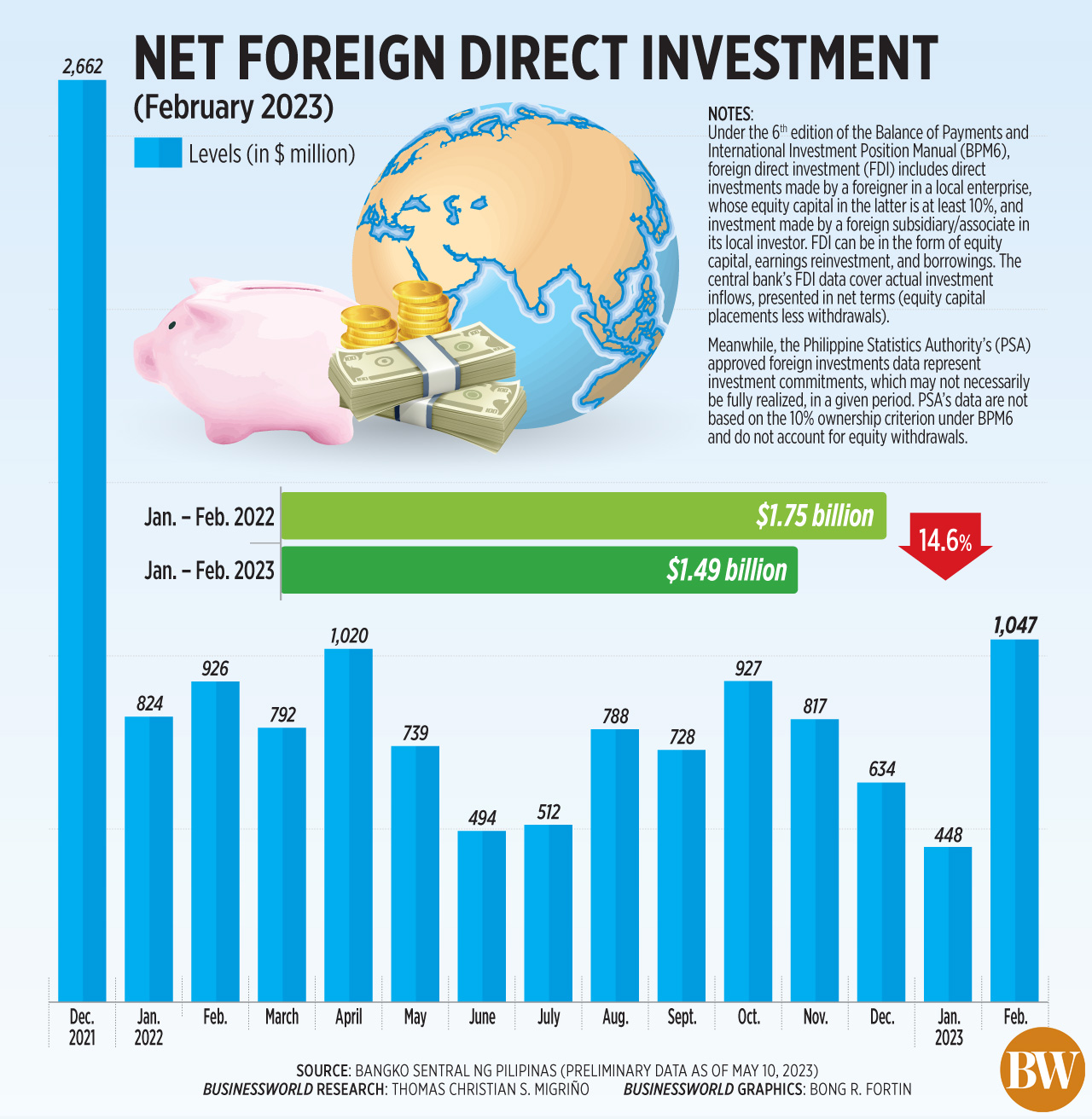

February FDI inflows highest in 14 months

FOREIGN DIRECT INVESTMENT (FDI) net inflows rose by 13% in February to its highest level in 14 months, amid improving investor sentiment towards the Philippines.

Data released by the Bangko Sentral ng Pilipinas (BSP) on Wednesday showed that FDI net inflows climbed to USD 1.05 billion in February from USD 926 million in the same month in 2022.

Net inflows of FDIs in February was more than double the USD 448-million inflows seen in January.

This was also the highest level in 14 months, or since the USD 2.66-billion net inflows in December 2021.

“FDI is up on improved sentiment with [the Philippines’] potential for growth, as well as the efforts of the economic managers to attract these,” Security Bank Corp. Chief Economist Robert Dan J. Roces said in a Viber message.

Since the start of the year, President Ferdinand R. Marcos, Jr. has made several trips to Japan, Switzerland (for the World Economic Forum), China and most recently, the United States as part of efforts to woo investors.

Around USD 13 billion worth of investment commitments were made during the Japan visit in February, according to officials.

The BSP attributed the year-on-year increase in FDI to the higher non-residents’ net investments in debt instruments, which offset the drop in net equity capital placements and reinvestment of earnings.

BSP data showed non-residents’ net investments in debt instruments of local affiliates jumped by 19.4% to USD 910 million in February, from USD 762 million a year ago.

On the other hand, investments in equity and investment fund shares declined by 16.7% in February to USD 136 million from USD 164 million in the same month in 2022.

Non-residents’ net investments in equity capital (other than reinvestment of earnings) dropped by 23.6% to USD 74 million in February from USD 97 million a year ago. Equity capital withdrawals surged by 101% to USD 38 million, while placements slid by 3.1% to USD 113 million.

“The jump in February [FDIs] can be traced largely to an increase in debt instruments and to a lesser extent, fresh equity placements,” ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said in an e-mail.

The equity placements were mainly from Japan, the United States, and the Cayman Islands. These were invested mostly in manufacturing, real estate, electricity, gas steam and air-conditioning supply, and financial and insurance industries.

Reinvestment of earnings also slipped by 6.5% to USD 62 million year on year in February.

DECLINE

Meanwhile, total FDI net inflows declined by 14.6% to USD 1.49 billion in the January-to-February period, from the USD 1.75-billion net inflows in the same period last year.

Investments in equity capital other than reinvestment of earnings slumped by 18.1% to USD 167 million in the first two months. Placements rose by 11.7% to USD 261 million, while withdrawals surged by 215% to USD 94 million.

Reinvestment of earnings dipped by 1% to USD 137 million in the two-month period.

Also, investments in debt instruments dropped by 15.4% to USD 1.19 billion in the January-to-February period.

BSP Governor Felipe M. Medalla said there is strong interest for the Philippines from foreign investors.

“[But] whether when it will be actually translated to actual foreign direct investments will depend on many things,” he said in an interview with The Banker on the sidelines of the Asian Development Bank (ADB) annual meetings in Seoul, South Korea.

Still, Mr. Medalla said there is optimism that the current administration’s policies and recent economic reforms will help attract more foreign investments.

“More and improved diplomatic relations recently, especially with developed countries that are the biggest sources of foreign investments, would help improve the FDI data in the coming months,” Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort

For ING’s Mr. Mapa, still-robust economic growth could help attract more FDIs into the country.

“The influx of foreign currency could provide an additional source of foreign exchange as well as work to fund productive ventures in the country, hopefully leading to job creation,” he said. — By Keisha B. Ta-asan, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld