Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

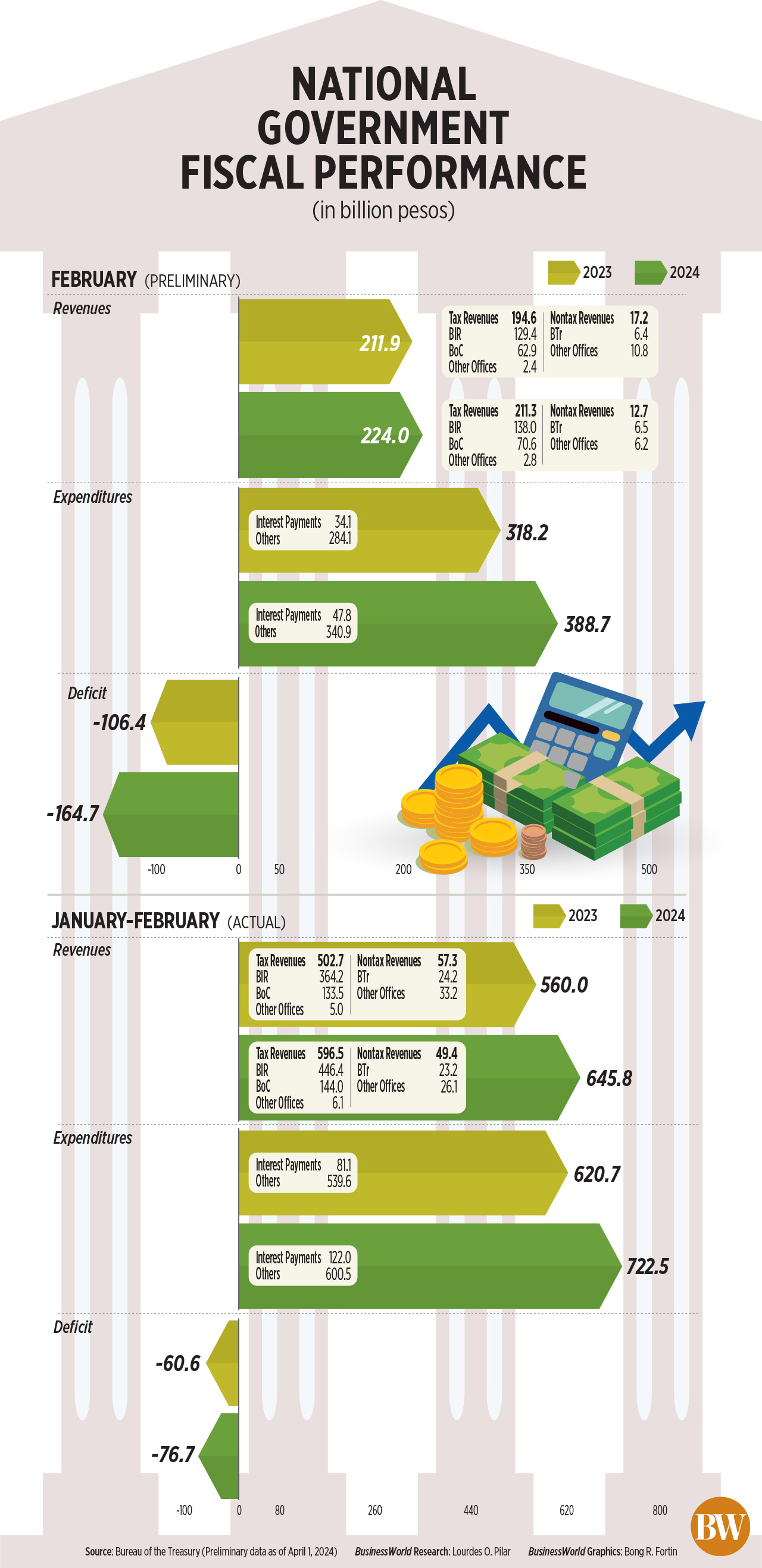

February budget gap widens

The National Government’s (NG) budget deficit ballooned in February amid double-digit growth in state spending, the Bureau of the Treasury (BTr) reported on Monday.

Data from the BTr showed that the fiscal gap widened by 54.81% to PHP 164.7 billion from PHP 106.4 billion a year earlier.

Month on month, the budget balance swung back to a deficit from the P88-billion surplus in January.

“The wider budget gap stemmed from the 22.14% year-over-year increase in expenditures, matched with moderate revenue growth of 5.73%,” the BTr said in a press release.

“The wider budget gap stemmed from the 22.14% year-over-year increase in expenditures, matched with moderate revenue growth of 5.73%,” the BTr said in a press release.

In February, government expenditures surged by 22.14% to PHP 388.7 billion from PHP 318.2 billion a year ago.

The BTr said expenditure growth was driven by “higher releases to local government units, as well as larger disbursements recorded in the Department of Health and Department of Social Welfare and Development for their banner health and social protection programs, respectively.”

“Similarly, higher capital expenditures posted by the Department of Public Works and Highways contributed to the growth of February 2024 disbursements,” it added.

Interest payments jumped by 40.22% to PHP 47.8 billion in February from PHP 34.1 billion a year ago.

Primary spending, which refers to total expenditures minus interest payments, climbed by 19.97% to PHP 340.9 billion from PHP 284.1 billion a year ago.

Meanwhile, revenues rose by 5.73% to PHP 224 billion from PHP 211.9 billion a year earlier.

Tax revenues went up by 8.56% year on year to PHP 211.3 billion, as Bureau of Internal Revenue (BIR) collections increased by 6.65% to PHP 138 billion and Bureau of Customs (BoC) revenues climbed by 12.19% to PHP 70.6 billion.

On the other hand, nontax revenues declined by 26.21% to PHP 12.7 billion in February. Revenues from other offices plunged by 42.62% to PHP 6.2 billion due to “lower Malampaya proceeds.”

During the month, BTr income inched up by 1.56% to PHP 6.5 billion due to higher dividend remittances and the NG’s share from Philippine Amusement and Gaming Corp. income.

Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, Inc., said the jump in state spending in February was expected.

“It’s the start of the year and understandably the NG would like to get spending going via local government units, health and social services, and the flagship infrastructure development,” he said in a Viber message.

“Note that interest payments also were up 40% year on year, and this is also within our expectation of NG’s push for fiscal consolidation and debt payments,” he added.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort noted that high inflation and elevated interest rates had driven up expenditures.

Inflation accelerated for the first time in five months to 3.4% in February.

The Bangko Sentral ng Pilipinas (BSP) kept its benchmark rate steady for a third straight meeting at a near 17-year high of 6.5% in February.

TWO-MONTH DEFICIT

In the first two months of 2024, the budget deficit swelled by 26.56% to PHP 76.7 billion from PHP 60.6 billion in the year-ago period as revenue collection and expenditures grew by double digits.

Government revenues jumped by 15.32% to PHP 645.8 billion from PHP 560 billion a year earlier.

Tax revenues jumped by 18.66% to PHP 596.5 billion as BIR and Customs collections increased by 22.58% to PHP 446.4 billion and 7.84% to PHP 144 billion, respectively.

Nontax revenues, on the other hand, dropped by 13.95% to PHP 49.4 billion. This as BTr income slid by 3.8% to PHP 23.2 billion, while revenues from other offices fell by 21.33% to PHP 26.1 billion.

The BTr said the income drop was “mainly on account of lower interest income on NG deposits and BTr investments.”

Meanwhile, expenditures rose by 16.42% to PHP 722.5 billion in January-February from PHP 620.7 billion a year ago.

Interest payments surged by 50.53% to PHP 122 billion, while primary expenditures went up by 11.29% to PHP 600.5 billion.

“For the coming months, a further pickup in business and other economic activities would still lead to higher government tax revenue collections amid intensified tax collection efforts, as well as other priority tax reform measures,” Mr. Ricafort said.

This year, the NG’s deficit ceiling is capped at PHP 1.39 trillion or 5.1% of gross domestic product (GDP).

As of end-2023, the deficit as a share of GDP stood at 6.2%. The government is targeting to bring this further down to 3% by 2028. — Luisa Maria Jacinta C. Jocson

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld