Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

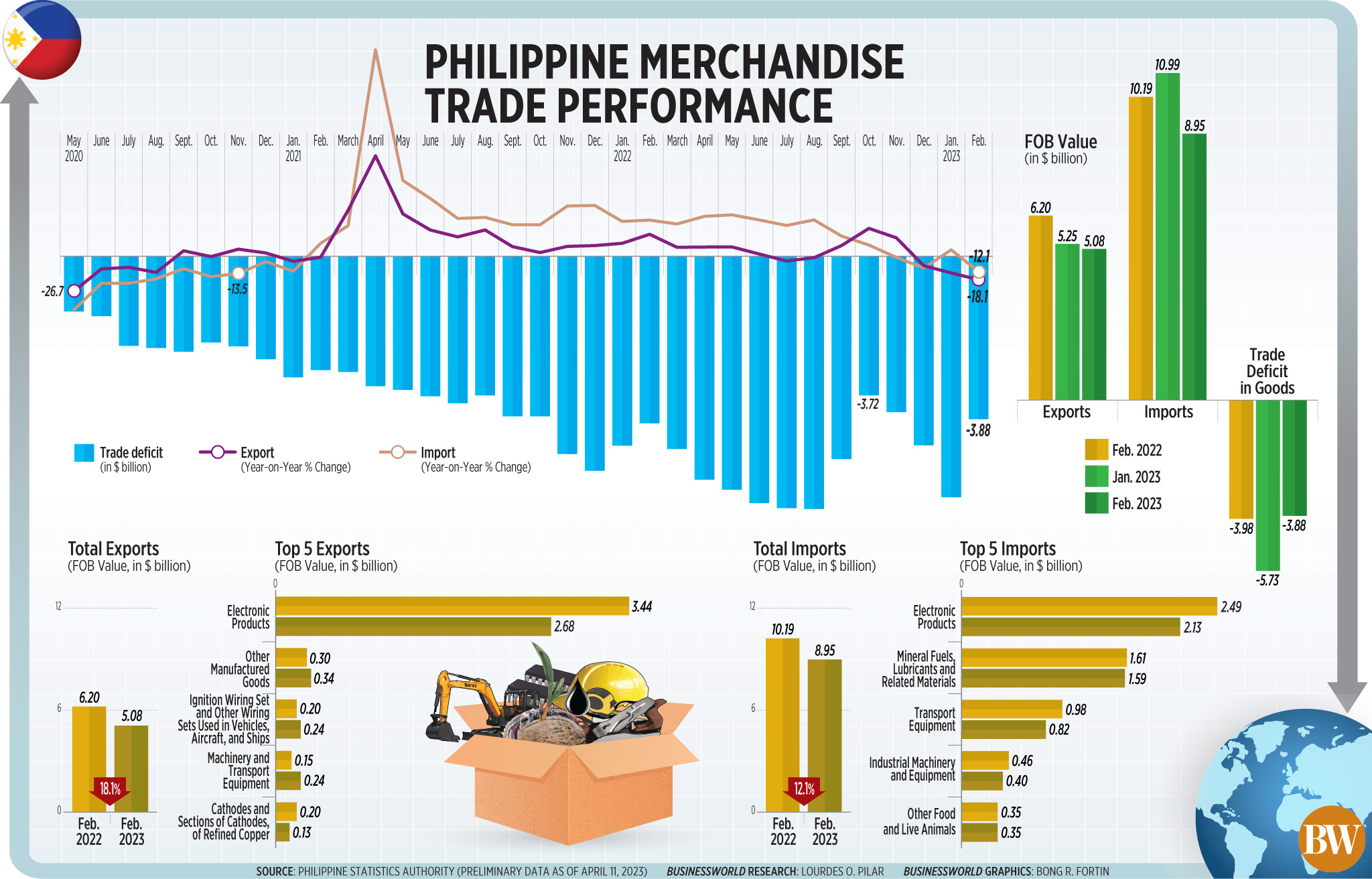

February trade deficit narrows to smallest in 3 months

THE Philippines’ trade deficit in goods narrowed in February to the smallest in three months, as imports and exports slumped to their lowest levels in over two years.

Preliminary data from the Philippine Statistics Authority (PSA) showed the trade gap shrank to USD 3.88 billion in February, from the USD 5.73 billion gap in January and the USD 3.98 billion deficit in February last year.

February saw the slimmest trade gap since the USD 3.72 billion deficit in November 2022.

The country has recorded a trade-in-goods deficit for almost eight years or since the trade surplus of USD 64.95 million in May 2015.

Merchandise exports fell 18.1% annually to USD 5.08 billion, faster than the revised 13.1% drop in January and a reversal of the 15.7% growth in February last year.

The export decline in February was the steepest in 33 months or since the 26.7% fall in May 2020. Export receipts also fell to the lowest level since USD 4.54 billion in May 2020.

Meanwhile, imports returned to negative territory, as it slipped 12.1% to USD 8.95 billion from a year earlier. This was a reversal of the 4.1% uptick in January and 26.3% growth in February 2022.

The drop in imports was the sharpest in 27 months or since the 13.5% decline in November 2020. By value, it was the smallest import bill in 22 months or since USD 8.88 billion in April 2021.

In the first two months, the trade deficit widened to USD 9.61 billion from USD 8.50 billion gap a year ago.

Year to date, exports slid 15.6% to USD 10.33 billion, while imports dropped 3.9% to USD 19.94 billion.

The Development Budget and Coordination Committee is projecting a 3% growth for exports and a 4% increase for imports this year.

“We can expect exports to revert to modest expansion as shipments to China resume after a holiday. Meanwhile, imports can be expected to rise but by single digits,” ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said in an e-mail.

“The overall trade balance will stay in deficit of roughly USD 5 billion, which means the current account will also remain deficit. This should mean that the peso will lag any regional rally as outflows of foreign currency continue to outpace inflows at least for the real sector,” Mr. Mapa added.

In February, outbound shipments of manufactured goods, which accounted for 83.2% of total exports, dropped by 14.5% year on year to USD 4.22 billion.

Electronic products, which made up 63.4% of manufactured goods and more than half of total exports that month, declined by 22.2% to USD 2.68 billion. Almost three-fourths of electronic product sales came from semiconductors, which also fell by 23.2% to USD 1.99 billion.

Meanwhile, orders of raw materials and intermediate goods went down by 20.9% to USD 3.11 billion in February. These accounted for more than a third of the total February import bill.

Imports of capital and consumer goods were valued at USD 2.62 billion (down 11.9%) and USD 1.60 billion (up by 0.7%), respectively.

Mineral fuels, lubricants and related materials dipped to USD 1.59 billion from USD 1.61 billion last year.

Philippine Exporters Confederation, Inc. President Sergio R. Ortiz-Luis, Jr. said in a Viber interview that the “usual global problems” affected the trade performance in February.

“It is the usual international problems in trade. Problems in shipping lines, effects of sanctions, disrupted supply chain. These problems were out of control,” he said.

Japan, which accounted for 16.2% (USD 822.65 million) of the total receipts, was the top destination of locally made products in February. It was followed by the United States (14.9% or USD 756 million) and China (12% or USD 611.59 million).

Meanwhile, China was the country’s main source of foreign goods, with a 21.6% share (USD 1.93 billion) of the total bill, followed by Indonesia (10.2% or USD 917.76 million) and Japan (8.8% or USD 788.35 million).

“If the situation in the global markets normalized, and local inflation as well, negative results will be lessened,” added Mr. Ortiz-Luis. — By Lourdes O. Pilar, Researcher

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld