Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

FDI net inflows jump to 3-month high in July

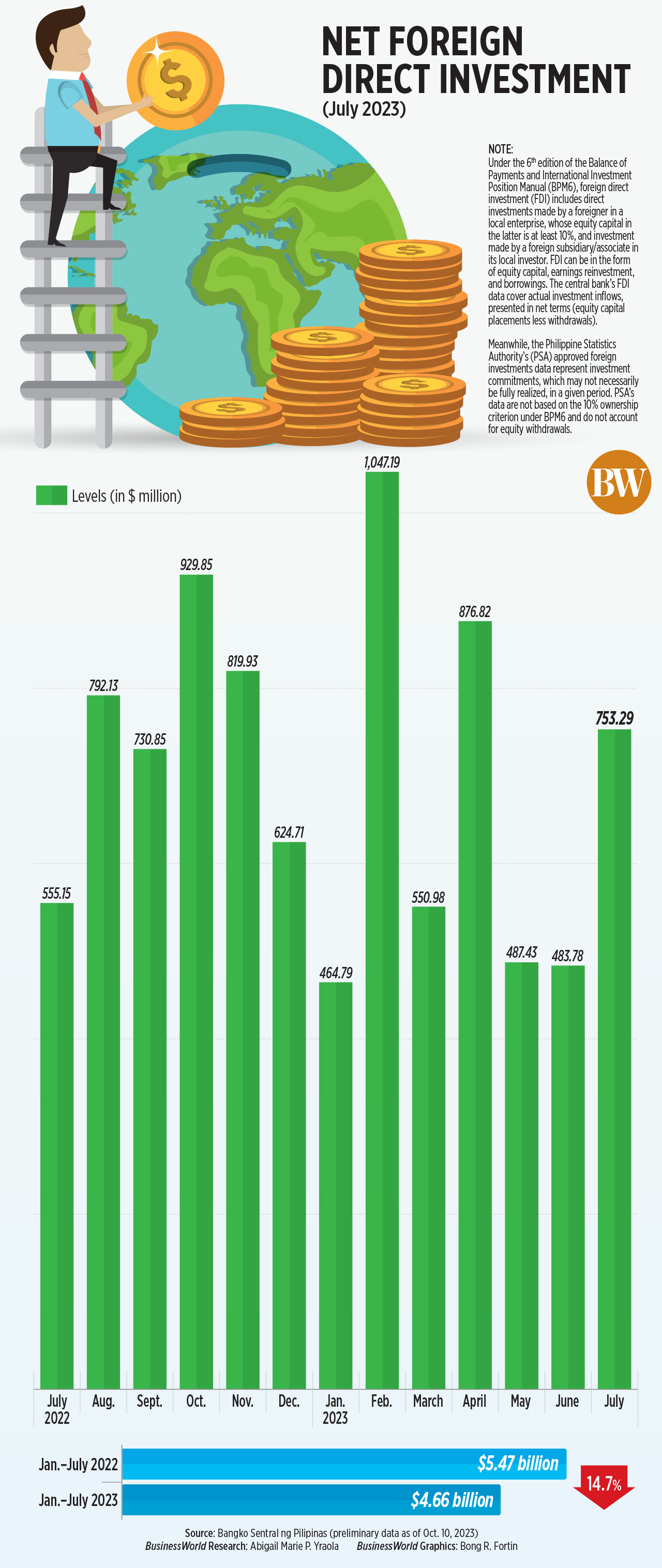

Net inflows of foreign direct investments (FDI) rose to its highest level in three months in July, amid improved investor sentiment.

Data released by the Bangko Sentral ng Pilipinas (BSP) on Tuesday showed FDI net inflows jumped by 35.7% to USD 753 million in July from USD 555 million in the same month a year earlier. It also rose by 55.6% from the USD 484-million inflows seen in June.

The July FDI inflows were the highest in three months or since USD 877 million in April.

“The jump in FDI inflows was likely due to positive risk sentiment which encouraged investments in emerging markets like the Philippines,” China Banking Corp. Chief Economist Domini S. Velasquez said in a Viber message.

“The jump in FDI inflows was likely due to positive risk sentiment which encouraged investments in emerging markets like the Philippines,” China Banking Corp. Chief Economist Domini S. Velasquez said in a Viber message.

Ms. Velasquez said market players had expected the US Federal Reserve to be nearing the end of its tightening cycle in July due to weaker US inflation and US jobs data.

The US Federal Reserve hiked its own policy rates by 25 basis points (bps) to 5.25-5.5% at its July 25-26 meeting. It has raised borrowing costs by a total of 525 bps since March 2022.

“Additionally, the launch of green lanes for strategic investments and the signing of the Maharlika Investment Fund could have also encouraged inflows,” she said.

President Ferdinand R. Marcos, Jr. signed Executive Order No. 18 in February, which aims to expedite, streamline, and automate government processes for strategic investments to attract more foreign investors.

In July, Mr. Marcos signed into law Republic Act No. 11954, which created the Philippines’ first sovereign wealth fund. The MIF is expected to be operational by yearend.

The BSP attributed the increase in FDI net inflows in July to nonresidents’ net investments in debt instruments more than doubling to USD 575 million from USD 276 million a year earlier.

However, equity and investment fund shares fell by 36.1% to USD 179 million in July from USD 279 million in the same month last year.

In July, reinvestment of earnings slid by 20.1% to USD 114 million from USD 142 million a year ago.

Equity inflows other than reinvestment of earnings dropped by 52.6% year on year to USD 65 million. This, as placements plummeted by 47.6% to USD 81 million, while withdrawals went down by 9.1% to USD 16 million.

For the first seven months of 2023, FDI inflows decreased by 14.7% to USD 4.66 billion from USD 5.47 billion in the same period last year.

Broken down, investments in debt instruments dropped by 15.2% to USD 3.28 billion in the January-to-July period.

Equity and investment fund shares went down by 13.6% to USD 1.38 billion as of July. Reinvestment of earnings declined by 13.1% to USD 573 million in the seven-month period.

Investments in equity capital other than reinvestment of earnings slipped by 14% to USD 808 million. Placements dipped by 4% to USD 1.004 billion, while withdrawals surged by 83% to USD 196 million.

“In the near term, the prevailing risk-off sentiment may dissuade investments in the Philippines. On a positive note, enacted legislations and reforms should help improve investor sentiment in the country,” Ms. Velasquez said.

She cited recent laws such as the Retail Trade Liberalization Act, the Public Service Act, and the Regional Comprehensive Economic Partnership.

“We expect FDI inflows to be better in 2024 in line with a global economic recovery,” she added.

Last month, the BSP lowered its full-year projection for FDI net inflows to USD 8 billion from USD 9 billion previously. FDI net inflows are also projected to reach USD 10.5 billion in 2024. — Keisha B. Ta-asan

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld