February Economic Update: Cut to the chase

DOWNLOAD

DOWNLOAD

Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

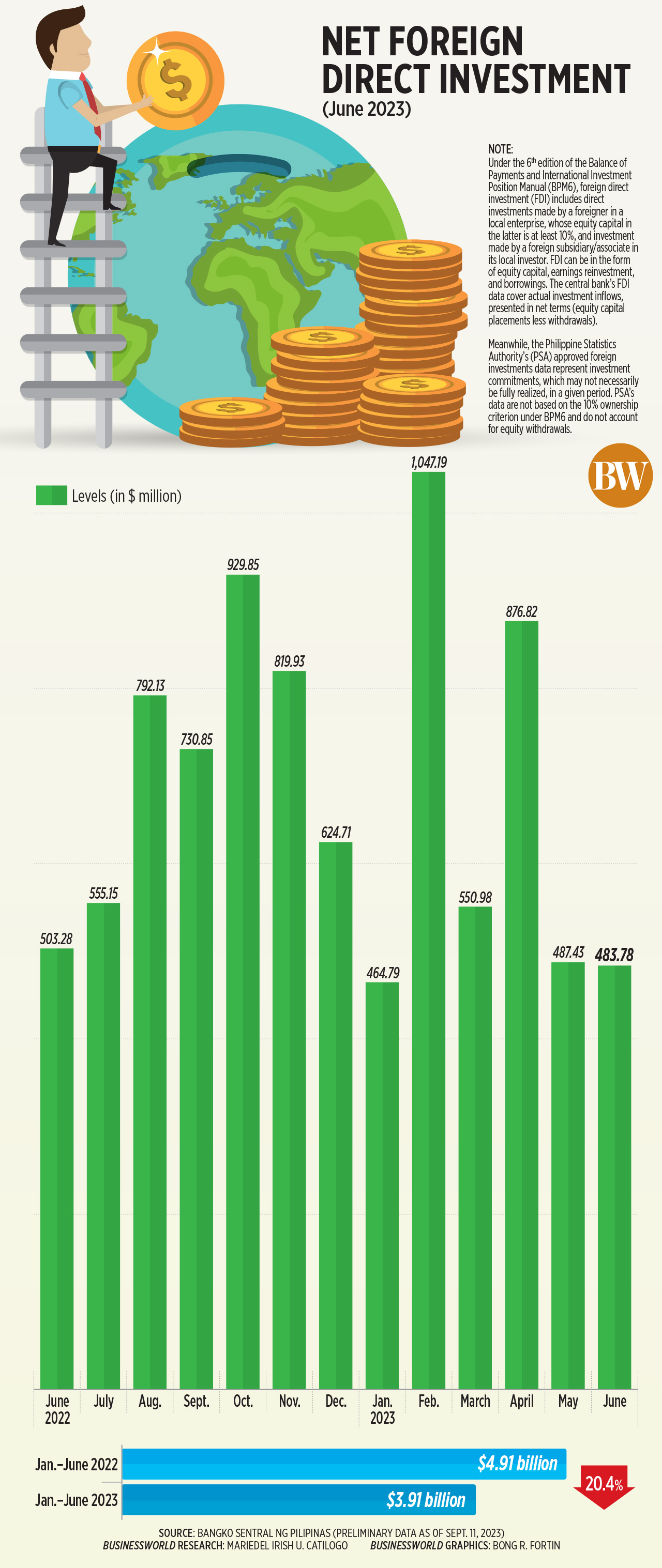

FDI inflows fall to 5-month low in June

Foreign direct investment (FDI) net inflows to the Philippines dropped to the lowest in five months in June, as investors worry over slowing economic growth, elevated inflation, and high interest rates.

Data released by the Bangko Sentral ng Pilipinas (BSP) on Monday showed FDI net inflows declined by 3.9% to USD 484 million in June from USD 503 million in the same month in 2022. This was also 0.6% lower than the USD 487-million FDI net inflows in May.

The June figure was the lowest monthly net inflows of FDI in five months or since USD 465 million in January.

The BSP attributed the decline in FDI net inflows to the decrease in nonresidents’ net investments in equity capital and their reinvestment of earnings, which offset the growth in investments in debt instruments.

The BSP attributed the decline in FDI net inflows to the decrease in nonresidents’ net investments in equity capital and their reinvestment of earnings, which offset the growth in investments in debt instruments.

BSP data showed nonresidents’ net investments in equity capital (other than reinvestment of earnings) fell by 11.8 % to USD 111 million in June from USD 126 million in the same month last year.

Broken down, equity capital placements slipped by 8% to USD 132 million, while withdrawals increased by 20% to USD 21 million.

Reinvestment of earnings also slumped by 26.8% year on year to USD 89 million in June from USD 122 million in the same month in 2022.

The equity placements were mainly from Japan, the United States, and Singapore. These were invested mostly in manufacturing, real estate, and information and communication industries.

Investments in equity and investment fund shares also declined by 19.2% to USD 200 million in June from USD 248 million in June 2022.

On the other hand, nonresidents’ net investments in debt instruments of local affiliates jumped by 11% to USD 283 million in June from USD 255 million a year ago.

“Concerns about global growth as well as anxiety over slowing growth in the Philippines may have prompted investors to hold back on investing at this time,” ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said in a Viber message.

Philippine gross domestic product (GDP) grew by a weaker-than-expected 4.3% in the second quarter, lower than 6.4% a quarter prior and 7.5% in the second quarter of 2022. In the first half, GDP growth averaged 5.3%.

“Equity and reinvestment of earnings were down (in June) indicating a slow pickup for fresh FDI, and less money being plowed back into the economy from existing firms,” Mr. Mapa said.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort in a note said elevated inflation and high borrowing costs continue to weigh on FDIs as these raised the cost of investments.

The central bank maintained its key policy rate at 6.25% at its meeting in June.

For the first half of the year, FDI net inflows dropped by 20.4% to USD 3.9 billion from USD 4.9 billion a year ago.

BSP data showed foreign investments in debt instruments declined by 24.6% year on year to USD 2.71 billion in the January-to-June period from USD 3.59 billion a year prior.

Investments in equity and investment fund shares also slid by 8.8% to USD 1.2 billion during the six-month period.

Net foreign investments in equity capital fell by 7.3% to USD 744 million. Equity capital placements inched up by 3.5% to USD 923 million, while withdrawals doubled to USD 180 million.

Most of these placements were from Japan, Germany, the United States, and Singapore.

Reinvestment of earnings fell by 11.2% to USD 459 million in the six-month period from USD 517 million in the comparable period in 2022.

“Given heightened uncertainty regarding the global economy, the Philippines may need to convince investors that second-quarter GDP was an aberration. Unless this is done, given our outlook for domestic growth, we could see FDI remain subdued in the coming months,” Mr. Mapa said.

Economic managers have said GDP needs to grow by 6.6% in the second semester to be able to reach the government’s 6-7% full-year target.

Mr. Ricafort said the free trade agreement (FTA) signed between the Philippines and South Korea earlier this month could boost trade, investments, employment, and overall economic growth.

The Philippine Economic Zone Authority earlier said it expects South Korea to become a top-four source of FDIs into the country, following the recently signed FTA.

Eventual policy rate cuts, especially in 2024, would also help reduce borrowing costs for investments, Mr. Ricafort added.

The BSP expects FDI net inflows at USD 9 billion by end-2023 and at USD 11 billion by end-2024. — Keisha B. Ta-asan

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld