January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

Debt yields climb ahead of Fed meeting

Yields on government securities (GS) traded in the secondary market rose last week ahead of the US Federal Reserve’s policy meeting and following the signing of the US debt ceiling deal.

Yields on government securities (GS) traded in the secondary market rose last week ahead of the US Federal Reserve’s policy meeting and following the signing of the US debt ceiling deal.

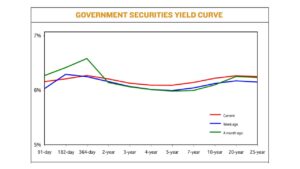

GS yields inched up by an average of 5.06 basis points (bps) week on week, based on PHP Bloomberg Valuation Service Reference Rates as of June 9 published on the Philippine Dealing System’s website.

The short end of the curve ended mixed, with the 91- and 364-day Treasury bills (T-bills) rising by 9.74 bps to 5.8631% and 1.68 bps to yield 5.9482%, respectively, while the rate of the 182-day T-bills fell by 6.21% to 5.9009%.

Meanwhile, rates at the belly of the curve went up, with the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) rising by 3.64 bps (to 5.901%), 4.57 bps (5.8428%), 5.93 bps (5.8156%), 7.33 bps (5.8127%), and 7.49 bps (5.8519%), respectively.

At the long end, yields on the 10-, 20-, and 25-year paper debt papers increased by 7.15 bps (to 5.909%), 6.92 bps (5.9437%), and 7.47 bps (5.9325%), respectively.

Total GS volume reached PHP 8.07 billion, higher than the PHP 4.38 billion recorded on June 2.

Robinsons Bank Corp. Assistant Vice-President and Peso Fixed Income Trader Kevin S. Palma attributed the upward trend seen in yields to domestic and overseas developments that caused bearish market sentiment.

“Bond traders and investors may have also opted for a more defensive approach this past trading week, awaiting the outcome of the FOMC (Federal Open Market Committee) decision this coming Thursday,” Mr. Palma said.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said local yield movements mirrored the increase in US Treasury rates following the approval of a deal suspending the US debt limit and Fed bets.

“These overshadowed the latest decline in the local inflation data at new one-year low at 6.1% and the latest cuts on banks’ reserve requirement ratio (RRR)… As a result, the markets are now anticipating possible pause on Fed rates and also a pause on local policy rates,” Mr. Ricafort added in a Viber message.

On June 3, US President Joseph R. Biden, Jr. signed into law a bill that will raise the country’s $31.4-trillion debt ceiling until Jan. 1, 2025, averting what would have been a first-ever default, Reuters reported.

Meanwhile, the Fed is expected to hold rates steady at its June 13-14 meeting, but is likely to remain hawkish and indicate a probable hike in July as inflation stays above its 2% target.

It is expected to revise higher its “dot plot” of policy makers’ rate expectations and inflation projections.

The Fed has raised borrowing costs by 500 bps since March 2022, with its target interest rate now at 5% to 5.25%.

On the other hand, preliminary data from the Philippine Statistics Authority (PSA) showed headline inflation eased to 6.1% in May from 6.6% in April.

This was the slowest in a year or since the 5.4% in May 2022.

For the first five months, the consumer price index averaged 7.5%, still higher than the Bangko Sentral ng Pilipinas’ (BSP) 2-4% target and 5.5% forecast for the year.

The BSP last month paused its aggressive tightening cycle after hiking for nine straight meetings, with the key rate now at 6.25%.

The Monetary Board had raised benchmark interest rates by 425 bps from May 2022 to March 2023.

Its next policy meeting will be held on June 22. It is expected to keep rates steady for its next two to three meetings as inflation continues to ease.

For this week, Mr. Palma expects the market players to monitor the “language used” in the Fed’s policy statement this week and its updated projections.

“These factors will play a significant role in determining the direction of local yields, which are likely to continue trading within a narrow range, contingent upon the outcome of the FOMC meeting this Thursday,” he added. — M.I.U. Catilogo with Reuters

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld