Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

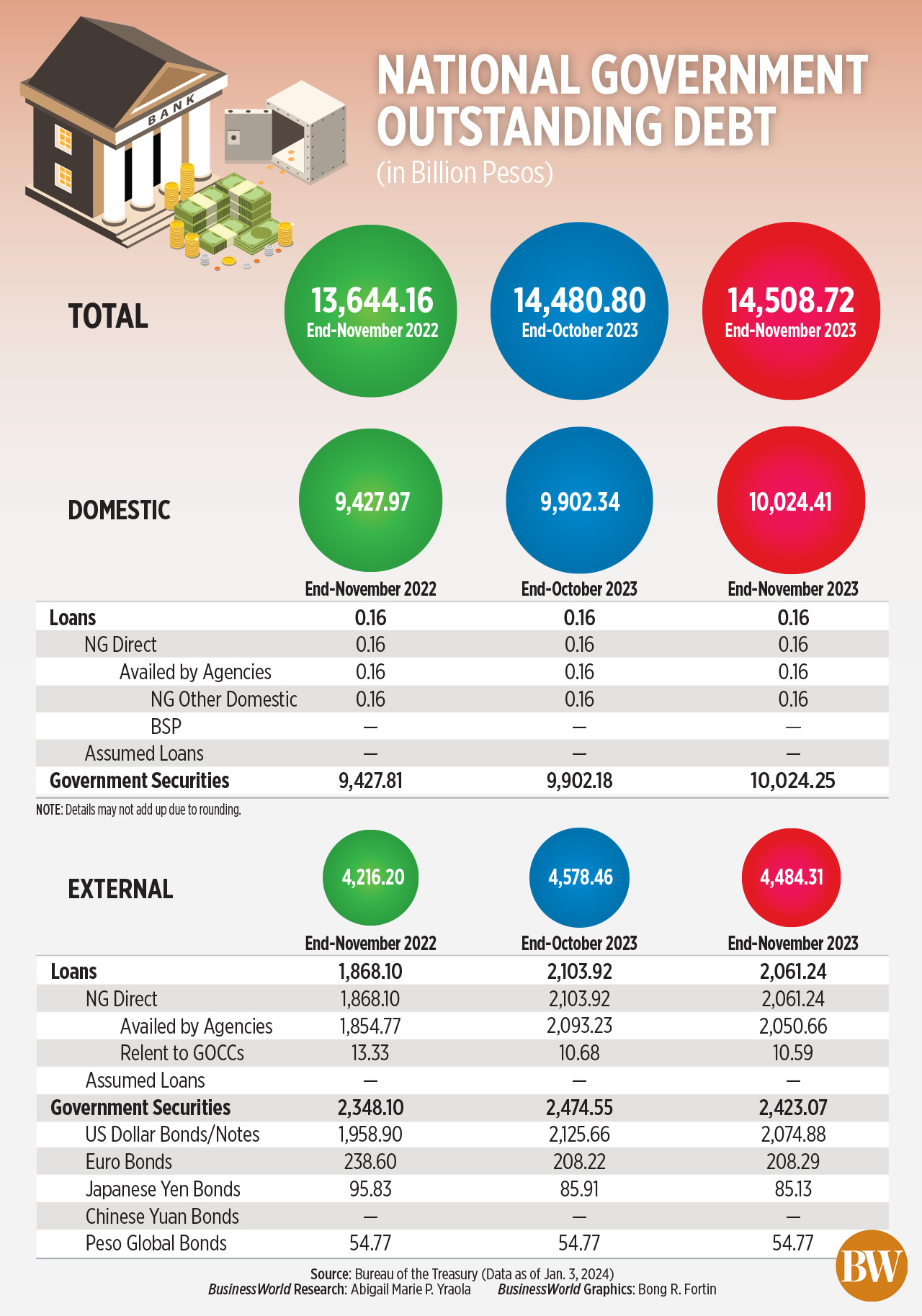

Debt pile rises to record PHP14.5 trillion

The National Government’s (NG) total outstanding debt hit a fresh high of PHP 14.51 trillion as of end-November, the Bureau of the Treasury (BTr) said on Wednesday.

The outstanding debt inched up by 0.2% from PHP 14.48 trillion as of end-October, data from the BTr showed.

“NG’s debt stock increased by PHP 27.92 billion or 0.2% month over month, primarily due to the net issuance of domestic securities,” the BTr said in a press release.

Year on year, the debt stock rose by 6.3% from PHP 13.64 trillion.

Year on year, the debt stock rose by 6.3% from PHP 13.64 trillion.

Outstanding debt went up by 8.1% from PHP 13.42 trillion as of end-December 2022.

More than two-thirds or 69.1% of total outstanding debt as of end-November came from domestic sources.

As of end-November, domestic debt increased by 1.2% to PHP 10.02 trillion from PHP 9.9 trillion a month earlier due to the net issuance of government securities.

Domestic debt also rose by 6.3% from PHP 9.43 trillion in the same period a year prior.

“New domestic debt issued during the month totaled PHP 171.091 billion while principal redemption amounted to PHP 45.14 billion, underlying a net issuance of PHP 125.95 billion,” the BTr said.

“The increase was partially offset by the PHP 3.87-billion effect of peso appreciation on foreign currency-denominated domestic securities,” it added.

Data from the Treasury department showed the peso closed at PHP 55.451 against the dollar as of end-November, strengthening by PHP 1.357 or 2.4% from PHP 56.808 as of end-October.

Meanwhile, external debt, which accounted for 31% of the total, slipped by 2.1% to PHP 4.48 trillion as of end-November from PHP 4.58 trillion as of end-October.

However, external debt rose by 6.4% from PHP 4.22 trillion a year ago.

“For November, the lower level of external debt was due to the net repayment of foreign loans amounting to PHP 1.08 billion and favorable foreign exchange movements, wherein the PHP 109.37 billion reduction attributed to peso appreciation against the US dollar far exceeded the upward adjustment linked to third-currency appreciation of PHP 16.3 billion,” the BTr said.

Broken down, external borrowings consisted of PHP 2.06 trillion in loans and PHP 2.42 trillion in global bonds.

As of end November, the NG’s overall guaranteed obligations slid by 12.2% to PHP 353.14 billion from PHP 361 billion as of end-October.

Year on year, guaranteed debt declined by 8.9% from PHP 388 billion.

“The decline in the level of guaranteed debt was attributed to the net repayment of both domestic and external guarantees amounting to PHP 1.21 billion and PHP 3.5 billion, respectively,” the BTr said.

“In addition, the peso appreciation against the US dollar further trimmed PHP 4.07 billion (from guaranteed debt). These more than offset the P0.92-billion effect of third currency appreciation on similarly denominated guarantees,” it added.

China Banking Corp. Chief Economist Domini S. Velasquez said the government incurred more debt to support budget financing.

“The increase in government debt was likely driven by the financing needs of government projects and programs. However, this growth was likely limited by lower market interest rates and the appreciation of the peso during the month,” she said.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said the record high NG debt was due to new borrowings to fund the budget deficit.

For 2023, the government has set a budget deficit ceiling of PHP 1.499 trillion, equivalent to 6.1% of the gross domestic product (GDP).

“Looking ahead to 2024, we expect the government to increase its borrowings to fund the 2024 budget which is 9.5% higher than that of last year,” Ms. Velasquez said.

“On a positive note, the expected downtrend in market yields and further strengthening of the peso will help moderate debt growth. However, we think that the proposed tax reforms are crucial to ensure that the budget deficit and government debt remain at manageable levels,” she added.

Mr. Ricafort said the government’s outstanding debt could still increase in the coming months due to the maiden issuance of Sukuk bonds worth USD 1 billion last December.

“Continued budget deficits, though narrower from year ago levels, could still lead to additional borrowings/debt by the national government,” he said.

For 2023, the government plans to borrow PHP 2.207 trillion, consisting of PHP 1.654 trillion from domestic sources and PHP 553.5 billion from foreign sources. –– Keisha B. Ta-asan

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld