January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

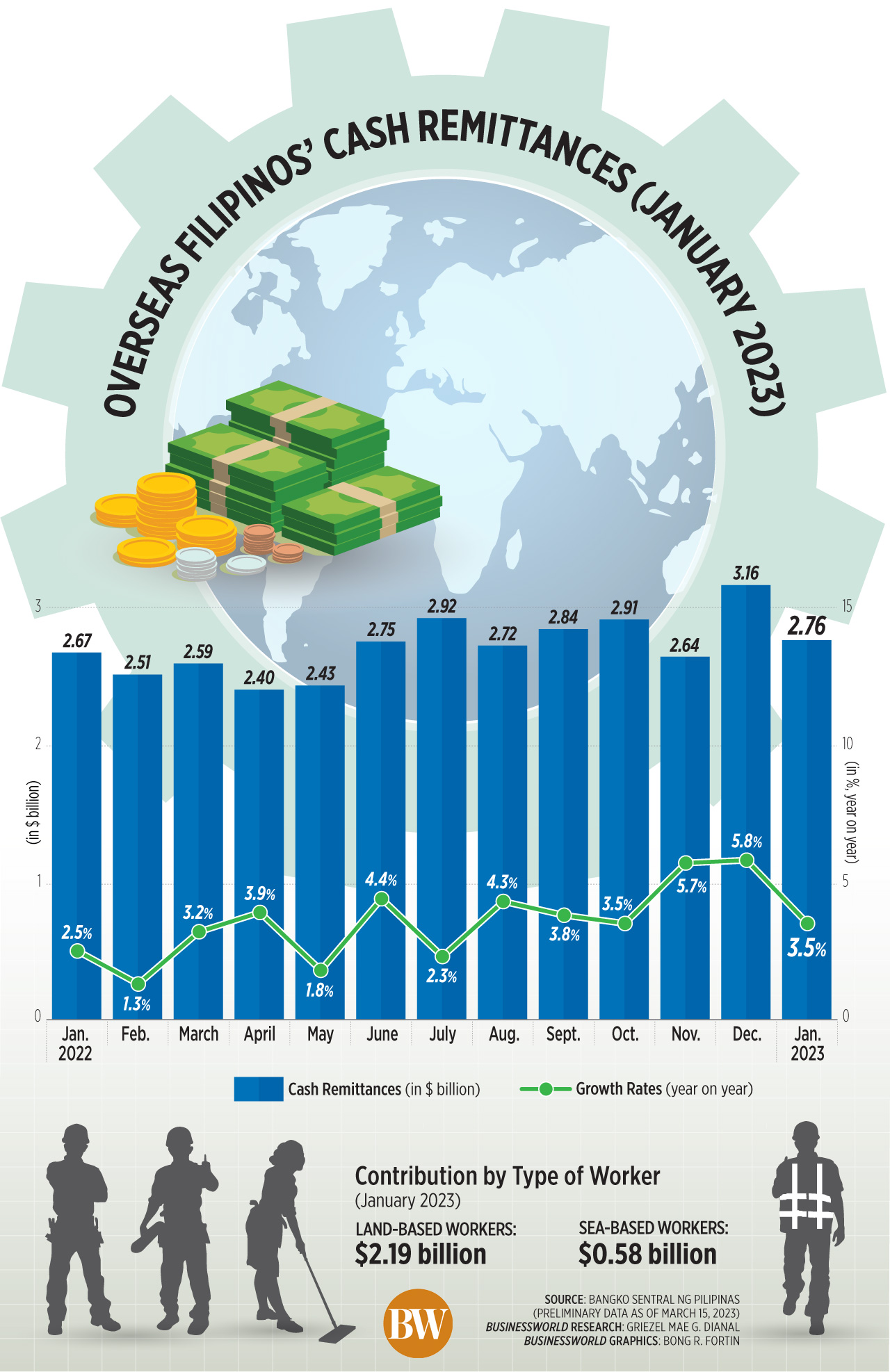

Cash remittances up 3.5% in January

MONEY SENT HOME by overseas Filipino workers (OFWs) rose by 3.5% annually in January, as they sought to help their families cope with the rising cost of living.

Data released by the Bangko Sentral ng Pilipinas (BSP) showed cash remittances coursed through banks jumped to USD 2.76 billion in January from USD 2.67 billion in the same month last year.

However, the amount of cash sent home by migrant Filipinos was the lowest in two months or since the USD 2.64 billion in November 2022.

Month on month, the growth in cash remittances slowed to 3.5% from 5.8% in December 2022.

Month on month, the growth in cash remittances slowed to 3.5% from 5.8% in December 2022.

The BSP expects remittances to grow by 4% this year.

“The expansion in cash remittances in January 2023 was due to the growth in receipts from land- and sea-based workers,” the BSP said in a statement on Wednesday.

Land-based OFWs sent USD 2.19 billion worth of remittances in January, up by 4% from USD 2.10 billion in the same month last year. Remittances from sea-based workers grew by 1.8% to USD 576 million in January from USD 565 million a year ago.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said OFWs may have sent more cash remittances in January as their families and dependents had to cope with rising inflation.

“(This was) offset by the fact that similarly higher prices/inflation in host countries could have also increased the cost of living of OFWs abroad, thereby could have been a drag on the amount of remittances sent to the country,” he said.

Headline inflation accelerated to 8.7% in January, from 8.1% in December. It was the fastest in over 14 years and marked the 10th consecutive month inflation was above the BSP’s 2-4% target range.

Core inflation, which discounts food and fuel volatile prices, jumped to 7.4% in January from 6.9% in December.

Migrant Filipinos were also likely encouraged to send more money after the holidays to take advantage of the favorable peso-dollar exchange rate.

“Still near record-high OFW remittances, on a monthly basis, also came amid the downward correction of the US dollar/peso exchange rate to PHP 54.80-PHP 55.00 levels recently, but still higher by about PHP 4 or about 8% compared to PHP 50.00-PHP 51.00 levels in January 2022,” Mr. Ricafort said.

The local currency rebounded to the PHP 54-a-dollar mark in January, closing the month at PHP 54.64 on January 31, up by PHP 1.115 or 2.04% from its PHP 55.755 finish on December 29, 2022.

Meanwhile, cash remittances declined by 12.6% from the USD 3.16 billion in December, reflecting the seasonal dip in inflows after the holidays.

“The month-on-month decline definitely signifies the seasonality of remittances. No more reason to send more money after the holidays,” Union Bank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said in a Viber message.

“Nonetheless, the uptick year on year shows residual momentum from the holiday remittances surge,” he added.

Inflows from the United States, Saudi Arabia, Japan, and Singapore largely contributed to the growth in cash remittances in January.

Nearly half or 41.9% of the overall remittances came from OFWs in the United States, followed by Singapore (7.2%), Japan (5.9%), Saudi Arabia (5.9%), the United Kingdom (4.8%), and the United Arab Emirates (3.2%).

Remittances from the top 10 countries accounted for 80% of the total in January.

Personal remittances, which contain inflows in kind, also increased by 3.5% year on year to USD 3.07 billion from USD 2.97 billion in January 2022.

Mr. Asuncion said he expects the pace of remittances to slow later this year.

“While still early days with anticipated soft or hard landings for the developed and emerging markets, (this is) likely to affect the forecast path. The dips in the current remittance trajectory especially for July and October reflect the global downturn’s impact on broad labor demand in the second half could result in subdued remittance flows,” he said.

Asian Institute of Management economist John Paolo R. Rivera said cash remittances may continue to increase as more OFWs are deployed abroad.

BSP data showed cash remittances hit a record high in 2022, climbing by 3.6% to USD 32.54 last year from USD 31.42 billion in 2021. — By Keisha B. Ta-asan, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld