Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

Budget gap widens in February as revenue collections decline

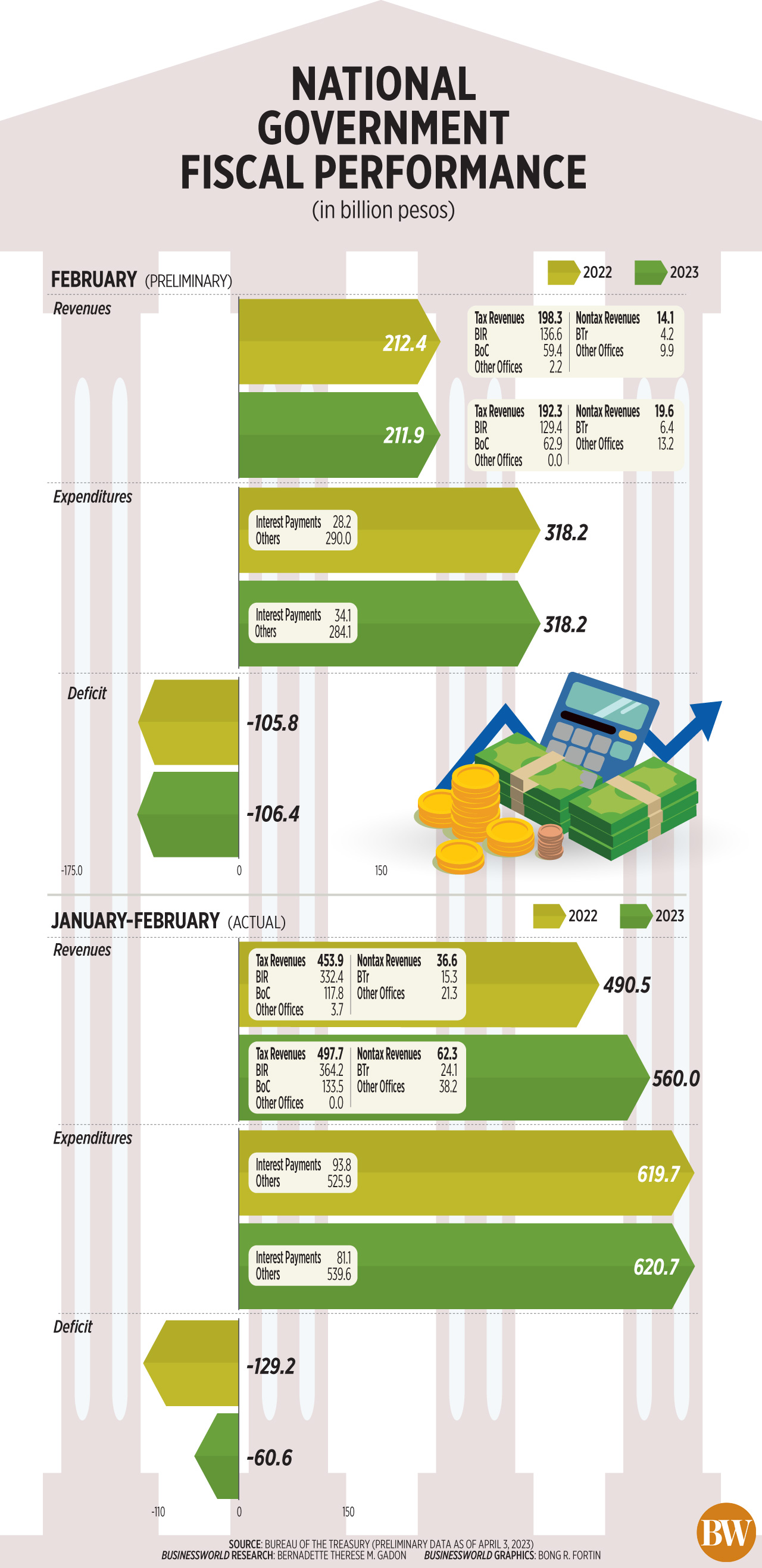

THE NATIONAL GOVERNMENT’S (NG) budget deficit slightly widened in February as revenue collection slipped and spending was flat, the Bureau of the Treasury (BTr) reported on Monday.

Data from the BTr showed the Philippines’ budget gap reached PHP 106.4 billion in February, up by 0.5% from PHP 105.8 billion recorded in the same month in 2022.

Month on month, the NG’s fiscal balance swung back to a deficit in February from the PHP 45.75-billion surplus in January.

“The fiscal performance was mainly attributed to a marginal 0.25% decrease in revenue collection, coupled with the flat expenditure outturn during the period,” the BTr said.

“The fiscal performance was mainly attributed to a marginal 0.25% decrease in revenue collection, coupled with the flat expenditure outturn during the period,” the BTr said.

State revenue collections dipped by 0.25% year on year to PHP 211.9 billion in February as tax revenues declined.

In February, tax revenues fell by 3.01% to PHP 192.3 billion, amid a 5.29% drop in collections by the Bureau of Internal Revenue (BIR) to PHP 129.4 billion. The Bureau of Customs (BoC) reported a 5.83% rise in revenues to PHP 62.9 billion for the month.

Nontax revenues, on the other hand, climbed by 38.37% to PHP 19.6 billion in February, thanks to a 51.16% increase in income from the Bureau of the Treasury to PHP 6.4 billion.

“The upturn was driven by the higher remittance of NG share from Philippine Amusement and Gaming Corp. (PAGCOR) earnings, as well as income from Bond Sinking Fund (BSF) investment and interest on NG deposits,” the Treasury said.

Nontax collections from other offices such as privatization proceeds and fees and charges, grew by 32.93% to PHP 13.2 billion.

Nicholas Antonio T. Mapa, a senior economist at ING Bank N.V. Manila, said February revenue collections have declined as base effects waned.

“BIR collections were benefiting from the positive base effects due to the economic reopening but that appears to be ebbing,” Mr. Mapa said in an e-mail.

Union Bank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said Customs collections also grew at a softer pace in February.

“It may be a signal that the reopening narrative and its momentum may be starting to fade with easing domestic demand particularly on imports,” Mr. Asuncion said.

Meanwhile, expenditures were flat, inching up by 0.01% to PHP 318.2 billion in February. Interest payments climbed by 20.83% to PHP 34.1 billion.

“The growth of disbursements was dampened by the decline of the National Tax Allotment (NTA) shares of local government units (LGUs) resulting from the lower national tax collections in 2020,” the BTr said, adding that this was due to the impact of the pandemic.

Mr. Asuncion said the sharply lower LGU revenue allocations on the expenditure side “may have mitigated the fiscal impact of the drop in tax collections.”

According to Mr. Mapa, lower spending suggests that the government may not be a significant source of economic growth this year.

Primary spending — which refers to total expenditures minus interest payments — contracted by 2.01% to PHP 284.1 billion from PHP 290 billion a year ago.

TWO-MONTH GAP

For the first two months of the year, the fiscal deficit sharply narrowed to PHP 60.6 billion, 53.07% lower than the PHP 129.2-billion gap a year ago.

Total revenues jumped by 14.2% to PHP 560 billion in the January-to-February period, 88.9% of which were from taxes.

Tax collection rose by 9.66% to PHP 497.7 billion. Broken down, the BIR collections rose 9.6% to PHP 364.2 billion, while Customs collections went up by 13.3% to P133.5 billion.

Nontax revenues surged by 70.3% to PHP 62.3 billion, driven by an 80% surge in revenues from other offices to PHP 38.2 billion. BTr income also jumped by 57.3% to PHP 24.1 billion.

On the other hand, expenditures in the January-to-February period inched up by 0.16% to PHP 620.7 billion as interest payments fell by 13.5% to PHP 81.1 billion.

Primary expenditures rose by 2.6% to PHP 539.6 billion.

Aside from the high base effect, Mr. Asuncion said disinflation and slower spending conditions may dampen total collections this year.

“Less upbeat revenues will restrain primary expenditure growth to 4% in our estimate. Next year, tax revenues may improve by 5-6% as economic growth heads back to potential with inflation back to the (2-4%) target range,” he said.

Primary expenditure gain is also expected next year, but the government may decide to keep spending in line with revenue growth, he added.

Mr. Mapa said lower revenue collection may continue in the coming months due to the uncertain growth outlook.

This year, the government has set a budget deficit ceiling of PHP 1.47 trillion, equivalent to 6.1% of gross domestic product. The program consists of PHP 3.71 trillion in revenues and PHP 5.18 trillion in disbursements. — By Keisha B. Ta-asan, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld