Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Budget gap narrows in November

The National Government’s (NG) budget deficit narrowed to PHP 93.3 billion in November from a year ago, amid tepid revenue growth and a decline in spending.

Data from the Bureau of the Treasury (BTr) released on Thursday showed the fiscal gap shrank by 24.8% from the PHP 123.9-billion deficit in November 2022.

Month on month, the November deficit widened from the PHP 34.4 billion in October.

“The National Government ran a PHP 93.3-billion budget deficit in November 2023, declining by 24.75% (PHP 30.7 billion) from a year ago due to the 2.82% growth in revenue collection alongside a 4.69% contraction in public spending,” the BTr said in a statement.

In November, revenue collections rose by 2.8% to PHP 340.4 billion, from PHP 331.1 billion in the same month in 2022.

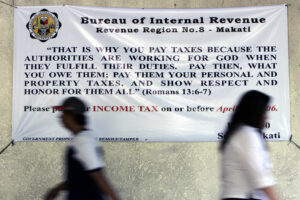

Tax revenues declined by 8.9% year on year to PHP 286 billion in November, amid a drop in collections by the Bureau of Internal Revenue (BIR) and Bureau of Customs.

BIR revenues decreased by 11% year on year to PHP 210.2 billion last month, while Customs collections slipped by 2.7% to P73.7 billion. Other tax offices collected PHP 2.1 billion, up 90.9% a year prior.

On the other hand, nontax revenues more than tripled to PHP 54.4 billion in November, as the Treasury posted a 686% jump in revenues to PHP 41.5 billion from just PHP 5.3 billion last year. Other offices saw an 8.8% increase in revenues to PHP 12.9 billion.

Income from the Treasury department was “primarily driven by higher dividend remittances and NG share from PAGCOR (Philippine Amusement and Gaming Corp.) income,” the BTr said.

However, state spending slumped by 4.7% to PHP 433.6 billion in November, from PHP 455 billion a year ago.

The BTr attributed the decline to a drop in tax allotment shares of local government units, lower direct payments from development partners for foreign-assisted rail transport projects, as well as the different schedules of big-ticket disbursements for infrastructure and social welfare projects.

Primary spending — which refers to total expenditures minus interest payments — fell by 10.2% to PHP 385.1 billion year on year from PHP 428.9 billion. Meanwhile, interest payments rose 86% to PHP 48.5 billion in November.

11-month gap

For the January-to-November period, the budget gap narrowed by 10.1% to PHP 1.11 trillion from a year earlier. This represents 74.1% of the programmed PHP 1.499-trillion deficit for the full year.

Revenue collection rose by an annual 8.8% to PHP 3.6 trillion as of end-November, representing 95.58% of the PHP 3.729-trillion target for 2023.

Tax revenues rose by 7.3% to PHP 3.18 trillion, while nontax revenues climbed by 22.9% to PHP 381.9 billion.

The BIR collections jumped by 8.6% to PHP 2.34 trillion in the 11-month period, already accounting for 88.77% of the PHP 2.64-trillion target.

Customs collections went up by 2.9% to PHP 812 billion, which made up 93% of the full-year target of PHP 874.2 billion.

BTr revenues increased by 46% to PHP 216.3 billion as of end-November. This is more than triple the PHP 58.3-billion program for the year, thanks to “higher dividend remittances, interest income from BTr’s managed funds and NG deposits, NG share from PAGCOR and MIAA (Manila International Airport Authority) profit, and government service income.”

Meanwhile, government spending went up by 3.6% to PHP 4.68 trillion as of end-November, accounting for 89.42% of the full-year expenditure program.

For the 11-month period, primary spending increased by 1.32% to PHP 4.1 trillion, while interest payments jumped by 23.6% to PHP 567.7 billion.

“Our 2023 budget deficit estimate could reach PHP 1.38 trillion that would fall short of the government’s program deficit target of PHP 1.499 trillion,” Union Bank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said in a Viber message.

“Key assumption behind this sanguine fiscal deficit outlook is a government prioritizing deficit and debt management as we close the year amid higher interest rate pressures on cash disbursements,” he added.

Meanwhile, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort in a note said continued tax reform measures and intensified tax collections may lead to a narrower budget deficit, reduced borrowings, and slower increment in the outstanding National Government debt.

These new tax reforms would be complemented by easing inflation, especially if prices continued to stabilize towards the central bank’s 2-4% target in the coming months, he said. — Keisha B. Ta-asan

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld