Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

Budget gap exceeds ceiling in 2022

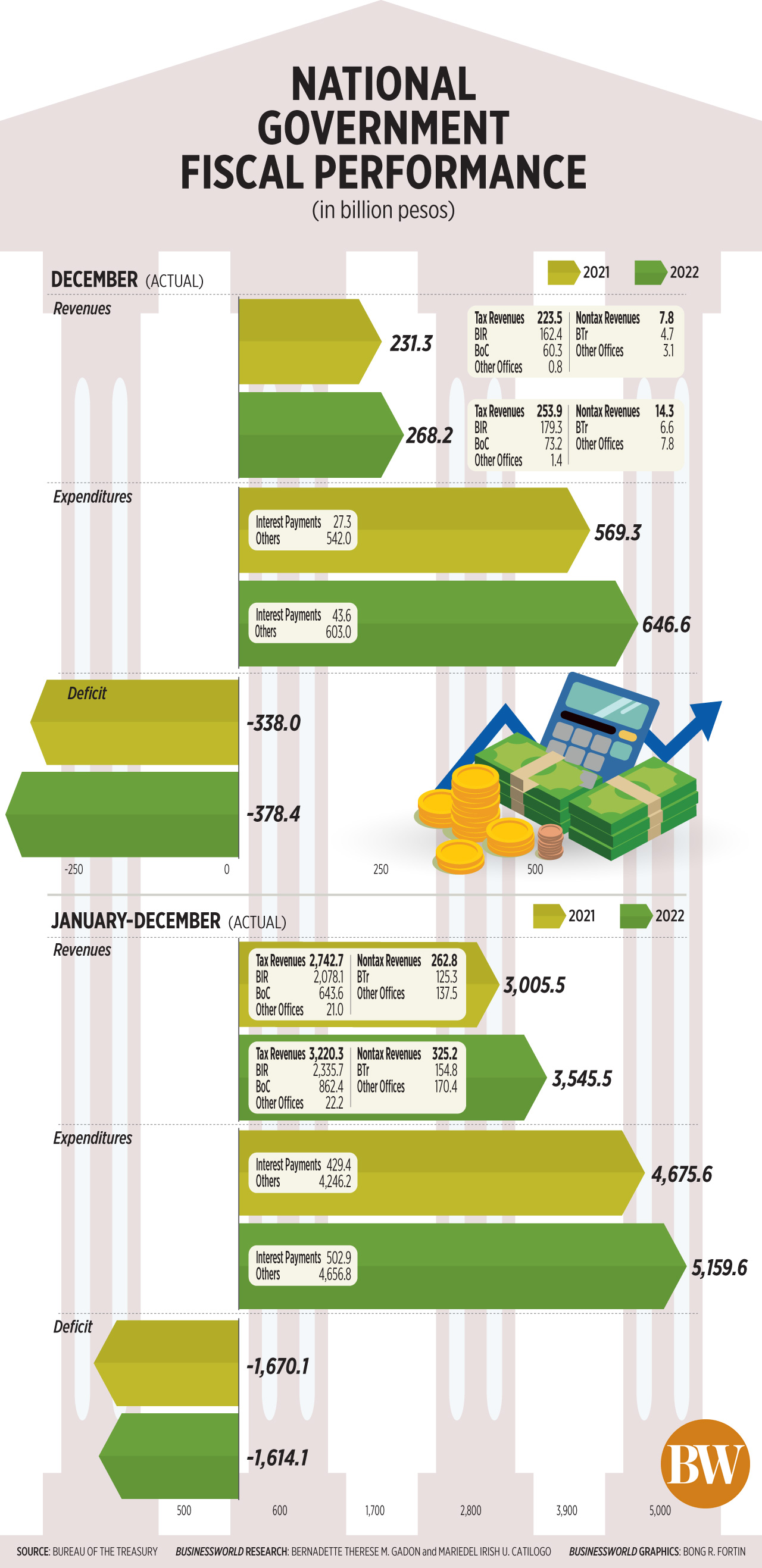

THE NATIONAL Government’s (NG) fiscal gap narrowed year on year to PHP 1.61 trillion in 2022, but exceeded the budget deficit ceiling.

Data from the Bureau of the Treasury (BTr) showed the full-year deficit was lower by 3.35% or PHP 56 billion than the PHP 1.67 trillion shortfall in 2021.

It was also higher than the revised PHP 1.502-trillion target set by the Development Budget Coordination Committee (DBCC) last December.

“The fiscal outturn was driven by revenue growth of 17.97% outpacing the 10.35% expansion in government spending,” the BTr said in a press release on Wednesday.

This brought the fiscal deficit to 7.33% of gross domestic product (GDP), lower than 8.6% in 2021 but higher than the DBCC target of 6.9%.

In December alone, the budget gap widened to a record PHP 378.4 billion, up 11.94% from the PHP 338 billion in the same month in 2021.

Revenues in December increased by 15.95% year on year to PHP 268.2 billion.

Tax revenues grew by 13.61% to PHP 253.9 billion during the month, as Bureau of Internal Revenue’s (BIR) collection rose by 10.42% to PHP 179.3 billion and the Bureau of Customs (BoC) revenues reached PHP 73.2 billion, up by 21.4% from a year ago.

On the other hand, nontax revenues from the Treasury went up by 38.31% to PHP 6.6 billion in December.

Meanwhile, government spending jumped by 13.57% to PHP 646.6 billion in December from PHP 569.3 billion in the same month a year ago.

Primary spending — which refers to total expenditures minus interest payments — rose by 11.25% to PHP 603 billion from PHP 542 billion.

Full year

For the full-year 2022, revenue collection jumped by 17.97% to PHP 3.55 trillion from PHP 3.01 trillion in 2021. It was also slightly higher than its PHP 3.52-trillion program for the year.

Tax revenues, which accounted for 91% of the total revenues, rose by 17.41% to P3.22 trillion from PHP 2.74 trillion a year ago.

Of this, revenues generated by the BIR went up by 12.39% to PHP 2.34 trillion, while collections from the BoC jumped 34.01% to PHP 862.4 billion.

Other tax collecting offices posted PHP 22.2 billion in revenue, an increase of 5.69% from a year earlier.

Nontax revenues from the BTr reached PHP 154.8 million, up by 23.48% from a year ago.

“The BTr’s robust collection was largely driven by higher remittances of dividends on shares of stocks, income from Bond Sinking Fund investments, and interest on NG deposits,” the Treasury added.

Meanwhile, expenditures increased by 10.35% to PHP 5.16 trillion, from the previous year’s PHP 4.68 trillion. This also surpassed the DBCC’s PHP 5.02-trillion program for the full year.

The BTr said that spending was largely attributed to the “faster execution of capital outlay projects amid the lowest COVID-19 (coronavirus disease 2019) alert level classification for most parts of the country; implementation of targeted subsidy programs to mitigate the impact of higher food and fuel prices; and payment of compensation and other benefits for COVID-19 healthcare workers in health facilities.”

Primary spending rose by 9.67% to PHP 4.66 trillion from PHP 4.25 trillion a year ago.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message that inflation may have contributed to the month-on-month widening of the budget deficit in December.

“The higher inflation could have pushed up nominally the incomes of taxpayers, raised nominal values of assets, and allowed the government to borrow money at higher rates and earn more interest income on its holdings of government bonds. The main result is the increase in government revenues,” Leonardo A. Lanzona, who teaches economics at the Ateneo de Manila University, said in an e-mail.

Mr. Lanzona noted the government needs to look for new sources of revenues, such as new taxes.

“Currently, instead of raising taxes directly, governments allowed inflation to reduce the value of money, which in turn reduced the real value of outstanding debts and generated extra revenues. However, relying on inflation as a revenue source is generally seen as a harmful policy, as it can lead to economic instability, uncertainty, and distortions in the economy,” he added.

Union Bank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said the narrower full-year NG budget shortfall “is a welcome development even amid rising global and domestic borrowing costs.”

“Higher-than-expected revenue collections due to the economic reopening narrative and higher-than-expected 2022 GDP growth has enabled the trimmed fiscal deficit. Nevertheless, we still sense strong near- to medium-term fiscal pressures due to the higher debt stock this year and the uncertainties on the backdrop of rising monetary policy interest rates (to deal with higher prices),” Mr. Asuncion said. — Luisa Maria Jacinta C. Jocson

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld