January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

BSP to keep policy rates steady — poll

The Philippine central bank will likely keep its benchmark policy rates steady at 6.25% for a third straight meeting on Thursday, amid easing inflation and slowing economic growth.

Some analysts, however, expect the Bangko Sentral ng Pilipinas (BSP) to start cutting rates in the fourth quarter to boost consumer demand following the disappointing second-quarter gross domestic product (GDP) data.

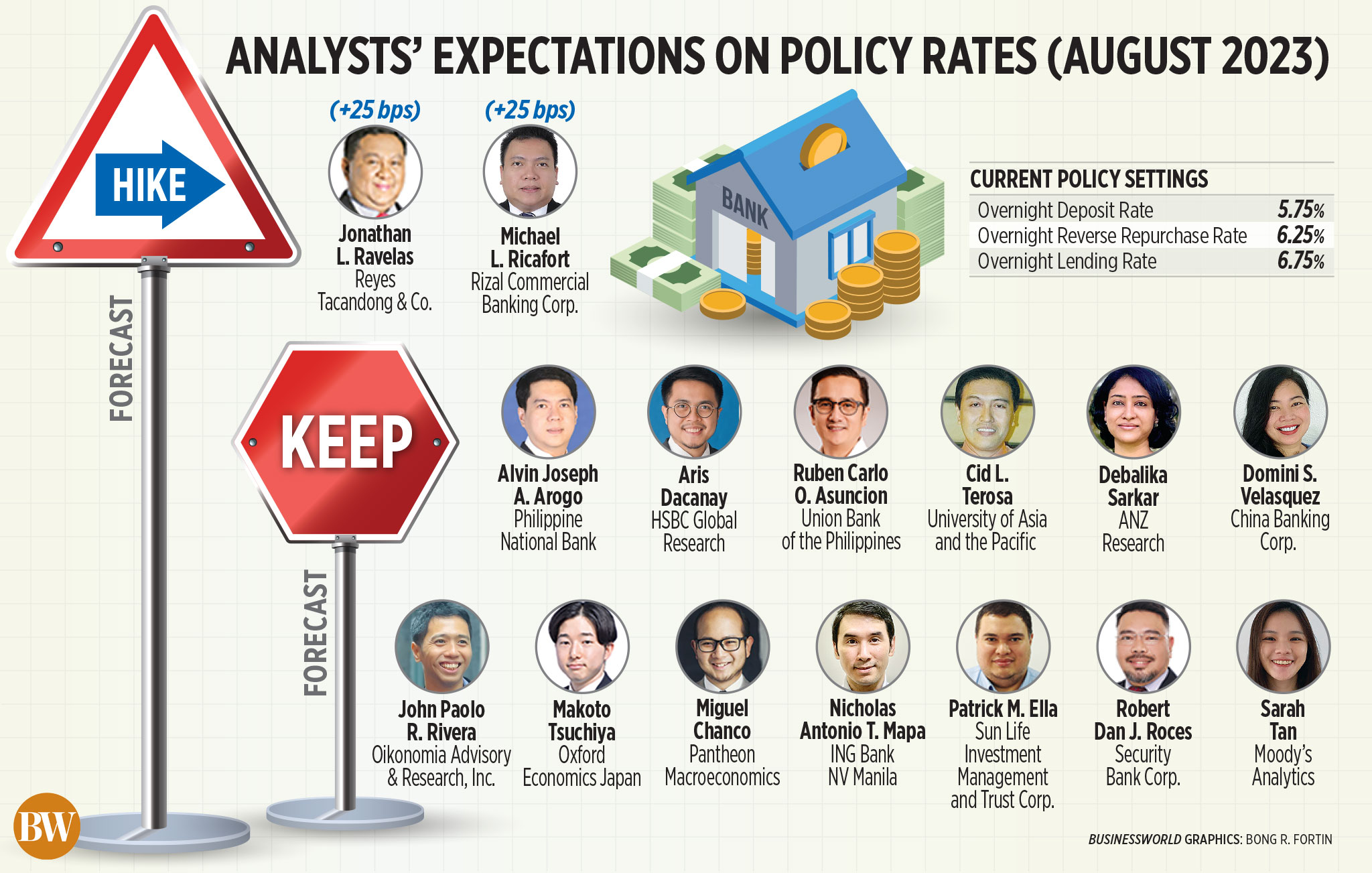

A BusinessWorld poll last week showed 13 of 15 analysts predict the Monetary Board will extend its pause at its Aug. 17 meeting.

On the other hand, two economists expect the BSP to hike borrowing costs by 25 basis points (bps), mirroring the move of the US Federal Reserve last month. If realized, this would bring the key rate to 6.5%.

Alvin Joseph A. Arogo, an economist from the Philippine National Bank, said a pause is appropriate since inflation continued to trend downwards in July.

Headline inflation slowed for a sixth straight month to 4.7% in July from 5.4% in June. It marked the slowest headline figure in 16 months, or since the 4% in March 2022.

For the first seven months of the year, inflation averaged 6.8%, still higher than the BSP’s 5.4% full-year forecast.

“I think BSP will extend its policy hold and continue to reassess the current economic situation. Slower second-quarter GDP growth will make BSP a bit more cautious in raising interest rates at this time,” University of Asia and the Pacific (UA&P) Senior Economist Cid L. Terosa said.

The Philippine economy expanded by 4.3%, easing from the 6.4% growth in the first quarter and 7.5% a year ago. This was much lower than the 6% median forecast in a BusinessWorld poll, and the slowest in two years.

For the first semester, GDP growth averaged 5.3%. Economic managers have said the economy has to expand by at least 6.6% in the second half to achieve the government’s 6-7% full-year target.

“We think that the BSP will likely pause in its August meeting as the effect of the cumulative tightening since last year has taken a toll on the economy,” China Banking Corp. Chief Economist Domini S. Velasquez said in an e-mail.

While government spending was a major drag on growth, Ms. Velasquez said weaker consumption, flat investments and muted private construction growth “will likely be major considerations in hiking rates too much.”

Government spending contracted by 7.1% in the April-to-June quarter, a reversal of the 6.2% growth in the first quarter and 10.9% a year ago.

Household spending growth slowed to 5.5% from 6.4% in the first quarter and 8.5% expansion a year earlier.

Gross capital formation — the investment component of the economy — dipped by 0.04%, ending eight straight quarters of growth. This was a reversal from 17.2% in the second quarter of 2022.

“We believe the BSP governor will need to consider a pause to provide growth with some support while remaining hawkish in his statement by vowing to hike if upside risks to the inflation outlook materialize,” Nicholas Antonio T. Mapa, senior economist at ING Bank N.V. Manila, said.

BSP Governor Eli M. Remolona, Jr. last week said the central bank wants to ensure a smooth exit from its tightening cycle.

“If there’s a chance that we might have to raise rates again after we start cutting, we don’t want to take the risk from these quick reversals. I think the exit has to be a smooth process and this is what central banks have learned over the years — sudden reversals are bad,” he said in a transcript of a discussion with Nomura Chief ASEAN (Association of Southeast Asian Nations) Economist Euben Paracuelles provided by the BSP on Thursday.

Mr. Remolona said the BSP is ready to resume its policy tightening should supply shocks on inflation emerge, especially if the El Niño weather event will turn out to be severe.

Meanwhile, Jonathan L. Ravelas, senior adviser at Reyes Tacandong & Co., said the BSP will likely raise policy rates by 25 bps on Thursday to match the recent hike of the US Federal Reserve.

“This is to keep the difference in interest rates between the Philippines and the US healthy, which can help stabilize the value of the Philippine peso compared to the US dollar and control inflation,” Mr. Ravelas said. “It will also serve as a calibrated preemptive response to the upside risks to inflation.”

The US central bank raised the federal funds rate target by 25 bps to 5.25-5.5%, the highest level in more than two decades.

Rate cuts by yearend

Pantheon Chief Emerging Asia Economist Miguel Chanco said the Monetary Board may cut rates by 25 bps in November and another 25 bps in December.

“This call has been bolstered by disappointing second-quarter GDP report, which shows a broad-based and sharp slowdown in domestic demand. Our core view now is that the economy will enter a shallow technical recession, implying another quarter-on-quarter contraction in GDP in the third quarter,” he said.

Patrick M. Ella, economist at Sun Life Investment Management and Trust Corp., likewise said there is room for a possible 25-bp cut in the fourth quarter if inflation continues to ease.

BSP Deputy Governor Francisco G. Dakila, Jr. on Friday said inflation could return to the 2-4% target range earlier than expected.

“There’s actually some chance that we may even go back to within target before the fourth quarter and that is something that will be considered,” he said at an economic briefing in Cebu, adding the full-year inflation forecast will be reviewed this week.

However, Mr. Arogo said the BSP will likely hold the key rate at 6.25% for the rest of the year due to the upside risks to prices.

“In particular, we are concerned about the impact of the minimum wage hike, El Niño, typhoons, oil production cuts, and prolonged Russia-Ukraine war,” he said.

A P40 wage hike in the National Capital Region took effect on July 16. Pending wage hike petitions for various provinces in the country will likely be decided on by September.

The El Niño weather phenomenon is expected to persist until the first quarter of 2024.

“If the exchange rate sharply weakens due to the lower BSP-Fed interest rate differential, however, then we believe that BSP may need to temporarily sacrifice supporting growth until the peso stabilizes,” Mr. Arogo said.

Meanwhile, HSBC Global Research ASEAN economist Aris Dacanay said the BSP will likely keep rates steady until yearend.

“Despite the challenges in growth, we continue to expect the BSP to maintain the policy rate at 6.25% and only cut rates after the Fed cuts its own. Since our baseline view is for the Fed to cut in the second quarter of 2024, we expect the BSP to begin its easing cycle in the third quarter of 2024,” he said.

After Aug. 17, the BSP will hold policy-setting meetings on Sept. 21, Nov. 16, and Dec. 14. — Keisha B. Ta-asan, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld