Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

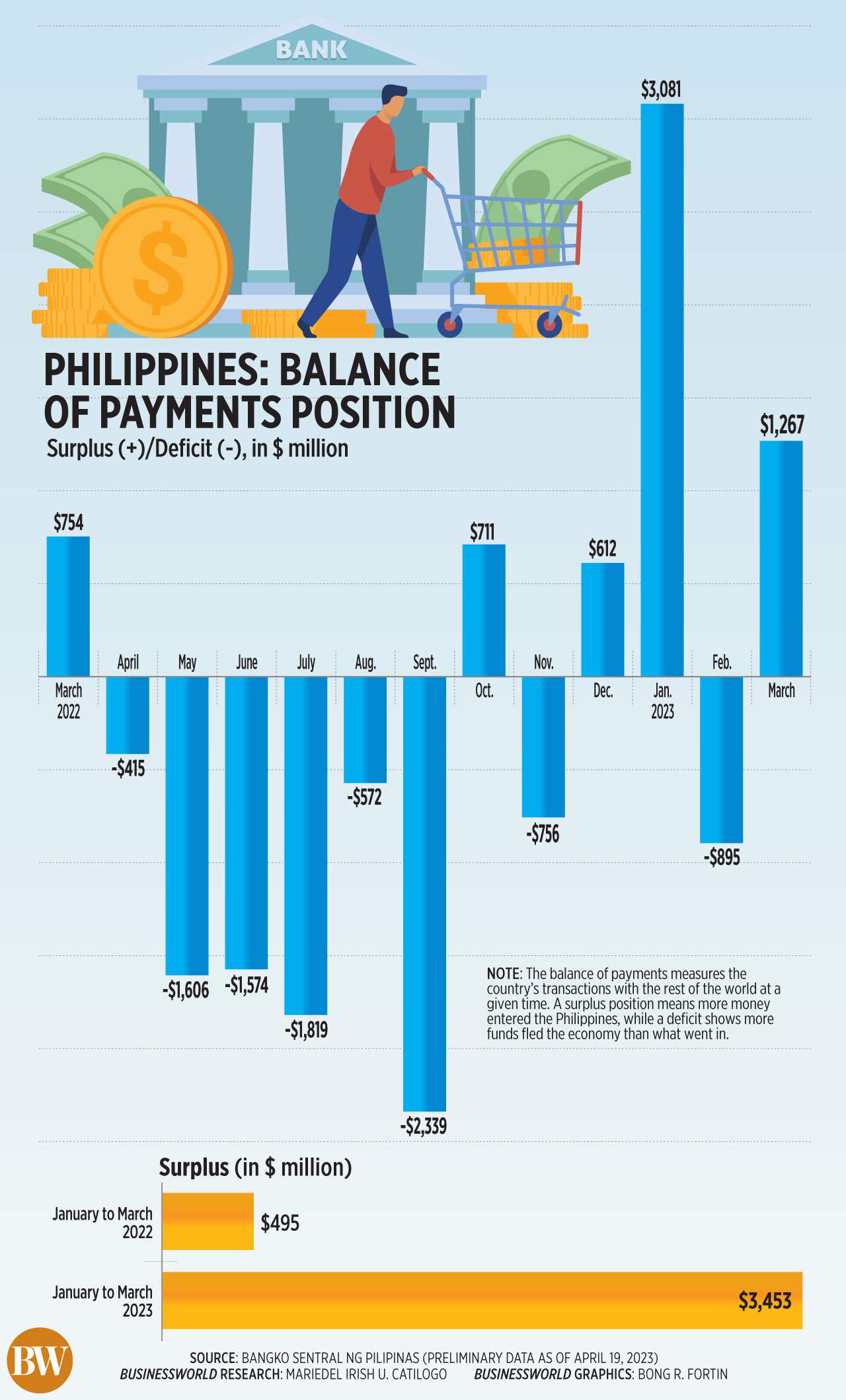

BoP surplus hits USD 1.27 billion in March

THE PHILIPPINES’ balance of payments (BoP) surplus hit a two-month high of USD 1.27 billion in March, mainly driven by foreign currency deposits from the National Government and the central bank’s investments abroad.

Data released by the Bangko Sentral ng Pilipinas (BSP) on Wednesday showed that the March surplus was bigger than the USD 754-million surfeit a year earlier. This is also a turnaround from the USD 895-million deficit in February.

This is also the biggest BoP surplus since the USD 3.08-billion surfeit in January.

“The BoP surplus in March 2023 reflected inflows arising mainly from the National Government’s (NG) net foreign currency loans, which were deposited with the BSP, and net income from the BSP’s investments abroad,” the central bank said in a statement.

“The BoP surplus in March 2023 reflected inflows arising mainly from the National Government’s (NG) net foreign currency loans, which were deposited with the BSP, and net income from the BSP’s investments abroad,” the central bank said in a statement.

The BoP gives a glimpse into the country’s transactions with the rest of the world. A deficit means more funds left the country, while a surplus shows that more money came in.

“The BoP surplus in March was likely supported by a narrowing trade gap. Latest trade data showed that the deficit in February was at the lowest in four months amid a weaker outturn in both exports and imports,” China Banking Corp. Chief Economist Domini S. Velasquez said in a Viber message.

Preliminary data from the Philippine Statistics Authority (PSA) showed the trade gap shrank to USD 3.88 billion in February, the smallest since the USD 3.72-billion deficit in November 2022.

Merchandise exports fell by 18.1% year on year to USD 5.08 billion, while imports slipped by 12.1% to USD 8.95 billion from a year earlier.

At its end-March level, the BoP reflects a final gross international reserve of USD 101.5 billion, up by 3.4% from the USD 98.2 billion a month earlier.

This is enough to cover 6.1 times the country’s short-term external debt based on original maturity and 4.2 times based on residual maturity.

It also represents buffers equivalent to 7.6 months’ worth of imports of goods and payments of services and primary income.

For the first quarter, the BoP position stood at a USD 3.45-billion surplus, ballooning from the USD 495-million surfeit in the same period last year.

Union Bank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said remittances from overseas Filipino workers contributed to higher BoP inflows.

Cash remittances hit a record high of USD 32.54 billion in 2022, up by 3.6% from USD 31.42 billion in 2021.

However, latest BSP data showed remittance growth slowed to 2.4% in February from 3.5% in January, marking the weakest annual growth since 2.3% in July 2022.

“The NG has also continued to borrow resulting to higher net foreign borrowings, probably as buffer for future spendings. Moreover, higher foreign direct investments (FDI) have also contributed to the rising BoP surplus,” Mr. Asuncion said in a Viber message.

Treasury data showed gross borrowings in February surged by 606% from P53.121 billion in the same month a year ago. External borrowings almost doubled to PHP 15.984 billion in February from P8.121 billion in the same month in 2022.

Meanwhile, FDI net inflows plunged 45.7% to USD 448 million in January from USD 824 million in the same month a year ago, data from the central bank showed.

“Overall, we think that the BoP may continue to be in surplus, but not for long as the global economic recession risk overhang continues to linger and darken the global economic outlook,” Mr. Asuncion said.

For her part, Ms. Velasquez expects the BoP position to end at a slightly narrower deficit this year as price pressures from the Russia-Ukraine war fade.

“The subdued external outlook as advanced economies continue to face recessionary risk will keep exports weak, but we expect Chinese demand to buoy exports towards the second half of the year,” she said.

Ms. Velasquez said investments abroad may support the BoP position amid the recent implementation of investor-friendly reforms.

The central bank expects the BoP position to end the year with a USD 1.6-billion deficit, narrower than the $7.3-billion deficit in 2022. — By Keisha B. Ta-asan

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld