Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

BIR goes after firms issuing fake receipts

THE BUREAU of Internal Revenue (BIR) on Thursday filed criminal complaints before the Department of Justice (DoJ) against four suspected “ghost” corporations allegedly behind the sale of fake receipts, which have cost the government around PHP 25.5 billion in revenue losses.

BIR Commissioner Romeo D. Lumagui, Jr. said the government will go after not just the companies that issued these fraudulent receipts, but also their buyers.

“We are just getting started. The financial magnitude of this syndicate issuing fictitious receipts is alarming. They are profiting from businesses through convincing their clients to ghost our tax authority,” he said in a statement.

Mr. Lumagui said the taxpayers and businesses found to have used these fake receipts will also be subjected to a BIR audit.

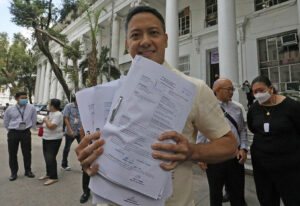

The BIR chief personally went to the DoJ to file the complaints against four corporations for violating Sections 254, 255, and 267 of the National Internal Revenue Code of 1997.

A BIR statement identified the four companies as Buildforce Trading, Inc., Crazykitchen Foodtrade Corp., Decarich Supertrade, Inc., and Redington Corp.

“These four corporations have no real businesses apart from selling receipts so they can sell these to other buyers or companies who will use them as deductions to their expenses,” Mr. Lumagui told reporters in Filipino on Thursday.

“It is clear that this is in violation of our law on tax evasion. In addition to this, their tax liabilities with all the penalties and surcharges will be imposed,” he added.

The complaint against these four companies stems from the raid conducted by the BIR in December 2022. At that time, BIR officials seized thousands of illegal receipts, invoices, and other documents inside a condominium in Quezon City.

“As a result of these companies’ fraudulent tax schemes, the government is losing an estimated total deficiency income tax amounting to PHP 17.63 billion and total deficiency value-added tax amounting to P7.91 billion, for taxable years 2019-2021, inclusive of surcharges and interests,” the BIR said.

Mr. Lumagui said the losses from fake receipts could even have reached “hundreds of billions.”

“We have a list of buyers and sellers of these fictitious receipts. Our main goal here is to put these fraudulent activities to a halt with the high hopes of increasing voluntary tax compliance,” Mr. Lumagui said, adding that the agency is currently preparing cases against the buyers of fake receipts.

In February, the BIR filed tax evasion cases against 74 individuals and corporate taxpayers worth PHP 3.58 billion.

The agency has also been cracking down on sellers of illicit cigarettes and vaping products. In December, the BIR filed a PHP 1.2-billion tax evasion case against five vape traders.

The BIR set a collection target of PHP 2.6 trillion this year, 11% higher than the PHP 2.34-trillion revenues it collected last year. — Keisha B. Ta-asan

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld