Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Big banks’ Q3 asset growth fastest in two quarters

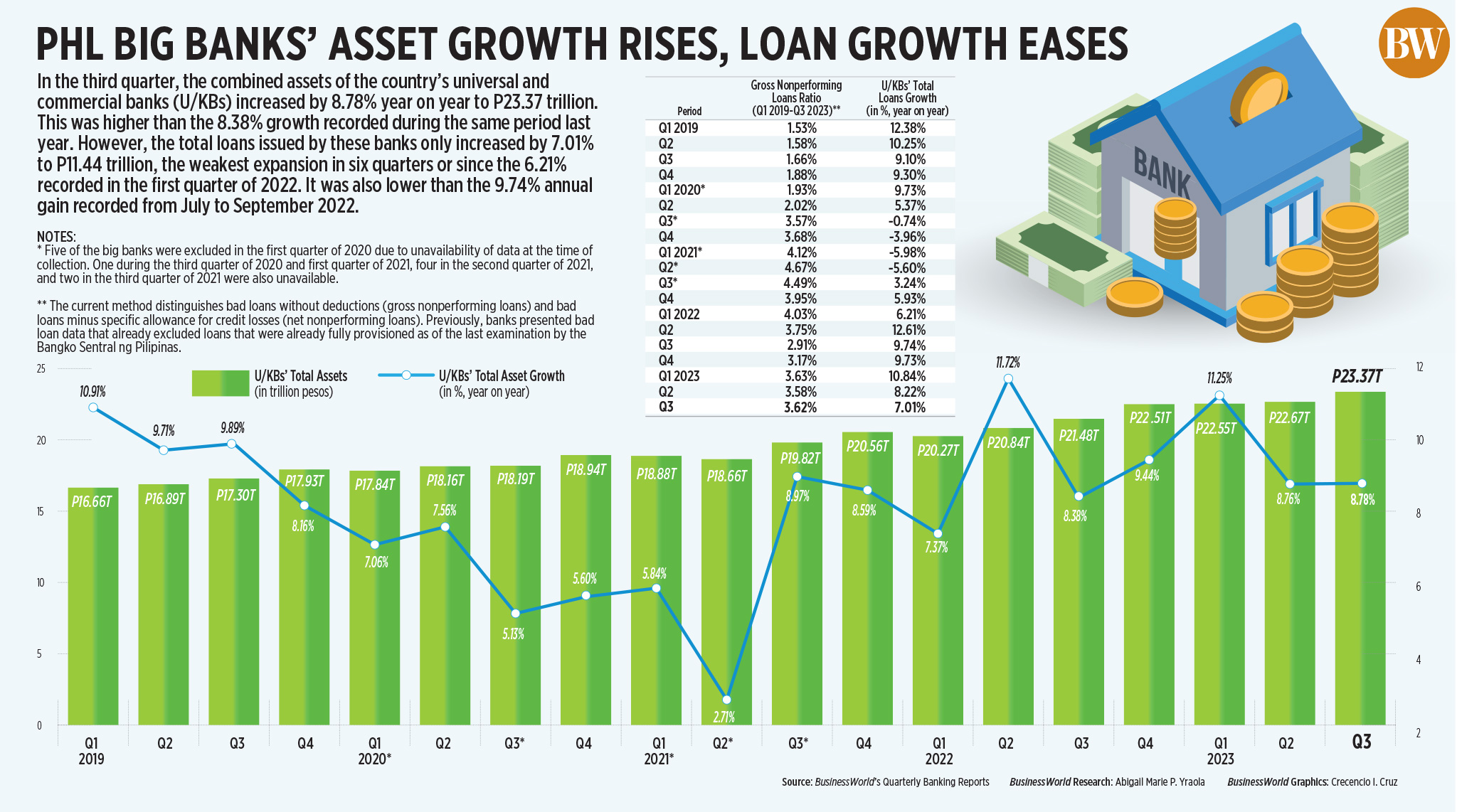

The combined assets of the Philippines’ biggest banks rose by 8.78% in the third quarter, while lending growth slowed amid high borrowing costs.

The latest edition of BusinessWorld’s quarterly banking report showed the combined assets of 45 universal and commercial banks (U/KBs) increased by 8.78% year on year to PHP 23.37 trillion in the July-to-September period from PHP 21.48 trillion a year ago.

This was a tad faster than the 8.38% growth logged in the same period last year and 8.76% in the second quarter.

Asset growth was the fastest in two quarters or since 11.25% in the first three months of 2023.

Meanwhile, total loans of these big banks inched up by 7.01% to PHP 11.44 trillion in the third quarter, slower than the 9.74% growth posted a year ago.

The third-quarter loan growth was the slowest in six quarters or since the 6.21% growth in the first quarter of 2022.

The slowdown in lending was reflected in soaring borrowing costs, which discouraged consumers from taking out loans. The Bangko Sentral ng Pilipinas’ (BSP) key rate stood at a near 16-year high 6.25% in the third quarter.

In late October, the Monetary Board raised policy rates by 25 basis points (bps) in an off-cycle hike, which brought the benchmark rate to 6.5%. Between May 2022 and October 2023, the BSP has raised borrowing costs by a cumulative 450 bps.

Bad loans, also known as nonperforming loans (NPLs), jumped by 6.8% to PHP 374.27 billion in the July-to-September period from PHP 350.44 billion in the same period a year ago.

This brought the NPL ratio — the share of soured loans to the total loan portfolio — to 3.62% from 2.91% in the same quarter a year ago.

Loans are considered to be nonperforming if any principal and/or interest are left unpaid for more than 90 days from the contractual due date or accrued interests for more than 90 days have been capitalized, refinanced, or delayed by agreement.

Meanwhile, the nonperforming asset (NPA) ratio — the share of NPLs and foreclosed properties to total assets — further eased to 0.89% from 1.1% a year ago.

Relative to total assets, foreclosed real and other properties stood at 0.25% in the third quarter, lower than 0.28% posted in the same period last year.

Total loan loss reserves went up by 8.4% to PHP 413.09 billion during the July-to-September period from PHP 381.25 billion a year ago.

These big banks median capital adequacy ratio (CAR) — the lender’s ability to absorb losses from risk-weighted assets — reached 21.54% in the third quarter, better than the 19.6% median a year ago. However, this was lower than the 21.75% median CAR in the second quarter.

The ratio remained well above the regulatory minimum of 10% set by the BSP as well as the international minimum standard of 8% under the Basel III framework.

The median return on equity (RoE), which is an indicator of profitability, increased to 9.42% in the third quarter from 6.42% in the same quarter a year ago.

The RoE, the ratio of net profit to average capital, measures the amount that shareholders make on every peso they invest in a company.

Sy-led BDO Unibank, Inc. (BDO) remained the largest bank in terms of total assets with PHP 4.22 trillion, followed by Metropolitan Bank & Trust Co. (Metrobank) with PHP 3.15 trillion and Land Bank of the Philippines (LANDBANK) with PHP 3.1 trillion.

BDO also led the industry in lending with PHP 2.63 trillion worth of loans issued, followed by Bank of the Philippine Islands (BPI) with PHP 1.73 trillion and Metrobank with PHP 1.4 trillion.

In terms of deposits, BDO led with PHP 3.41 trillion, followed by LANDBANK with PHP 2.74 trillion and Metrobank with PHP 2.35 trillion.

Among banks with at least PHP 100 billion assets, China Banking Corp. logged the fastest year-on-year asset growth of 21.16%, followed by Philippine Bank of Communications (15.23%) and Rizal Commercial Banking Corp. (14.63%).

Meanwhile, Standard Chartered Bank was the most aggressive lender with an annual increase of 31.08%, followed by Bank of Commerce with 20.66% and East West Banking Corp. with 18.42%

BusinessWorld Research has been tracking the financial performance of the country’s large banks on a quarterly basis since the late 1980s using banks’ published statements. — By Abigail Marie P. Yraola, Researcher

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld