Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

Policy Rate Views: Divided Fed kept rates unchanged for now

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Exports momentum further narrows gap

DOWNLOAD

DOWNLOAD

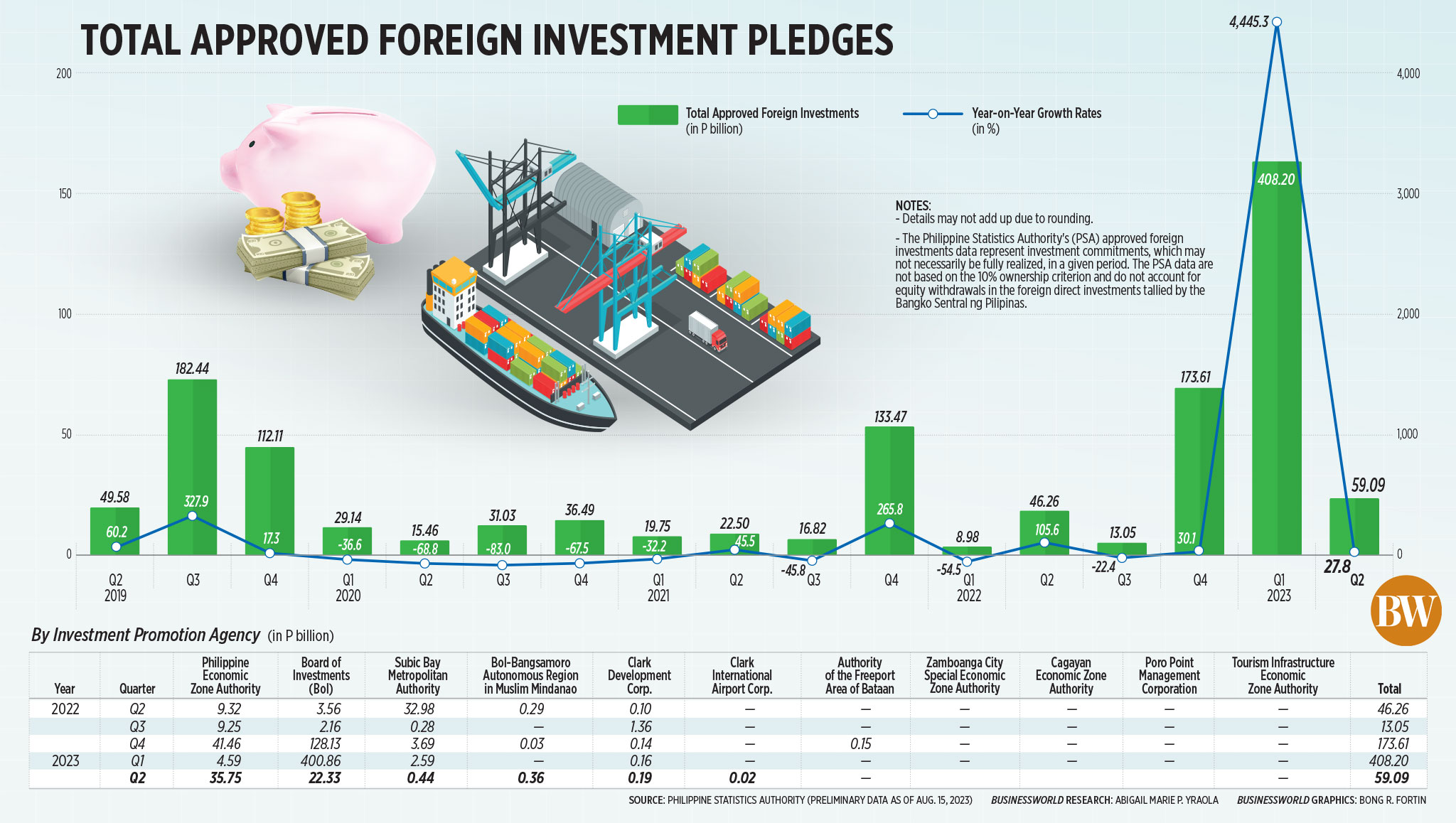

Approved foreign investment pledges jump by 28% in Q2

Foreign investment pledges approved by investment promotion agencies (IPAs) rose by an annual 27.8% in the second quarter, data from the Philippine Statistics Authority (PSA) showed.

Total foreign investment commitments jumped to PHP 59.09 billion in the April-to-June period from the PHP 46.26 billion recorded in the same period last year. This was the lowest level of foreign investment commitments since the PHP 46.26 billion in the second quarter of 2022.

The growth in foreign investment pledges was also the slowest since the 22.4% contraction in the third quarter of 2022.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in an e-mail the annual growth in foreign investment pledges reflected the further reopening of the economy, which had tempered concerns over elevated inflation and high borrowing costs.

Quarter on quarter, the amount of approved foreign investment commitments was almost seven times lower than the revised PHP 408.2 billion in the January-to-March period.

“The (quarter-on-quarter) slowdown (in investments) may be due to the wait-and-see attitude, lagged effects of policy hikes that inhibit investments, persistence of uncertainties, and headwinds to the economy,” Oikonomia Advisory & Research, Inc. President and Chief Economist John Paolo R. Rivera said in e-mail.

Japan was the biggest source of approved investment pledges with PHP 20.36 billion in the second quarter, followed by Singapore (PHP 17.65 billion) and Cayman Islands (PHP 11.63 billion).

In the second quarter, foreign investment pledges were approved by six IPAs.

The Philippine Economic Zone Authority (PEZA) accounted for 60.5% of the total foreign investment commitments with P35.75 billion.

The Board of Investments (BoI) approved P22.33 billion worth of foreign pledges, making up 37.8% of the total.

Other agencies that greenlit foreign pledges are Subic Bay Metropolitan Authority (PHP 441.01 million), BoI-Bangsamoro Autonomous Region in Muslim Mindanao (PHP 358.97 million), Clark Development Corp. (PHP 194.47 million), and Clark International Airport Corp. (PHP 16.44 million).

Meanwhile, the Authority of the Freeport Area of Bataan, Cagayan Economic Zone Authority, Poro Point Management Corp., Tourism Infrastructure and Enterprise Zone Authority, and Zamboanga City Special Economic Zone Authority did not approve foreign investment commitments in the second quarter.

Should these pledges materialize, these projects are expected to create 21,197 jobs.

Nearly a third or PHP 19.39 billion worth of projects will be located in Soccsksargen, while Calabarzon (Cavite, Laguna, Batangas, Rizal, Quezon) and Metro Manila will get projects worth PHP 14.64 billion and PHP 3.12 billion, respectively.

By industry, manufacturing will corner more than half or PHP 35.07 billion of the approved foreign investment pledges, while PHP 13.92 billion will go to the information and communication sector. The administrative and support service sector will get PHP 3.33 billion worth of foreign investment pledges.

“The country’s membership into RCEP, the world’s largest free trade agreement, also partly helped [the] increased approved foreign investments and would continue to help attract more in the coming months,” Mr. Ricafort said.

Recent economic reforms that further opened sectors to foreign investments may have also helped boost foreign investment inflows, he added.

PSA data on foreign investment commitments differ from actual foreign direct investments tracked by the central bank for the balance of payments. The central bank’s monitoring goes beyond the projects and includes other items such as reinvested earnings and lending to Philippine units via their debt instrument.

Meanwhile, PSA data showed the combined investment pledges by both foreigners and Filipino nationals reached PHP 317.23 billion in the second quarter, more than three times higher than PHP 99.64 billion a year ago. Quarter on quarter, the amount was 34% lower than the PHP 480.41 billion in the first quarter. — Mariedel Irish U. Catilogo

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld