Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

AMRO sees PHL as fastest-growing economy in the region

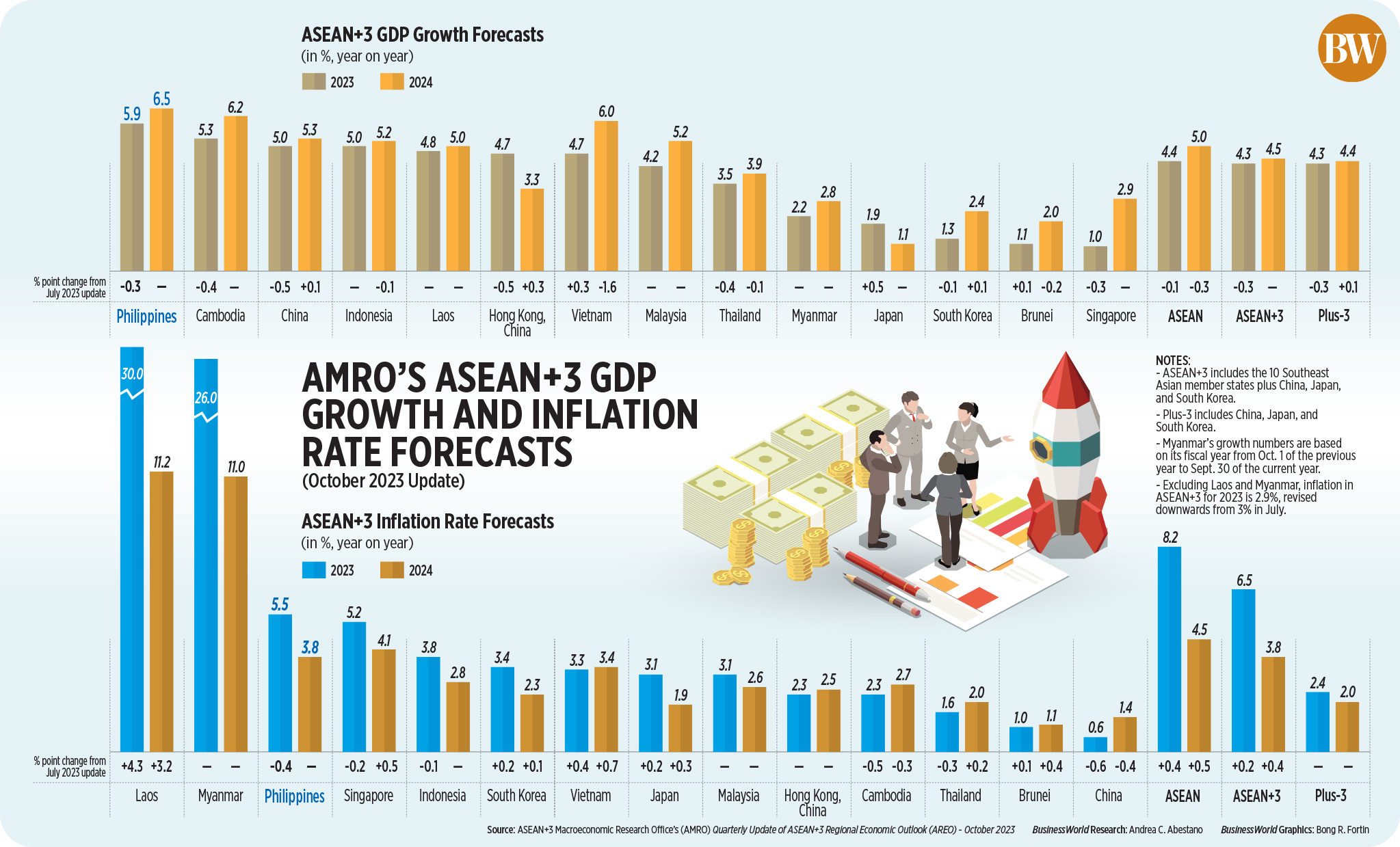

The Philippines is projected to be the fastest-growing economy in the region for this year and the next, the ASEAN+3 Macroeconomic Research Office (AMRO) said.

“For the Philippines, the second-quarter (growth) turned out to be weaker than we expected, but we are still quite bullish on the Philippines compared to the consensus,” AMRO Chief Economist Hoe Ee Khor said in a virtual briefing on its Regional Economic Outlook Update on Wednesday.

AMRO expects the Philippines’ gross domestic product (GDP) to grow by 5.9% this year, the fastest among ASEAN+3 economies. This is lower than the 6.2% forecast given in July.

“The Philippines has surprised us (these) last two years because domestic demand has been quite strong and is holding up quite well despite the increase in interest rates, and we think this will continue,” Mr. Khor added.

AMRO’s growth forecast for the Philippines is above the regional consensus. It expects ASEAN+3 growth to average 4.3% this year, lower than the 4.6% it gave earlier. The region is composed of the 10-member Association of Southeast Asian Nations (ASEAN) plus China, Japan and South Korea.

For the ASEAN region, AMRO also trimmed its forecast to 4.4% from 4.5% previously, “largely unchanged, buttressed in part by strong private sector spending and continuing recovery in tourism.”

For 2024, AMRO expects Philippine GDP to expand by 6.5%, which is still the fastest growth in the region. It is also the lower end of the government’s 6.5-8% target.

The think tank projects ASEAN+3 to grow by 4.5% and ASEAN by 5% next year.

Mr. Khor said economic growth next year will be robust, reflecting “an improvement in external demand.”

“Gradual adjustment in its property sector should help augment growth in China, with positive spillover effects across the ASEAN+3. Stronger tourism flows will be supplemented by the expected pickup in manufacturing exports. However, the weaker pace in global growth will keep a lid on the speed of the region’s expansion,” AMRO said.

Elevated inflation

Meanwhile, Mr. Khor noted that inflation in the Philippines has “come off faster than expected.” It sees inflation averaging 5.5% this year, below the Bangko Sentral ng Pilipinas’ (BSP) revised 5.8% full-year forecast.

“Inflation is coming off, although because of the recent increase in food prices, headline inflation picked up a bit. That’s going to be a drag on growth… otherwise, domestic demand is quite strong, and it’s being supported by remittance inflows,” Mr. Khor said.

Next year, AMRO sees Philippine inflation further easing to 3.8%, although above the BSP’s 3.5% 2024 forecast.

“We still expect inflation next year to be lower than this year… so that will be below (or) within the inflation target band of the central bank,” Mr. Khor said.

AMRO identified risks that could continue to stoke inflation in the region, such as rising global commodity prices, a possible recession in the US and Europe, and the slowdown in China.

“The overall balance of risk to the outlook has shifted, with the risk of higher inflation becoming more salient. While the risk of financial spillovers from tighter US monetary policy has subsided somewhat since the (July) update, the risk of a surge in global energy and food prices has heightened,” AMRO said.

Mr. Khor expects the BSP to hold policy rates higher for longer in order to contain stubborn inflation.

“I think even the (BSP governor) has expressed that (interest rates) will have to stay high until inflation comes down to meeting the target band. And, he has not ruled out the increase, if necessary,” Mr. Khor said.

BSP Governor Eli M. Remolona, Jr. earlier signaled that a policy rate hike in the fourth quarter this year is not off the table. He has also hinted at the possibility of an off-cycle hike.

“I think it’s important for central banks in the region to be clear in the objective to bring down inflation… how much longer (it’s) going to stay will very much depend on what happens,” Mr. Khor said.

From May 2022 to March 2023, the Monetary Board hiked borrowing costs by 425 basis points. It left interest rates unchanged at a near 16-year high of 6.25% for a fourth straight time last month.

The BSP is set to have its next policy-setting meeting this year on Nov. 16. — By Luisa Maria Jacinta C. Jocson, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld