Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

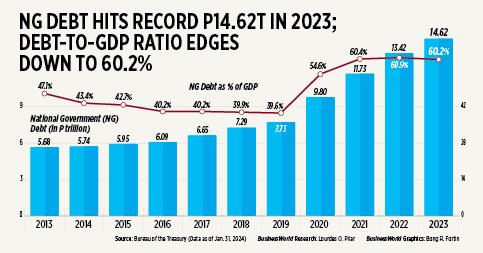

2023 debt-to-GDP ratio ends at 60.2%

THE National Government’s (NG) outstanding debt as a share of gross domestic product (GDP) further eased to 60.2% at the end of 2023, the Bureau of the Treasury (BTr) said.

Treasury data showed that the NG’s outstanding debt hit a record PHP 14.62 trillion as of end-2023, 8.92% or PHP 1.2 trillion higher than a year earlier.

The ratio was lower than 60.9% at the end of 2022. It was also below the 61.2% target under the government’s Medium-Term Fiscal Framework.

However, it was still slightly above the 60% threshold considered by multilateral lenders to be manageable for developing economies.

“Our debt right now remains at a very manageable level, and we are on track to bringing down the debt-to-GDP ratio to less than 60% by 2025. We have a sound and prudent strategy in place to effectively manage our debt and financ-ing requirements,” Finance Secretary Ralph G. Recto said in a statement.

Data from the BTr showed the bulk or 68.5% of the debt portfolio came from domestic sources, while the remaining 31.5% was from foreign creditors.

Domestic debt rose by 8.79% to PHP 10.02 trillion as of end-December from PHP 9.21 trillion in 2022. It slipped by 0.06% from the previous month due to the net redemption of government securities.

The domestic borrowing mix was composed almost entirely of government debt.

“Gross issuance of domestic debt in December 2023 totaled PHP 29.69 billion, while principal payments amounted to P36.08 billion, resulting in a net repayment of PHP 6.39 billion,” the BTr said.

“Meanwhile, the effect of local currency appreciation against the US dollar on debt stock valuation further trimmed PHP 0.09 billion from the December total,” it added.

Data from the Treasury showed that the peso closed at PHP 55.418 at end-December, appreciating by 0.71% from the PHP 55.815 close at end-December 2022.

Meanwhile, foreign borrowings jumped by 9.21% to PHP 4.6 trillion from PHP 4.21 trillion in 2022. Month on month, it went up by 2.54% from PHP 4.48 trillion.

The BTr said the increase was due to the net availment of foreign debt worth PHP 88.4 billion, including the administration’s maiden Sukuk bond and the disbursement of program loans worth $300 million from the Asian Development Bank (ADB).

External debt consisted of PHP 2.48 trillion in global bonds and PHP 2.11 trillion in loans.

Last year, the Philippine government raised USD 3 billion from its dollar bond issuance in January; USD 1.26 billion from its retail dollar bond offering in October; and USD 1 billion from the Sukuk bond issuance in December.

“Furthermore, the impact of third-currency adjustments against the US dollar added PHP 28.45 billion, which was slightly offset by the PHP 2.67-billion effect of peso appreciation against the US dollar,” the BTr added.

As of end-December, the NG’s overall guaranteed obligations inched lower by 1.05% to PHP 349.44 billion from PHP 353.14 billion in end-November.

Year on year, guaranteed debt fell by 12.43%.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said while the debt-to-GDP ratio is on a steady decline, there is still a need to further bring down the ratio. The debt-to-GDP ratio was 39.6% in 2019.

“The direction is welcome, but we hope the pace of consolation can improve given that we are a good year out from the lockdowns,” he said in a Viber message. “As long as we stay at these levels, we remain susceptible to potential rating actions should growth slow considerably.”

Union Bank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said the government has been ramping up its fiscal consolidation efforts.

“I think they have really prioritized debt and deficit management in the last few months of 2023. There was a catch-up plan for spending, but NG spending was hardly felt in fourth-quarter GDP as we have seen,” he said in a Viber message.

The Philippine economy grew by 5.6% in last quarter, bringing the full-year average to 5.6%. Government spending contracted by 1.8%.

“My thinking is that they will continue to consolidate and not set out to sacrifice the future. We should expect more of this in 2024 and they will carefully tread the fiscal landscape (with no new taxes, as asserted by the new DoF secretary) making sure that we maintain our sovereign credit ratings as we move forward,” Mr. Asuncion added.

Under the Medium-Term Fiscal Framework, the government is targeting to bring down its debt-to-GDP ratio to 60% this year.

According to the Budget of Expenditures and Sources of Financing, NG outstanding debt is expected to reach a record PHP 15.84 trillion this year.

This year, the NG’s borrowing plan is set at PHP 2.46 trillion. Broken down, this is composed of PHP 1.85 trillion in domestic borrowings and PHP 606.85 billion from external sources. — Luisa Maria Jacinta C. Jocson

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld