Bracing for an export slowdown

Until the fight for inflation is won globally, higher interest rates will keep global demand for Philippine exports sluggish.

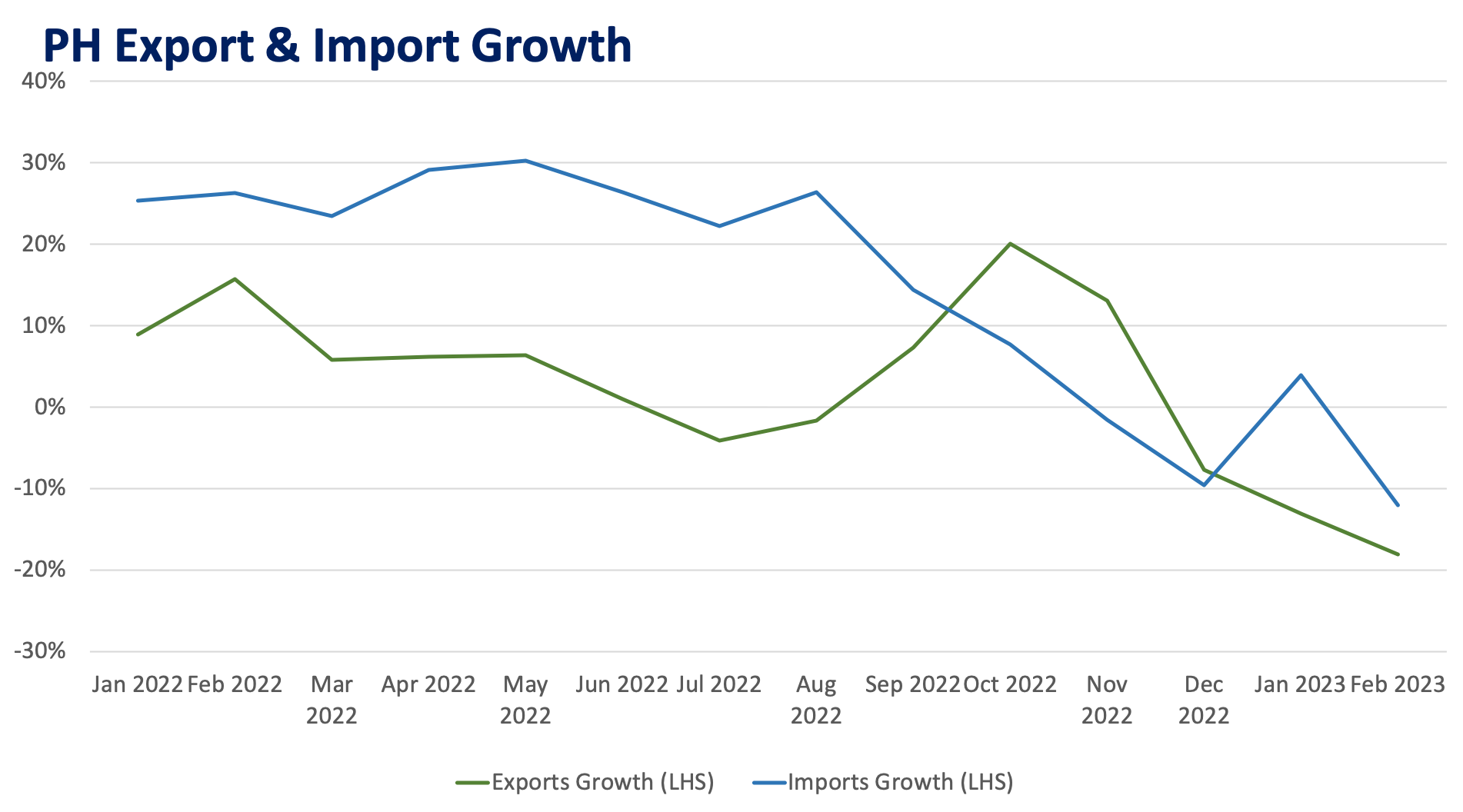

The Philippines posted a trade deficit of USD 3.88 billion in February, declining by 2.7% versus the same month in 2022, as both exports and imports contracted.

Exports dropped by USD 1.1 billion, or 18%, year-on-year and are on their third consecutive decline since December 2022. Meanwhile, imports slipped to USD 8.95 billion from USD 10.17 billion in February 2022, not sustaining their rebound from last month following three straight months of negative growth.

Historically, weak global demand partly explains a trade slowdown apart from structural reasons. Here we take a look at the numbers to see whether global demand is indeed softening and is already manifesting itself in our trading activity.

Graph of Philippine export and import growth where the latter dipped in February while exports continued to decline.

Major traded goods are tumbling

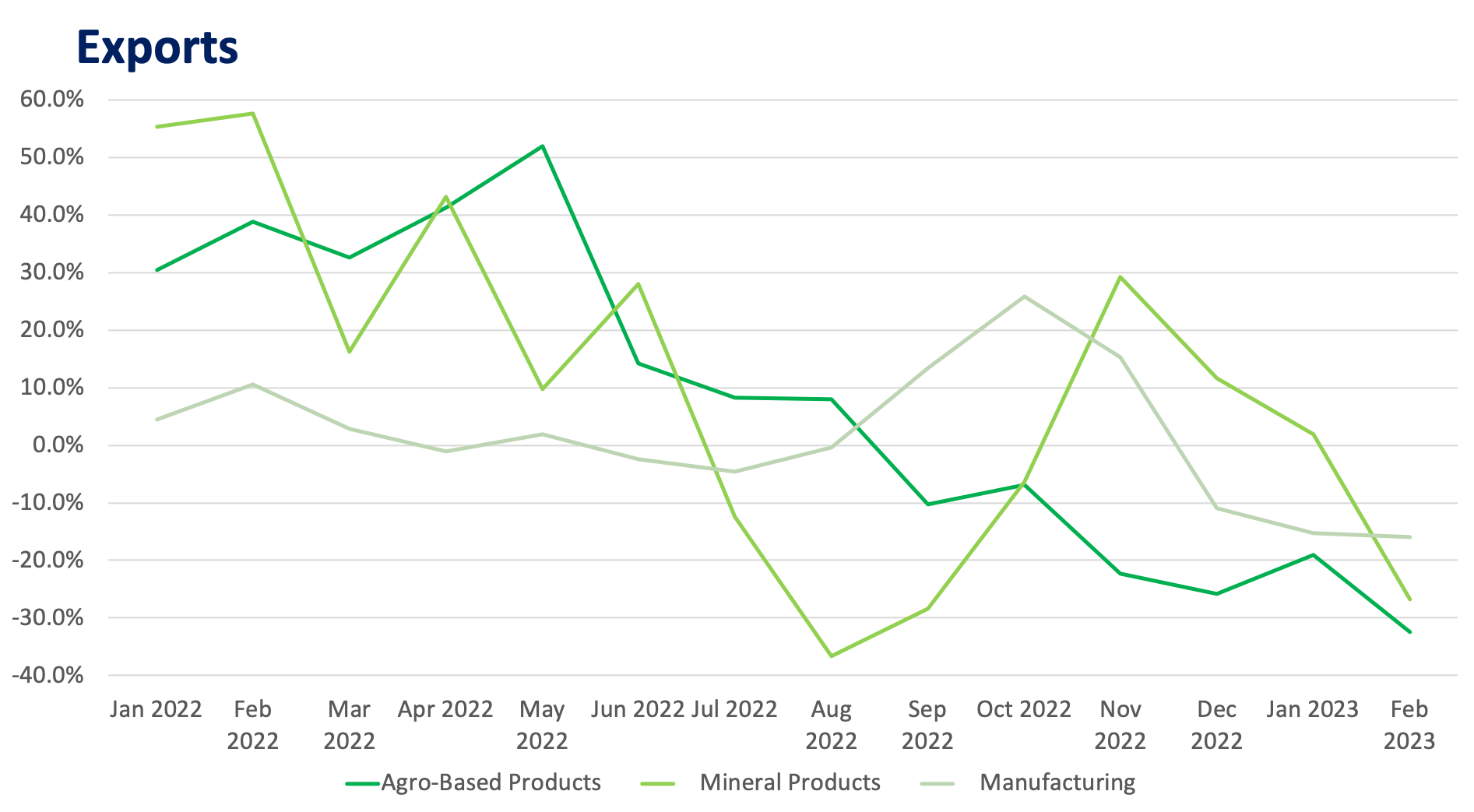

Exports of manufactured goods, which capture the largest portion of total exports among major types of goods, have been falling since November 2022 and further dipped in February, pushing overall exports down. Agro-based products have also yet to rebound and have been sustaining negative year-on-year growth since September 2022.

Growth of top PH export and import goods by major type of goods. Mineral exports declined year-on-year, as with imports of mineral fuels, lubricants, and related materials.

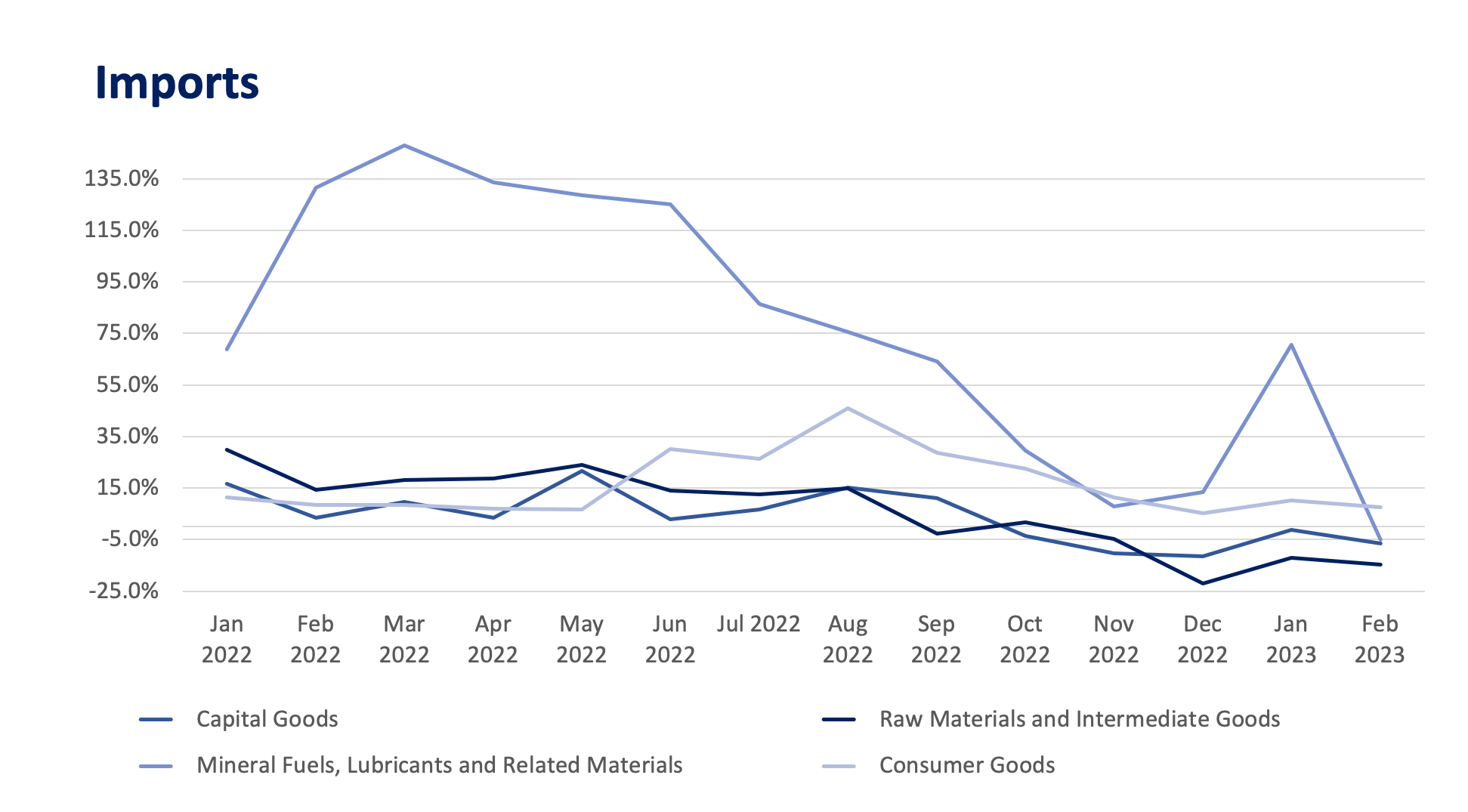

Meanwhile, top PH import goods such as capital goods, raw materials, and mineral fuels altogether posted a decline versus the previous year, bringing down overall imports in February.

Less demand from major trading partners

The Philippines’ export activity with advanced economies such as the US (PH’s 2nd largest export destination) has dipped sharply since December 2022 and has yet to recover, even inching further down in February. The growth of total US imports, on the other hand, slowed down in November last year, growing year-on-year by only a modest 2% on average since then, suggesting softening demand from the said major economy (see Figure 3).

The recent data on weaker retail sales and slowing manufacturing output in the US can likewise vouch for its slumping domestic demand, prodding businesses to slow down their inventory purchases.

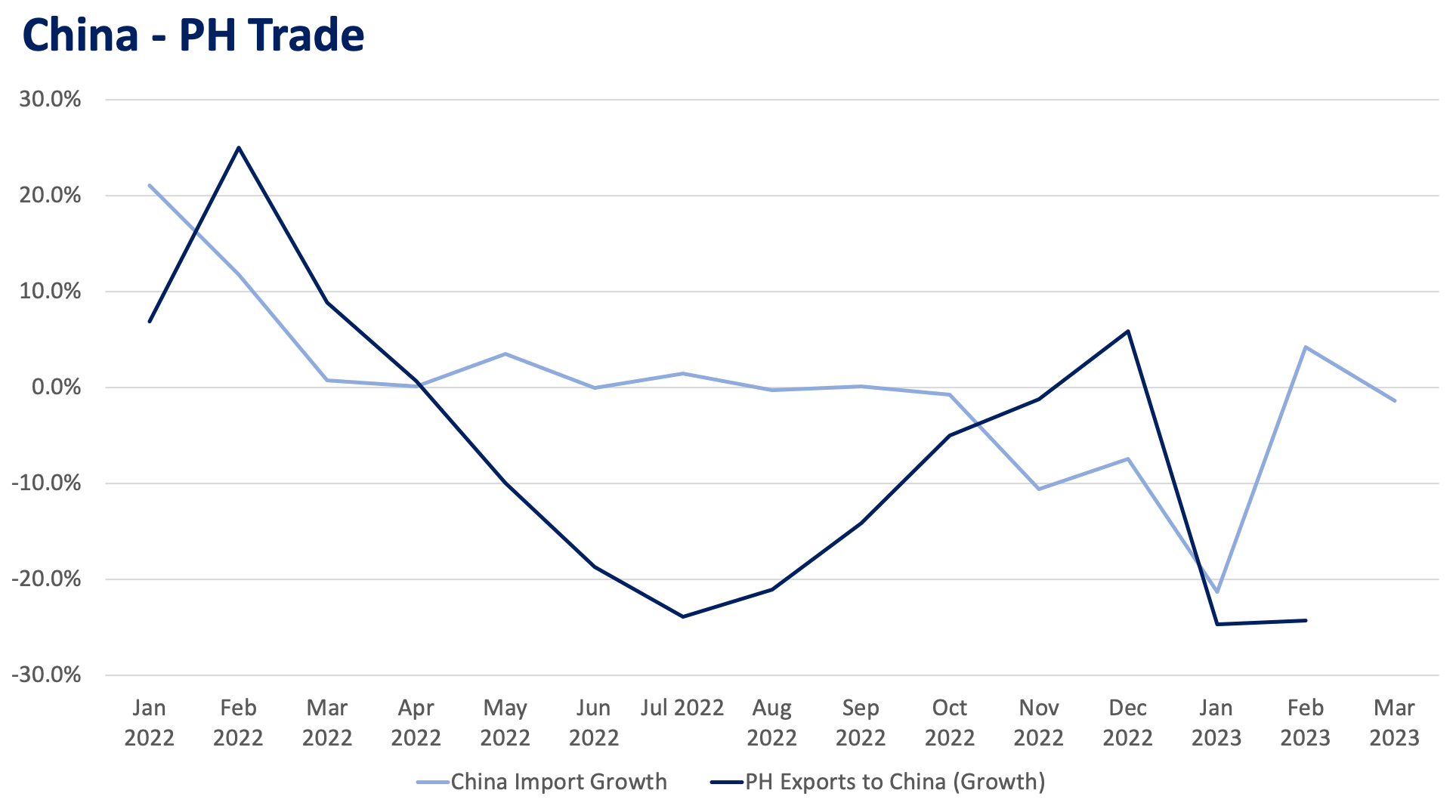

Comparative chart of US and China’s import growth and the Philippines’ exports to US and China. In both cases, imports from the rest of the world has declined affecting PH exports.

Meanwhile, China – the country’s third largest export destination – posted better-than-expected first quarter GDP (gross domestic product) growth of 4.5%, propelled by increased consumption as the country fully reopened. However, the country’s Q1 imports declined vs the previous year, which could explain why PH exports to China have been in negative growth territory in January and February.

While China’s manufacturing activity is recovering, it does so at a moderate pace as the slowdown in global demand is said to weigh in and dampen the processing demand in China. This then impacts its import of raw materials from other countries like the Philippines.

Not only in the Philippines

Declining exports is not a Philippines-only challenge, as other neighboring Asian countries, such as Singapore, Thailand, and South Korea, among others, are facing this, thus bringing a stronger case of a global slowdown already happening.

What lies ahead?

Apart from the peso strengthening in the first two months of the year, weak global demand has indeed manifested itself already in the Philippines’ trade numbers.

The fight against inflation has not been won yet in the Philippines and globally. Until then, higher interest rates will continue to temper spending, therefore constricting overall demand, which has actually been the goal of monetary policy tightening.

The good news is that global inflation is seen easing this year. Should there be no new supply shocks to detour inflation towards its downward path, global demand and therefore global trade are set to rebound in no time.

Photo courtesy of Alexander Villafania

INA CALABIO is a Research & Business Analytics Officer at Metrobank in charge of the bank’s research on industries. She loves OPM and you’ll occasionally find her at the front row at the gigs of her favorite bands.

DOWNLOAD

DOWNLOAD

By Ina Judith Calabio

By Ina Judith Calabio