Assessing the potential impact of infrastructure projects in the Philippines

There are 185 infrastructure projects either lined up for approval or being implemented across the country. What is their economic impact and is it enough?

In line with the Marcos Administration’s 8-Point Socio-Economic Agenda, Finance Chief Ralph Recto has introduced the Growth Enhancing Actions and Resolutions (GEARs) framework.

The five-point plan lays out the government’s strategies to boost economic growth, which include continued infrastructure buildup, a sustainable fiscal stance that still supports growth, managing inflation through the Reduce Inflation Now (REIN) blueprint, timely and effective execution of government projects, and intensified investment promotion.

For infrastructure, the government has set an annual spending target of 5-6% of the country’s Gross Domestic Product (GDP). The government will leverage private sector capital and expertise through the recently enacted Public-Private Partnership (PPP) code to cut the infrastructure backlog, free up fiscal space for social services, and generate jobs that boost domestic consumption.

Infrastructure Flagship Projects: from “Build, Build, Build” to “Build, Better, More”

The previous administration of then-President Rodrigo Duterte introduced the Build, Build, Build Program to usher the country into its Golden Age of Infrastructure. However, only 15 projects had been completed by the end of his term out of the 119 infrastructure flagship projects introduced.

When President Ferdinand Marcos Jr. stepped into office in June 2022, the Build Better More (BBM) infrastructure program superseded the Build, Build, Build program of the Duterte administration. Based on publicly available sources, there were 88 infrastructure flagship projects (IFPs) that were turned over by the Duterte administration, 71 of which were continued by the Marcos administration.

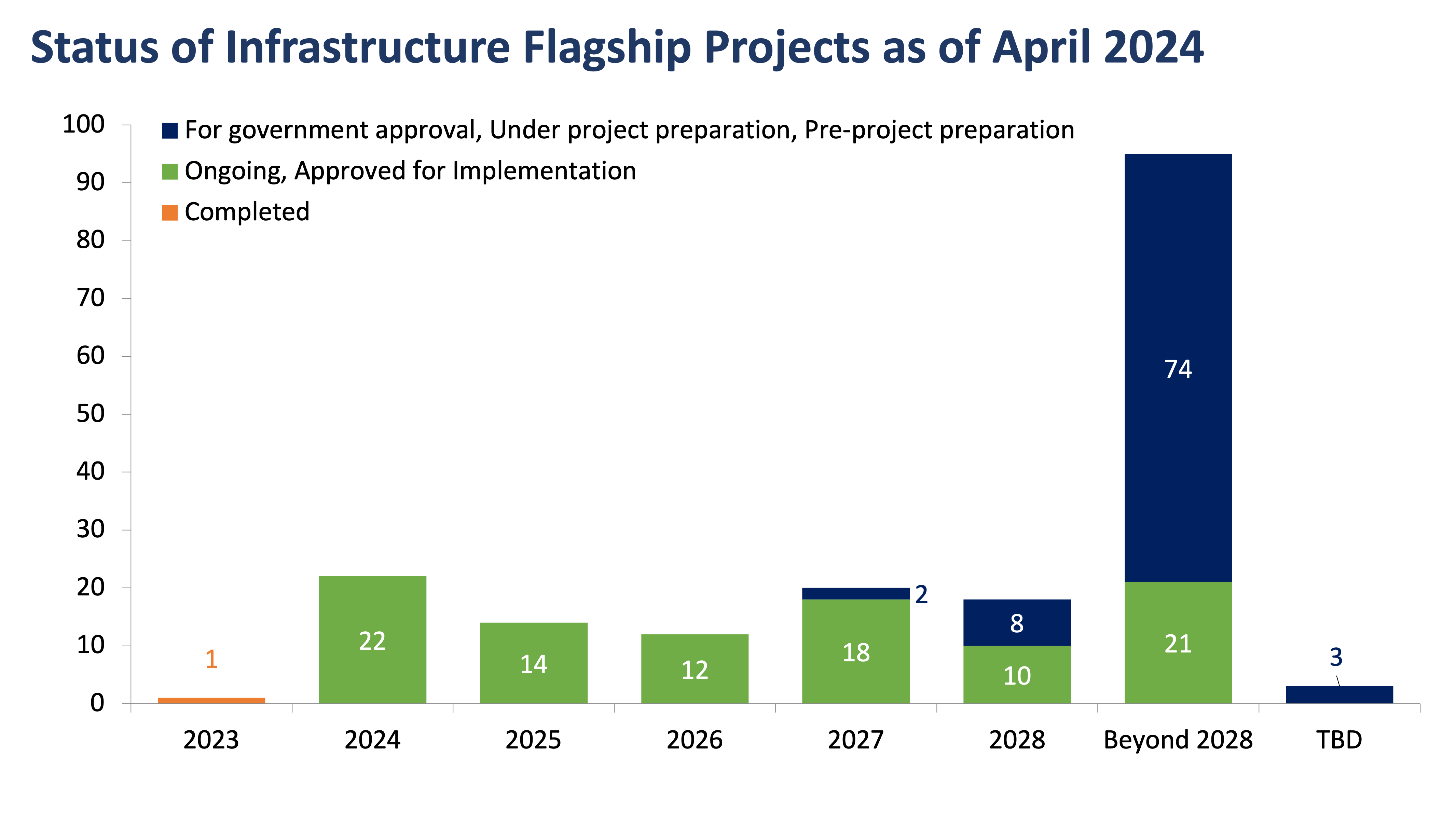

Currently, the Marcos administration boasts a total of 185 Infrastructure Flagship Projects (IFPs), with a total indicative cost of PHP 9.14 trillion. Of the 185 IFPs, 114 of these projects were conceptualized and introduced by the Marcos administration. The chart below shows the status of the infrastructure flagship programs since April 2024.

Source: National Economic and Development Authority

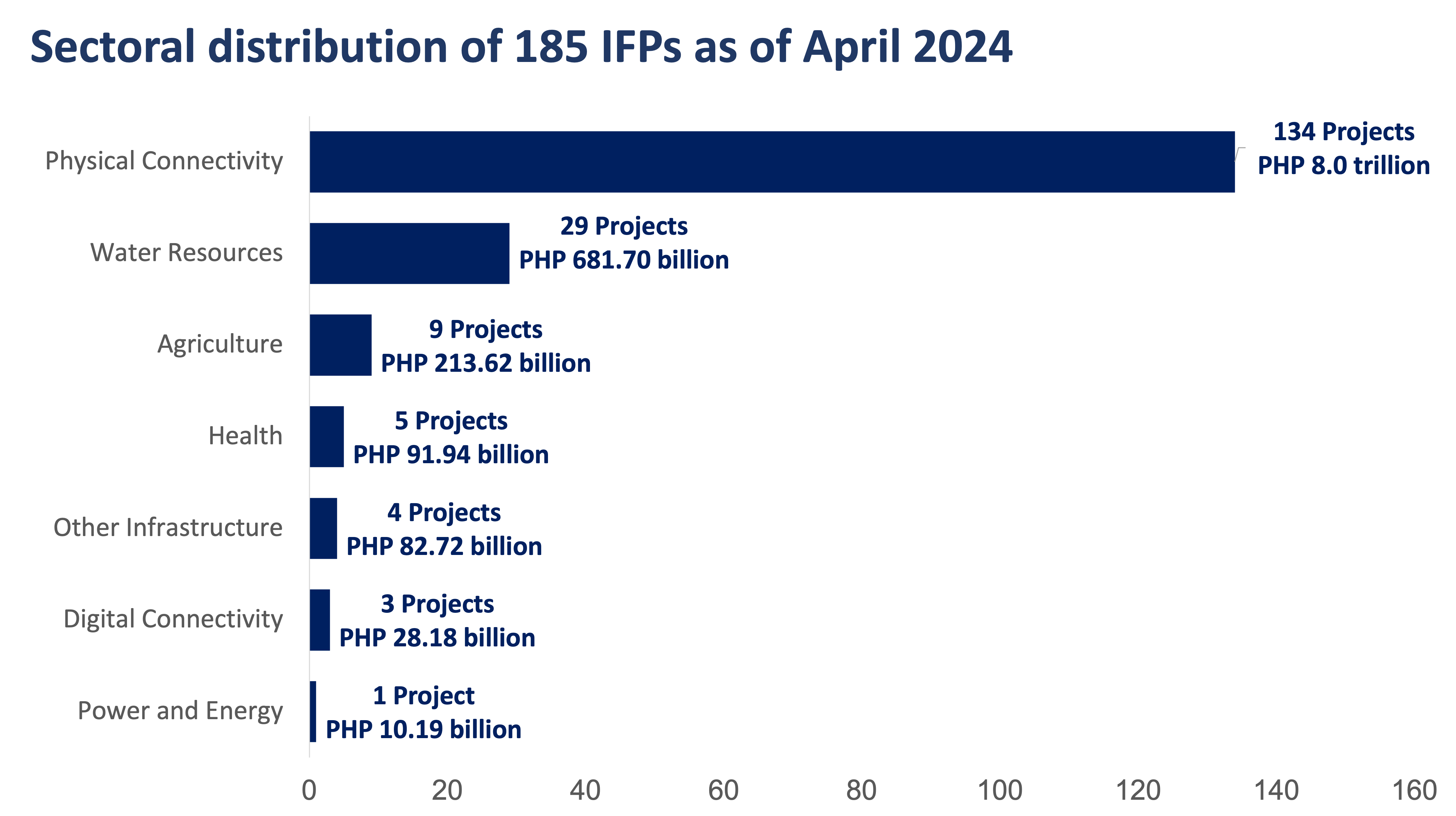

In terms of sector, 134 out of 185 are under the sector physical connectivity, while the rest are under the agriculture, digital connectivity, education, health, power and energy, and water resources sectors.

Source: National Economic and Development Authority

Notably, among the big-ticket projects that were turned over to the current administration, were the New Manila International Airport in Bulacan, the Ninoy Aquino International Airport, the Metro Rail Transit 7 (MRT-7), and the Metro Manila Line 1 (LRT-1) Cavite Extension.

With the ballooning debt from the Build, Build, Build program, the current administration has opened up the funding of its IFPs to the private sector through public-private partnerships (PPPs).

In fact, the new Public-Private Partnership (OPPP) Code of the Philippines, which became effective in April, aims to strengthen the private investment climate in the country. To date, PHP 2.5 trillion worth of IFPs will be funded through PPPs, although Official Development Assistance (ODA) remains the top funding source.

Boosting economic growth through IFPs

IFPs are aimed at addressing the infrastructure backlog in the country. With the majority of the projects falling under the physical connectivity sector, Filipinos can expect more and improved airports, roads, railways, and bridges that will provide easier access to strategic areas in the country.

The increased mobility will ease the transport of goods and services and could also encourage more local and international tourist visits to more parts of the Philippines. This will boost the economy through increased demand, investments, and job opportunities.

Meanwhile, the completion of projects in the agriculture, power and energy, and water resources sectors will enhance the country’s food, energy, and water security, which, when attained, could potentially be a long-term solution for high inflation.

The IFPs have much potential, especially as these infrastructure projects fall under focus areas identified in the current administration’s 8-Point Socioeconomic Agenda, which includes food security, improved transportation, affordable and clean energy, health care, social services, and education, among others.

Although the completion of most of the projects is projected beyond 2028 due to the long-term nature of infrastructure projects, we expect to see a significant change in the quality of infrastructure in the country over the medium- to long-term when the majority of these are completed.

There is no doubt that these projects can impact the economy and bring prosperity to many Filipinos. The question is whether they will be successfully completed in the coming years.

DOWNLOAD

DOWNLOAD

By Kaila Balite, Marian Florendo, Geraldine Wambangco

By Kaila Balite, Marian Florendo, Geraldine Wambangco