Are we ready for a demographic shock?

The Philippines markets itself as a strategic investment destination through a narrative of youth, talent, and innovation, which fuels the engine of economic growth. Can this be sustained?

Current population projections paint a grim future — by 2055, the Philippine population aged 65 and above will triple to 19 million, swelling from 5.9 million in 2020. This demographic shift, if unaddressed, threatens to undermine decades of economic progress and stability.

Before we discuss why this is so, let’s revisit some terms and concepts.

What is demographic dividend and demographic transition?

Demographic dividend refers to the economic growth arising from a population’s demographic structure. When the working-age population, or those who are 15- to 64-years-old, is bigger than the non-working-age population, or those 14-years-old and younger and those 65-years-old and older, economic productivity soars.

The other important concept is demographic transition. It is characterized by a change in the population structure within an economy attributable to declining fertility and mortality rates.

A demographic transition occurs in three phases. The first phase is marked by an initial decline in infant mortality even amid high fertility rates, followed by the second phase, which is marked by an increasing proportion of the working age population relative to the dependent population, particularly the young (0-14 years) and the older population (65 years and above). The third and final phase features a generally older population, with those 65 and older covering a larger proportion compared to the earlier two phases.

Promise of a demographic dividend

During the second phase of the demographic transition, in which the proportion of the working age to the dependent age is at its highest, the economy also reaches its most productive state. It is called the demographic window of opportunity.

With a demographic landscape currently dominated by a vibrant young population aged 15 to 64 years as of 2022, comprising 64% of the total population, the Philippines is on the brink of transformative potential through the demographic window.

Hence, the country is in the first phase of the demographic transition. However, beneath this promising facade lies the third phase of the demographic transition looming on the horizon, which could redefine the country’s socioeconomic landscape in the years to come.

Exploring the ASEAN Region’s demographic shifts

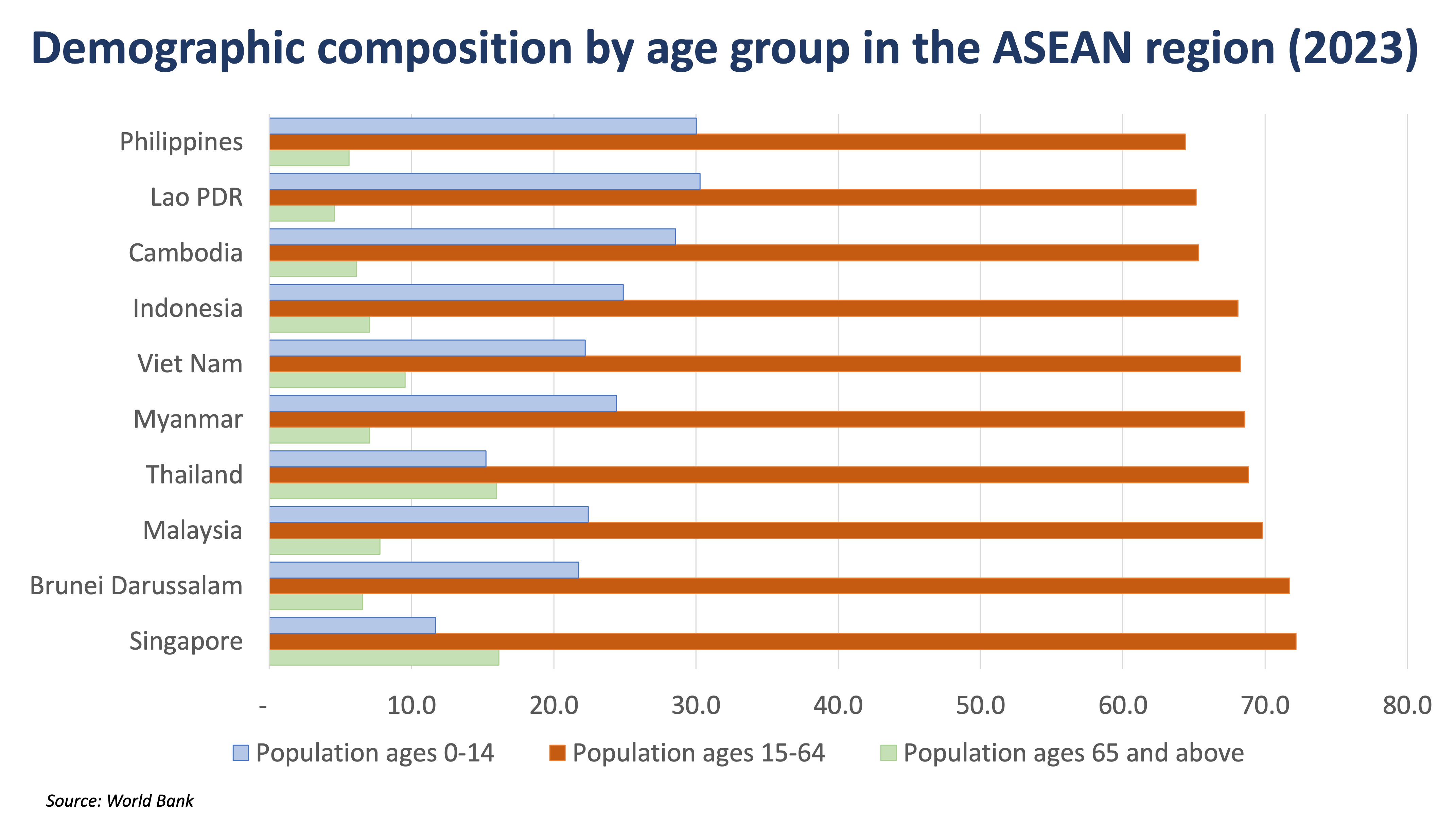

In 2023, the Philippines recorded the highest concentration of young dependents aged 0-14 years old compared to its ASEAN peers, as shown in the chart above, yet recorded the second lowest concentration of both working age individuals aged 15-64 years old and the older population aged 65 years and above, only next to Lao PDR (Lao People’s Democratic Republic).

The Philippines captures a minimal but desirable share of elderly dependents, thus, the country carries relatively less of an economic burden in terms of dispensing pension claims when compared to its regional peers.

Moreover, to effectively harness economic benefits, an ideal demographic structure features a concentrated pool of working-age individuals and minimal weight at both ends of the age spectrum.

When compared with regional peers, the Philippines seems to have a greater prospect of increasing the proportion of working-age individuals, which will effectively lead to a smaller proportion of the dependent population.

This will decrease the latter’s dependency burden on working-age individuals, which could bring the country towards a more productive, and therefore economically favorable, demographic structure.

The windows of opportunity and the shadow of a demographic wall

Behind the promise of the demographic dividend, the looming demographic wall is also casting a long shadow over the Philippines’ economic future in the long term. In particular, the fiscal strain of an aging population cannot be overstated.

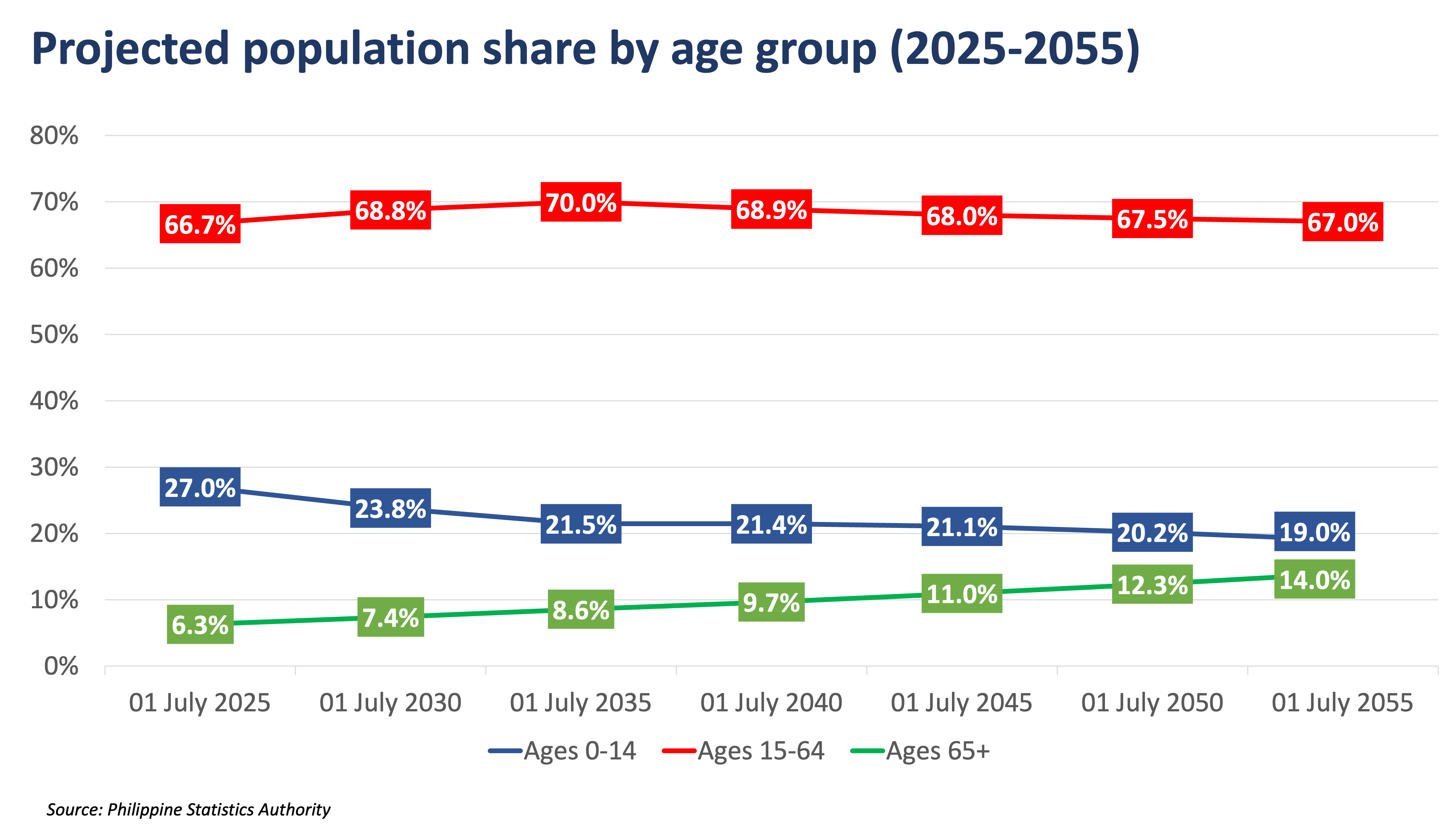

Based on projections by the PSA (see table above), the proportion of the country’s working-age individuals will peak in 2035. With this, it is imperative that the Philippines provide quality education and healthcare to the younger population for them to be fully equipped for when they enter the labor market, and for the country to fully maximize its demographic dividend in the coming years.

The PSA also projects that the proportion of the aging population will continuously increase to around 14% by 2055. Along with this, healthcare costs for elderly care are expected to surge, with public and private expenditures increasing significantly.

In 2020, the International Monetary Fund (IMF) reported that human life expectancy at birth was 72.1 on average, indicating enhanced living conditions and improved access to healthcare. As human existence lengthens and mortality rates decline, the burden of pensions will also grow, placing immense pressure on government budgets.

Thus, the Philippines may need to consider increasing taxes, cutting public services, or borrowing more. Each option carries consequences for economic stability and social cohesion.

Challenges amid the demographic transition

Navigating the demographic transition will entail challenging decisions: policymakers must balance immediate needs with long-term sustainability. Cutting back on pension benefits or increasing the retirement age may be unpopular, but delaying these reforms could exacerbate future fiscal pressures, especially when the elderly will increasingly comprise a significant share of the population. The challenge will be to implement these changes while maintaining social stability and public support.

The Philippines has a window of opportunity. With timely and strategic interventions, the country can harness its demographic dividend to build a robust, resilient economy. Investing in human capital, modernizing infrastructure, and fostering a business-friendly environment are critical steps. Finally, learning from the experiences of its neighbors and tailoring these lessons to local contexts will be essential.

Traversing the demographic future

The demographic future of the Philippines is a tale of two sequential scenarios. On one hand, there is the promise of a demographic dividend — a period of accelerated economic growth driven by a youthful, dynamic workforce.

On the other, there is the challenge of a demographic wall — an aging population with rising fiscal demands. How the Philippines navigates this transition will determine its economic trajectory for decades to come.

Will the Philippines seize the opportunity to invest in its young population, ensuring a prosperous, sustainable future? Or will it falter under the weight of an aging society, facing economic stagnation and fiscal strain?

The answer lies in strategic foresight, bold policymaking, and the collective will to secure a better tomorrow.

KAILA BALITE is a Research and Business Analytics Officer at the Institutional Investors Coverage Division, Financial Markets Sector, of Metrobank. She provides macroeconomic research, forecasts, and insights, as well as regular and ad hoc economic reports for both internal and external stakeholders. She holds a Master’s degree in Applied Economics and a bachelor’s degree in Financial Economics, both from De La Salle University Manila. Prior to joining Metrobank, she was an economist at the Office of the Chief Economist of the Department of Finance. Outside of work, she is into thriller movies, K-dramas, and dogs.

KATHERINE ANNE GO is an intern at the Institutional Investors Coverage Division, Financial Markets Sector, at Metrobank. Currently, she is completing her undergraduate studies, pursuing a Bachelor’s degree in Accountancy at the De La Salle University Manila. In her free time, she enjoys listening to music and podcasts and has a passion for traveling and exploring new places.

DOWNLOAD

DOWNLOAD

By Maria Kaila Balite, Katherine Anne Go

By Maria Kaila Balite, Katherine Anne Go