Are the country’s credit ratings important?

Should you worry about the Philippines’ sovereign credit rating? Learn how our credit rating can influence the decisions of global investors.

Simply put, credit ratings are informed opinions assigned to issuers of securities to assess their relative creditworthiness. These serve as a guide for investors to develop their views on whether or not they should invest in a security, given the relative ability of the issuer to pay its debts on time and in full.

An issuer may be a sovereign, private company, publicly listed corporation, or non-profit organization, among others.

In general, companies cannot have higher credit ratings than the country where they operate in because it is assumed that the country’s economic performance affects both the public and private sectors. This is sometimes referred to as the “sovereign ceiling.”

Who assigns credit ratings?

Credit rating agencies are the ones who officially decide on the credit ratings of an issuer based on the latter’s financial strength and level of default risk.

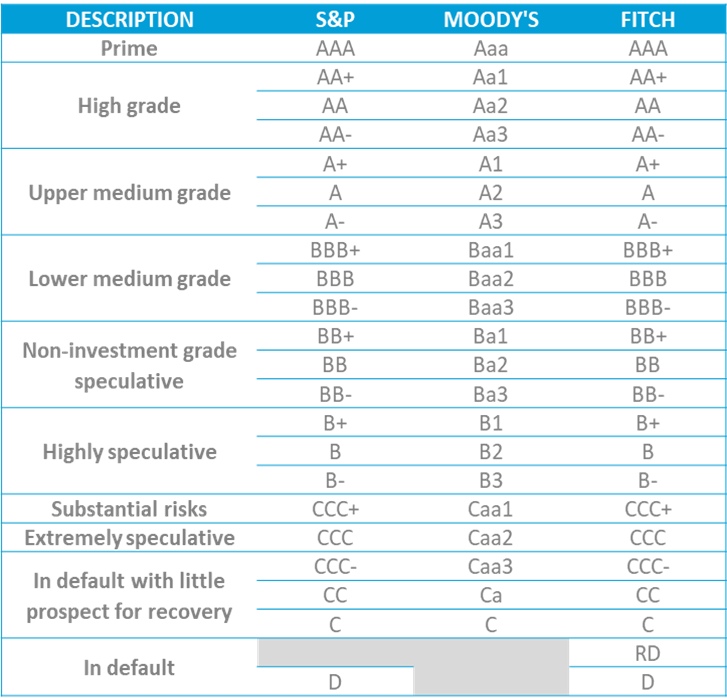

Letter-based credit ratings reflect the agency’s level of confidence that the issuer can meet the agreed upon debt obligation.

Moody’s Investors Service, S&P Global Ratings, and Fitch Ratings are the big three credit rating agencies globally. These agencies were also identified by the US Securities and Exchange Commission as the Nationally Recognized Statistical Rating Organizations (NRSROs) in 1975.

Different credit rating agencies have their own labels to describe the creditworthiness of a country or entity. (Sources: Trading Economics, Fitch Ratings, Moody’s Investors Service, S&P Global Ratings)

Benefits of credit ratings

In general, credit ratings are used to evaluate the risk premium to be charged on loans and bonds.

Entities with high credit ratings typically have lower default risks and are therefore assigned lower rates of interest. On the other hand, those with low credit ratings are considered to have a higher default risk and are given more expensive rates.

Having a good credit rating makes it easier for an issuer to raise funds from the public or borrow from financial institutions at lower interest rates.

Credit ratings support the development of capital markets by providing risk measures for issuers that let investors understand the issuers’ credit risk.

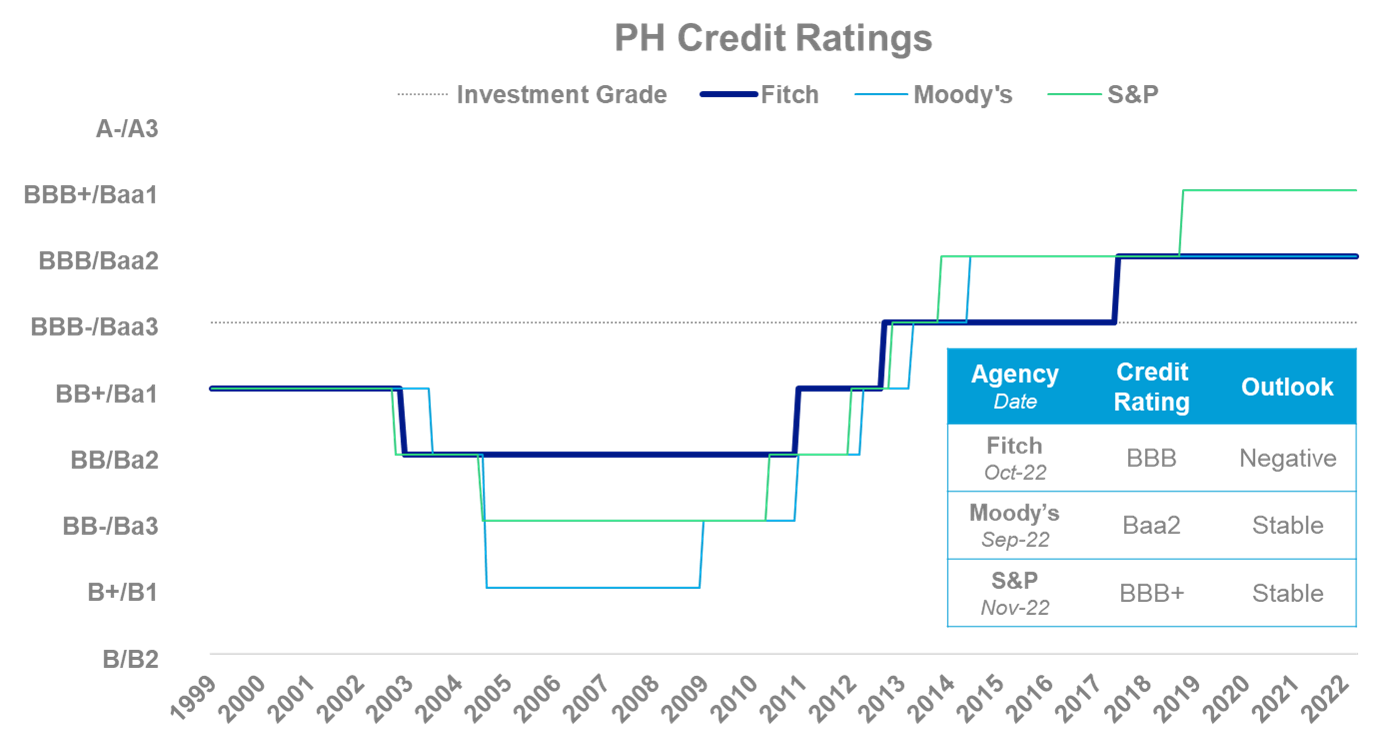

Philippines’ credit ratings

The Philippines currently has investment grade credit ratings as assigned by the big three credit ratings agencies. This means that the country’s government-issued securities are considered safer than those of countries without investment-grade credit ratings.

The Philippines enjoys investment-grade credit ratings. (Sources: Fitch Ratings, Moody’s Investors Service, S&P Global Ratings)

Impact on assets of a potential downgrade

If an issuer’s credit rating is downgraded, it only means that there are heightened risks in terms of the financial stability and capability of that issuer to meet its debt obligations. This may be due to several reasons, including economic and political uncertainties, and may be specific to that issuer alone or to a number of other issuers.

Credit ratings are most relevant to fixed income securities. The higher the credit risk is, the larger the risk premium charged to the fixed income asset, and the higher the rate or yield asked for by investors to compensate for that risk. Therefore, if the Philippines is downgraded, there will be higher rates for its government and corporate bonds, and it will be costlier for the Philippine government and companies to borrow.

While there are also other factors that affect equity prices, capital-raising activities for both common and preferred shares are expected to be cheaper for issuers with higher credit ratings.

In terms of the foreign exchange, there is no direct impact, as there are other factors that matter more such as the country’s current account balance, which is primarily driven by the balance of trade.

ANNA DOMINIQUE CUDIA, MBA, CSS, is the Head of Markets Research at Metrobank’s Trust Banking Group, spearheading the generation and presentation of financial markets insights to internal and external clients. She used to be with Metrobank’s Investor Relations, where she brought in international awards and took part in various multi-billion peso and dollar capital raising activities. She has a Master of Business Administration (Finance) degree, with distinction, from the University of London, and a Bachelor of Science in Business Administration degree, cum laude, from the University of the Philippines. She is also a CFA Level I exam passer and a Certified Securities Specialist. She is a naturally curious person and likes to travel here and abroad.

DOWNLOAD

DOWNLOAD

By Anna Cudia

By Anna Cudia