Are REITs becoming appealing again?

With the recent rate hike pause of the central bank, investors may want to revisit real estate investment trusts (REITs).

With the Bangko Sentral ng Pilipinas (BSP) pausing its series of interest rate hikes recently, households and businesses alike can breathe a sigh of relief. That’s because the cost of borrowing from banks are likely to stop becoming more expensive as well.

The property sector, in particular, was at the mercy of high interest rates as the combination of elevated inflation and expensive financing discouraged new leases and expansion projects. But with a new monetary policy easing cycle on the horizon, it may be time for investors to consider increasing exposure to the property sector in their portfolios through REITs.

A REIT, or Real Estate Investment Trust, is a stock corporation which owns and operates income-generating real estate, such as office buildings, industrial plants, shopping malls, and more. (See our previous article, Finding the right time to invest in REITs.)

Investors may purchase shares in these REITs, which differ from other shares of stock as REITs are mandated by Philippine law to distribute 90% of their earnings in the form of dividends. Imagine reaping the benefits of investing in real estate without actually having to acquire and manage a property.

While REITs are already well-entrenched in financial markets around the world, the Philippine Stock Exchange welcomed its very first one when Ayala Land-sponsored AREIT, Inc. had its initial public offering (IPO) on August 13, 2020. Since then, the number of REITs in the country has grown to eight, with SM Prime Holdings, Inc. planning to enter in the second half of 2023.

2022 saw significant economic recovery from the pandemic which helped revitalize earnings in the property sector. Office space occupancy was at around 80% as employees returned to their offices, while increased mobility and revenge spending drew shoppers to the malls.

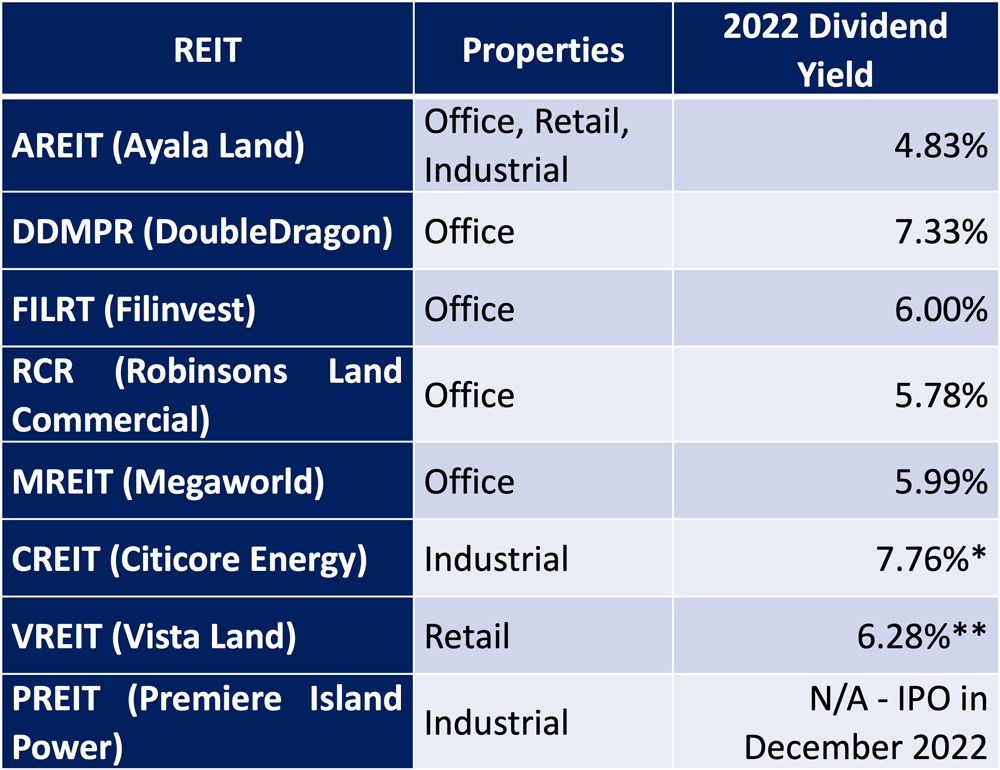

REITs were able to ride and essentially hedge against high inflation through rent adjustments. Even as the Philippines’ Consumer Price Index (CPI) averaged 5.8% year-on-year in 2022, REITs still declared dividends that were above or close to that figure.

Chart 1. Philippine REITs 2022 Dividend Yields

REITs can be a hedge against inflation. (*322-day annualized dividend yield, **198-day annualized dividend yield)

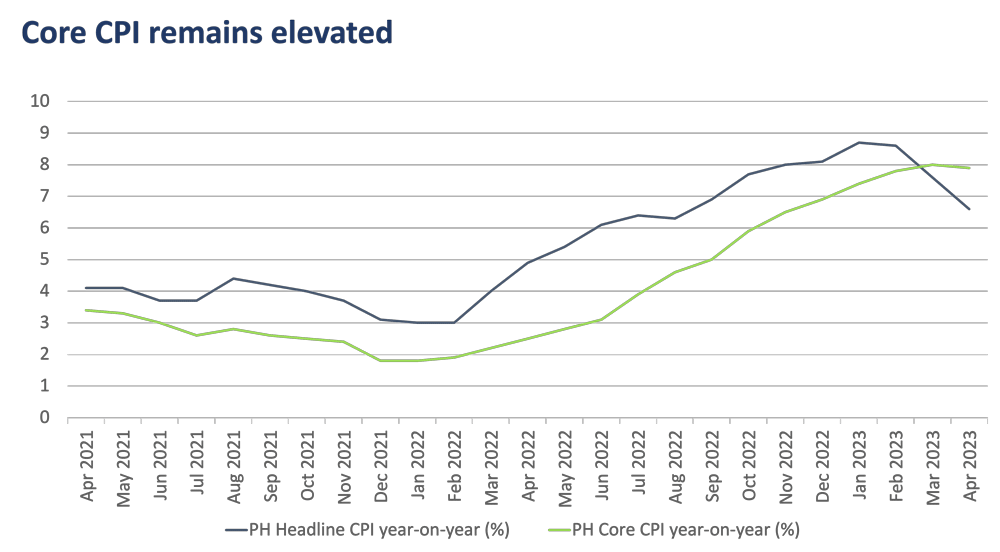

The Philippines’ CPI has since come down to 6.6% in April 2023 from a high of 8.7% in January 2023. However, despite the downward trend in headline inflation, the core CPI, which excludes volatile oil and food prices, has remained stubbornly elevated at 7.9%.

This is primarily due to second-round effects – businesses increase the prices of their goods and services in anticipation of present and future cost increases. With consumption spending still strong, businesses will likely keep their prices high, which should also allow properties to continue charging higher rent for longer.

Chart 2. Philippine Headline Consumer Price Index vs. Core Consumer Price Index

While headline inflation has begun to ease since the beginning of the year, core inflation has not.

While policy interest rates are still elevated, we expect a new BSP easing cycle to begin with a 25-basis-point cut in December 2023. Lower interest rates will encourage greater spending by households and businesses.

For the property sector, this means building and acquiring more commercial real estate to meet the needs of expanding businesses, which can potentially broaden sources of rental income. The risk to this view is greater adoption of work-from-home (WFH) arrangements and the exit of Philippine Offshore Gaming Operators (POGOs).

But despite these risks, there will continue to be demand for office space as the economy normalizes and as businesses shift to more hybrid work arrangements which balance both work from home and the office.

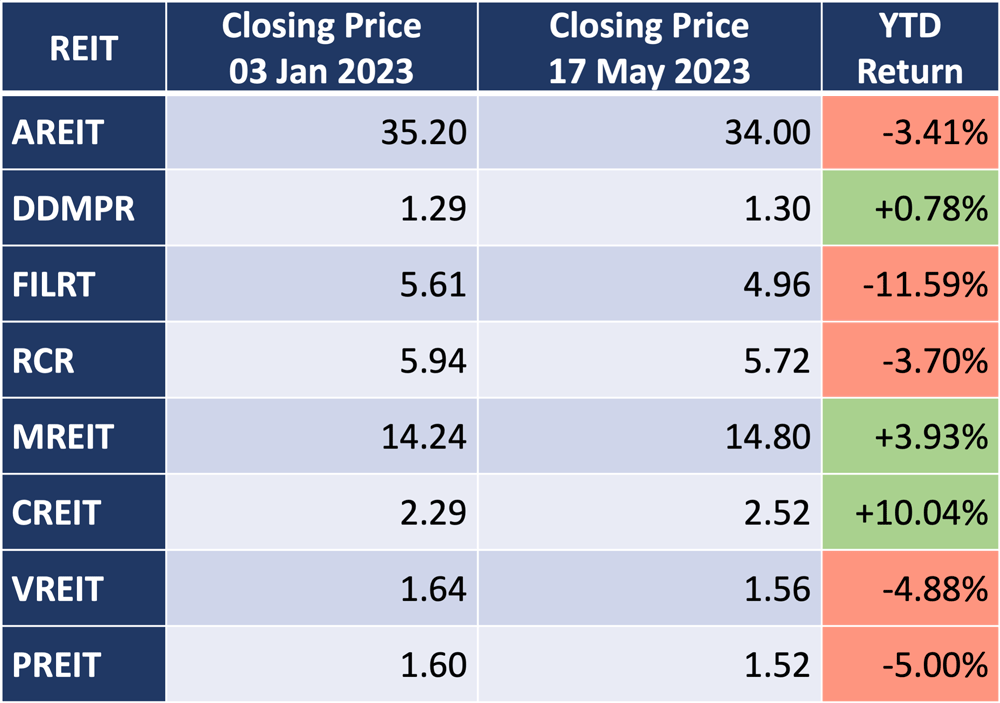

An easing cycle and improving business conditions may also bring in renewed optimism in the equities, which can help pull REIT valuations up. Five of the eight REITs’ share prices are down year-to-date, while DDMPR and MREIT are relatively flat.

This could be an opportunity to enter the market and slowly ladder in excess funds. Only CREIT has shown double-digit growth, likely due to its portfolio concentrated on non-cyclical renewable energy producers.

Chart 3. Philippine REITs year-to-date returns as of 17 May 2023

In summary, we believe that there is an opportunity to invest in REITs, considering that borrowing costs may be headed lower in the near future and commercial real estate occupancy will improve as the economy further normalizes.

As mentioned, REITs can be an alternative source of regular cash flow because of its dividends. And because most REIT share prices are down year-to-date, this could be an opportunity to accumulate shares in REITs.

However, please be aware that REITs are still equity instruments. They are meant for investors with aggressive risk appetites and long-term investment horizons.

It is still advisable to consult investment professionals.

(If you are a Metrobank client, you may contact your relationship manager or investment specialist to learn more.)

EARL ANDREW “EA” AGUIRRE is a Market Strategist at Metrobank’s Financial Markets Sector and has 10 years of experience in foreign exchange, fixed income securities, and derivatives sales. He has a Master’s in Business Administration from the Ateneo Graduate School of Business. His interests include regularly traveling to Japan and learning its language and culture.

DOWNLOAD

DOWNLOAD

By EA Aguirre

By EA Aguirre