April forex recap: Mixed reactions on USD amid crises

The US dollar’s value remains to be in a roller coaster state after being battered by the collapse of several US banks, plus a debt ceiling crisis. Still, there are silver linings that highlight the demand for US dollar-denominated instruments, particularly US treasury bonds, as safe havens.

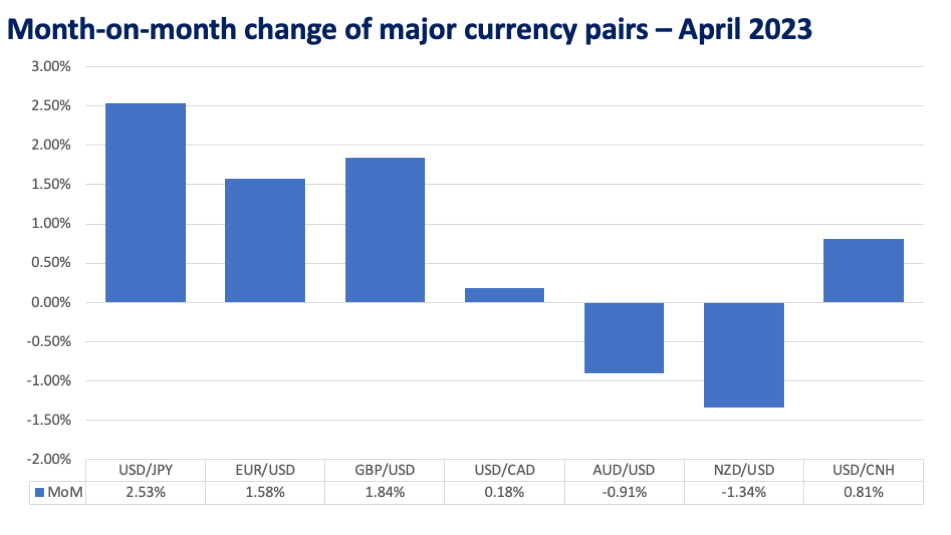

April 2023 was a generally weak month for the US dollar as it continued to be battered by a regional banking crisis that started in March with the collapse of Silicon Valley Bank (SVB). The tightening in bank credit conditions that followed had markets wondering whether the crisis was already doing the Federal Reserve’s job for it and if additional rate hikes were still necessary.

These sentiments grew stronger after the March 2023 Consumer Price Index (CPI) came out lower at 5% year-on-year versus 5.2% forecast. By mid-April, better than expected Q1 2023 earnings of the top US banks helped alleviate banking crisis fears and prop up the US dollar.

The currency continued to recover on still-high one-year US inflation expectations of 4.6% versus 3.7% forecast and was barely affected by news of First Republic Bank’s deposit outflows and stock sell off, which eventually led to its closure on May 1.

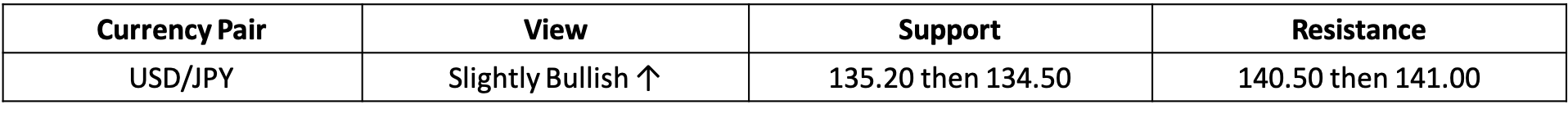

The Japanese yen (JPY) was the biggest loser in April, starting at 132.46, and then ending higher at 136.30 as the Bank of Japan (BOJ) made no changes to monetary policy at its April meeting. Markets saw the move as a dovish tilt from previous expectations of immediate hawkish changes when Governor Kazuo Ueda’s nomination was announced.

However, it seems that the BOJ is quietly laying the groundwork for a potential future policy shift. A review of past changes in monetary policy was announced at the meeting.

There were also some notable changes in rhetoric such as the removal of the central bank’s previous pledge to keep interest rates at “current or lower levels.”

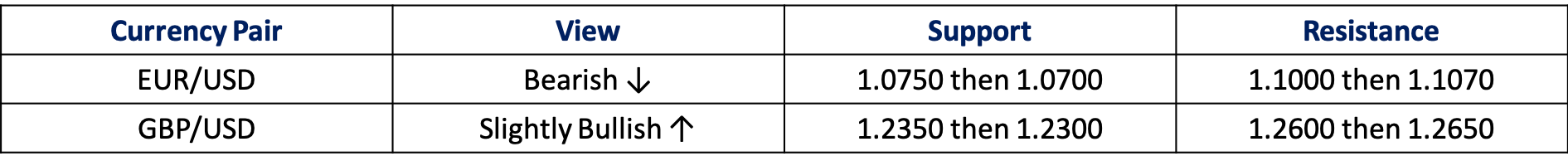

Despite Q1 2023 Gross Domestic Product (GDP) underperforming at 1.3% versus 1.4% forecast, the Euro fared much better than its G3 counterparts on a combination of improved growth expectations, steadily easing inflation and consistently hawkish European Central Bank (ECB) rhetoric which it still open to rate hikes in 50-basis point (bp) increments.

But the ECB may be in a similar position to the Fed as markets have priced in only 1-2 further hikes in the next two meetings. We also wonder whether the EUR/USD exchange rate already reached its target upside at 1.1100 as overly bullish Euro positions started to take profit at those levels.

Pound sterling (GBP) remained the best performer last month as United Kingdom inflation in March remained in double digit territory at 10.1% versus 9.8% forecast, which highlighted the extended need for the Bank of England (BOE) to keep policy rates elevated.

Wage growth also remained strong as quarterly total average weekly earnings surprised to the upside at 5.9% versus 5.1% forecast. The desk continues to be slightly bullish on GBP/USD exchange rate as the BOE has to remain more hawkish to stamp out inflation while also trying to avoid a technical recession.

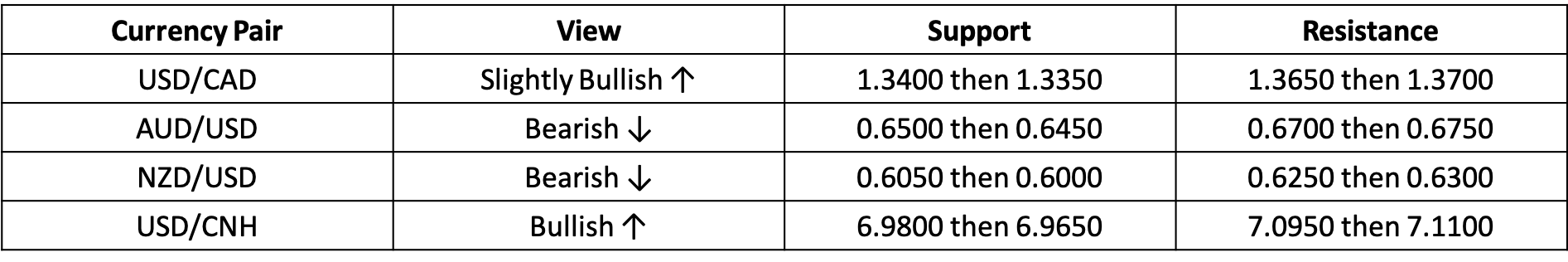

Despite initial expectations that an OPEC+ supply cut would cause oil prices to shoot up, prices remained stable in April, which caused the Canadian dollar (CAD) to weaken by as little as 0.18%. The currency pair seems to have established a near term bottom at the 1.3350/1.3400 region, similar to how oil has tapered off its decline at the USD 66-67 per barrel level. Given that the Bank of Canada (BOC) also paused its rate hikes earlier than the Fed, we still see opportunities for the US dollar to strengthen against its Canadian counterpart.

The Australian dollar and New Zealand dollar tracked lower metals prices as both seemed to track the move of copper futures in particular. Pessimistic views on China’s economy and decreasing demand for imported metals further reinforces the bearish views on Australian dollar (AUD) and New Zealand dollar (NZD). AUD was initially pressured by the Reserve Bank of Australia’s (RBA) decision to pause its policy rates at 3.6% but the currency pair was able to recover some losses as Australian Employment Change doubled expectations at 53,000 versus 20,000 forecast.

AUD ended lower by 0.91%. On the other hand, NZD weakened further by 1.34% as Q1 2023 CPI came out much lower at 6.7% year-on-year versus 7.1% forecast. Previously, New Zealand inflation had been stuck at 7.2% for both Q3 and Q4 2022.

Growing weakness in CNH

It has been months since China ended restrictive lockdowns and global markets have yet to see any spikes in significant demand, particularly the aforementioned metals that the country used to import from Australia and New Zealand. The offshore yuan (CNH) did not strengthen at all despite positive data in Q1 2023 GDP (4.5% versus 4% forecast), year-on-year March trade balance (USD 88.19 billion versus USD 39.20 billion forecast), year-to-date industrial production (3% versus 2.7% forecast), and unemployment (5.3% versus 5.5% forecast), as investors expected pre-pandemic-level figures.

To make matters worse, the People’s Bank of China (PBOC) signaled the possibility of rate cuts later in the year in order to further spur growth. This will continue to put pressure against the CNH, which will likely stay above the 7.0000 level.

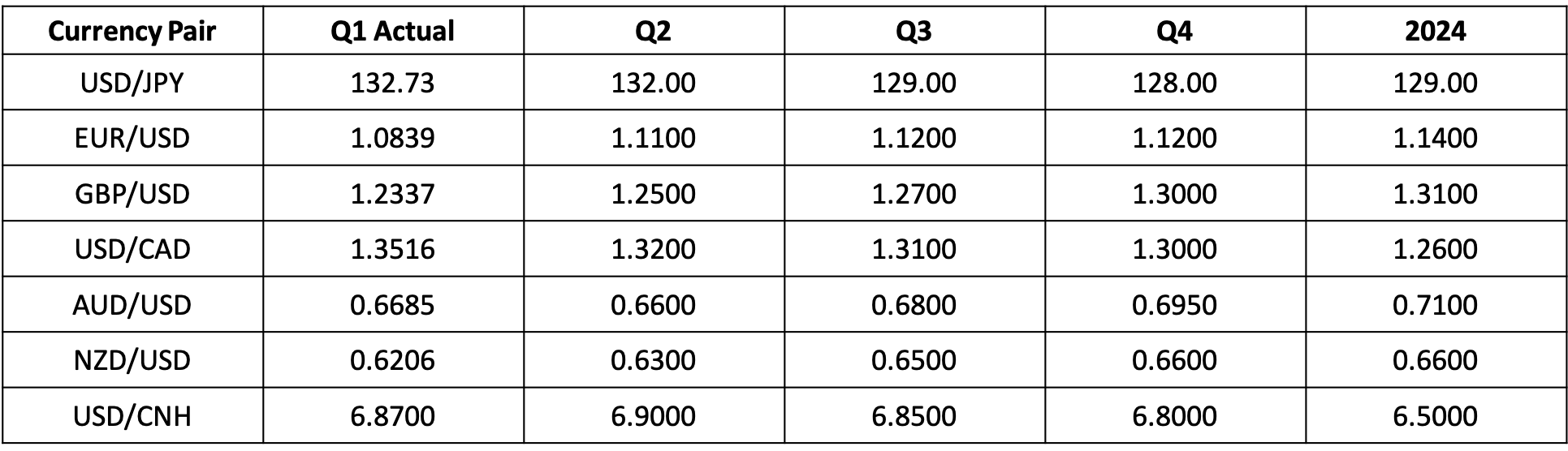

The above forecasts are the foreign exchange traders’ personal opinions and may not reflect the official views of the bank.

The US dollar continues to be strong against its global peers even after First Republic Bank replaced SVB as the second largest bank closure in US history. Ironically, the risk off sentiment brought about by both the regional banking crisis and debt ceiling only further increased the demand for US treasury bonds as a safe haven investment.

Slight decreases in recent inflation figures also support expectations of high policy rates. The Fed is currently divided on whether to pause or hike rates once more in June but it will probably take signals of future rate cuts to cause the US dollar to weaken significantly.

EARL ANDREW “EA” AGUIRRE is a Market Strategist at Metrobank’s Financial Markets Sector and has 10 years of experience in foreign exchange, fixed income securities, and derivatives sales. He has a Master’s in Business Administration from the Ateneo Graduate School of Business. His interests include regularly traveling to Japan and learning its language and culture.

DOWNLOAD

DOWNLOAD

By EA Aguirre

By EA Aguirre