April 2024 Economic Updates: Elevated inflation and the prospects of rate cuts

We have retained our forecasts for 2024 as the trend for inflation looks inauspicious.

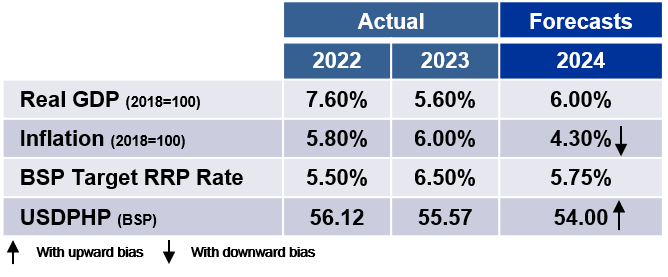

During the 187th Meeting of the Development Budget Coordination Committee (DBCC) last April 4, 2024, the government adjusted its economic growth projection for 2024 to 6.0-7.0% and for 2025 to 6.5-7.5%. We retain our 2024 full-year average GDP forecast at 6.0% because of decelerating inflation and interest rate cuts by the BSP in the 4th quarter of 2024.

The country’s headline inflation accelerated to 3.7 percent in March 2024 on account of faster growth in the prices of food and non-alcoholic beverages. We retain our yearend average inflation forecast at 4.3% (with a downward bias), owing to persistent upside risks to inflation from rising rice prices, the effects of El Niño, and emerging geopolitical risks.

The Bangko Sentral ng Pilipinas (BSP) maintained its target overnight reverse repurchase (RRP) rate at 6.50% and revised its risk-adjusted inflation forecast to 4.0% from 3.9% previously. We have re-weighed the base case and now expect the first rate cut to happen in the 4th quarter of 2024. We think there will be a total of 75 basis points (bps) in cuts to end the year at 5.75%.

For 2024, we maintain our forecast of a PHP 54 to the dollar, but with an upward bias considering existing upside risks and current market sentiment.

For more information, please download the full report below:

April 2024 Economic Updates: Elevated inflation and the prospects of rate cuts

It may take some time for the central bank to cut rates as inflation risks remain.

DOWNLOAD

DOWNLOAD

By Metrobank Research

By Metrobank Research