Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

20

The Gist

A daily dose of market updates and smart investment strategies to guide your portfolio decisions

Today's Report

Today's Report

Your Morning Fix

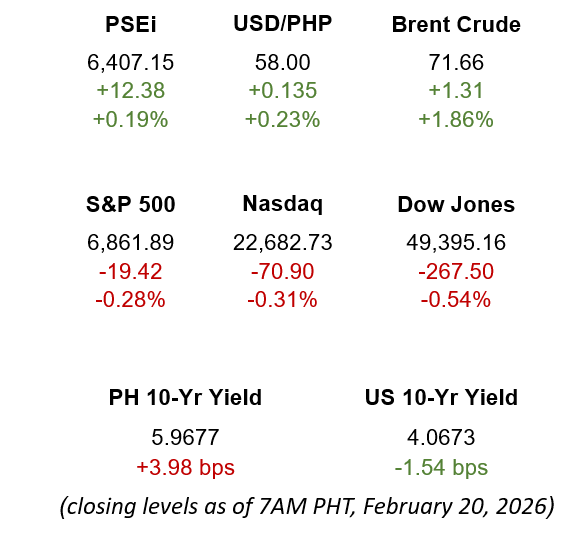

- The Bangko Sentral ng Pilipinas lowered its key policy rate by 25 basis points for a sixth straight meeting, bringing the target reverse repurchase (RRP) rate) to 4.25%, to support the economy.

- The Philippine government has raised PHP 235 billion in fresh funds from its offering of new fixed rate Treasury notes (FXTNs), closing the public offer period a day after the rate-setting auction due to strong demand.

- The Philippines’ balance of payments deficit sharply narrowed to USD 373 million in the first month of 2026, narrowing sharply from the USD 4.078-billion gap recorded in the same month last year.

- US initial jobless claims fell by 23,000 to 206,000 in the week ended February 14, falling the most since November 2025, which indicates a stabilization in the labor market.

- The US trade deficit widened by 33% to USD 70.31 billion in December, on a seasonally adjusted basis, as imports increased and exports fell, delayed government data showed.

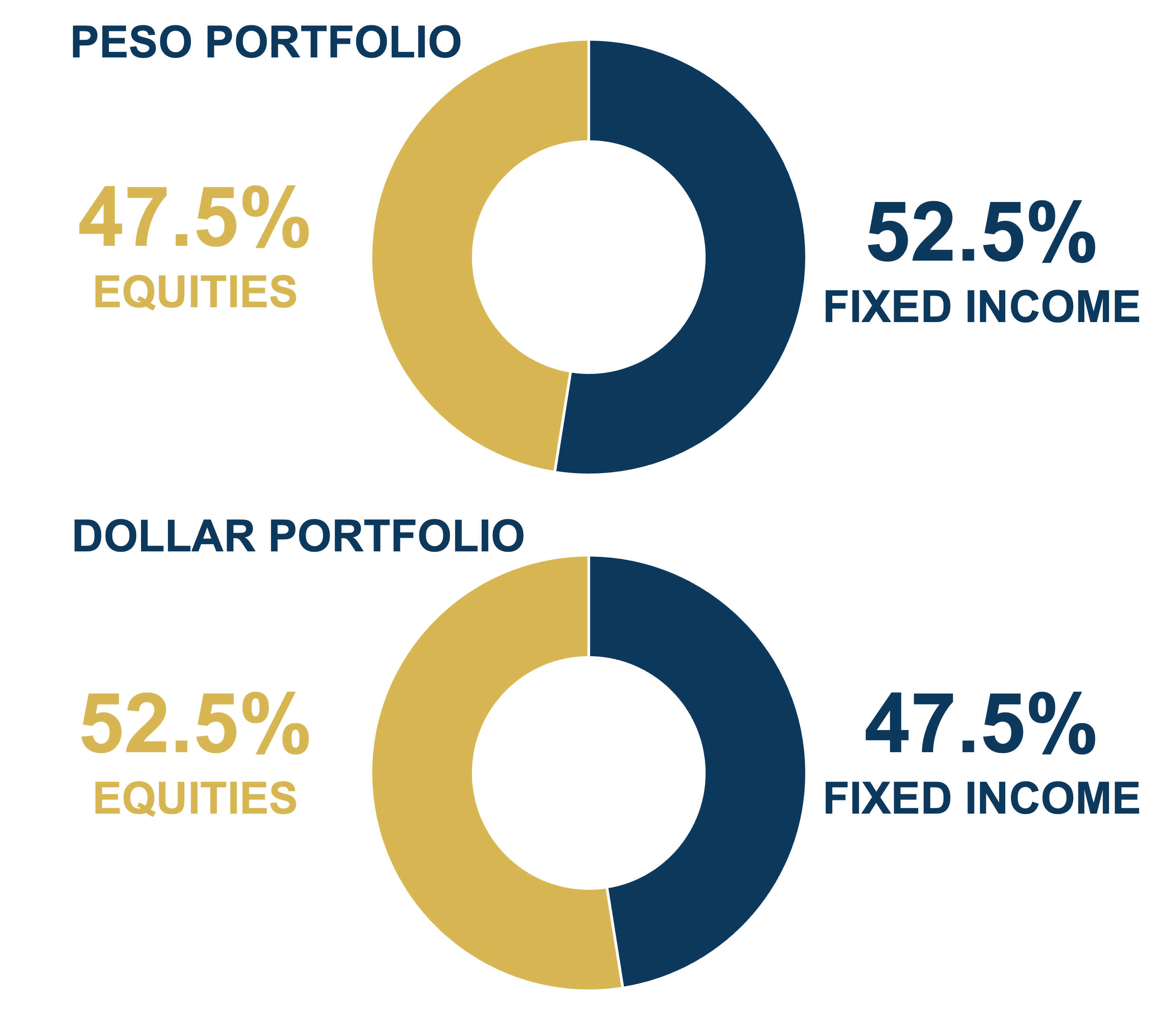

Our Portfolio Recommendation

Our peso portfolio is tilted slightly toward fixed income. While local inflation remains low and monetary easing is likely to continue, yields may be pushed higher by upcoming bond auctions. Continued rate cuts and rising consumer strength are also favorable for local equities, especially real estate and retail. The dollar portfolio is the reverse, with slightly lower fixed income owing to the uncertainty of the effects of tariffs on inflation. US Federal Reserve rate cuts are also closely watched. We remain positive on global equities, with a preference for US sectors, particularly technology, communication services, and financials.

| 2025 Actual | 2026 Metrobank Forecast | 2027 Metrobank Forecast | |

|---|---|---|---|

| GDP | 4.4% | 5.2% | 6.0% |

| Inflation | 1.7% | 3.3% | 3.0% |

| BSP Target Reverse Repurchase Rate | 4.50% | 4.00% | 4.00% |

| Federal Funds Rate | 3.75% | 3.25% | 3.25% |

| USD/PHP | 58.8 | 59.7 | 58.5 |

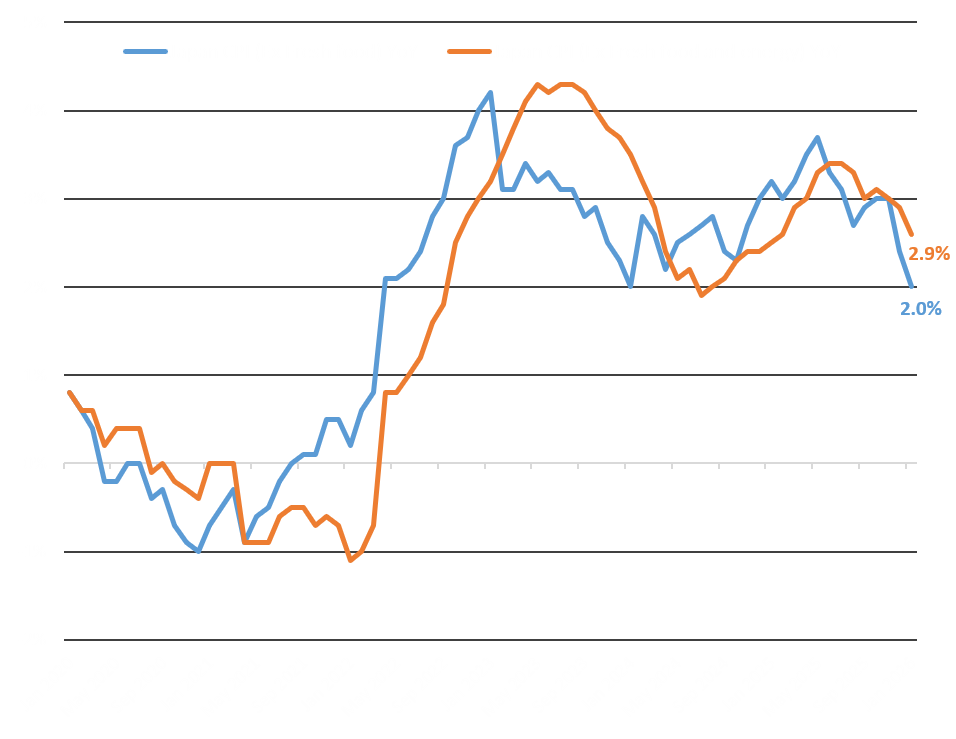

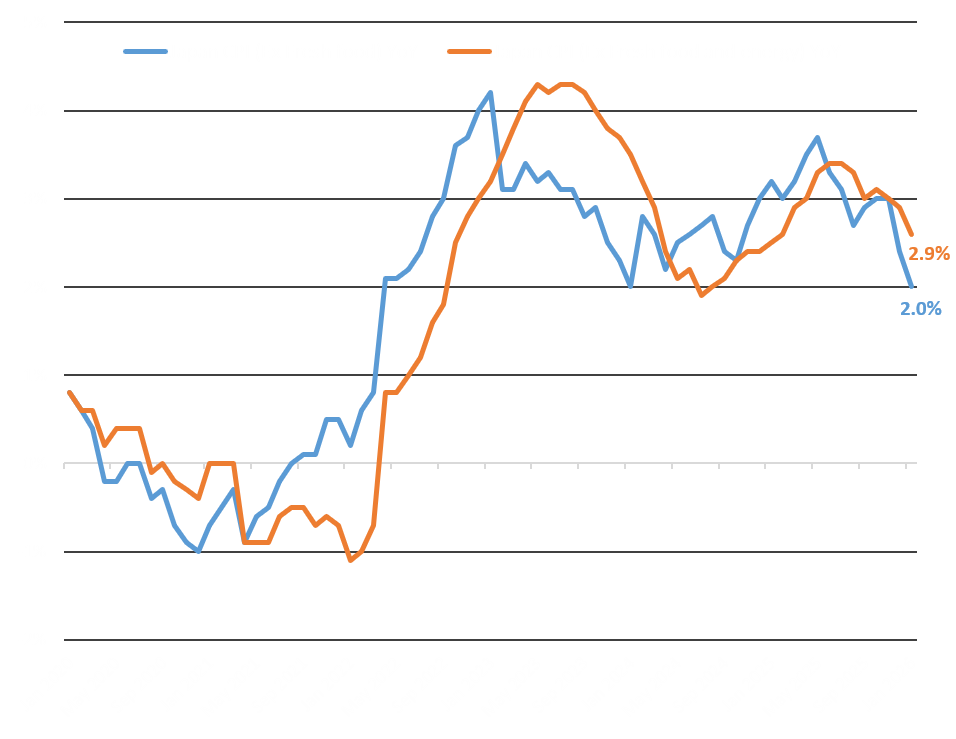

CHART OF THE DAY

CHART OF THE DAY

Chart of the Day

Japan inflation eases in January

Japan’s core Consumer Price Index (CPI), a measure of inflation excluding food and energy, slowed to 2.0% in January, the slowest in two years, as falling fuel costs and base effects pulled inflation down. The Bank of Japan’s (BOJ’s) preferred measure that excludes fresh food and fuel eased to 2.6% from 2.9%, pointing to softer demand-driven price pressures. The moderation may complicate the BOJ’s timing for future rate hikes after ending its massive stimulus and entering its current hiking cycle. Sources: Bloomberg, Reuters

Featured Reports

More Reads

USD/PHP closes higher post-BSP rate cut

- The USD/PHP exchange rate opened 1.9 centavos higher at 57.88 on Thursday, and immediately rallied to the mid-57.90s following the dollar strength overnight.

- The market was initially cautious in buying as defensive sizable supply was seen at the 58.00 level.

- In the afternoon, banks bought at 58.00 after the Bangko Sentral ng Pilipinas cut key policy rates, with the market possibly pricing in one more rate cut to support growth.

- The USD/PHP exchange rate ultimately closed at 57.996, or 13.5 centavos higher day-on-day.

- The current support levels of USD/PHP are 57.50/80, while the resistance levels are 58.30/50.

Local GS sees better selling for liquidity

- Selling pressure emerged in the local government securities (GS) market on Thursday, as players reduced inventory to raise liquidity ahead of the new Fixed Rate Treasury Note (FXTN) 10-74 settlement.

- Activity was concentrated in the 3- to 5-year sector, with Retail Treasury Bond 5-18 (3Y) and FXTN 7-71 (5Y) closing at 5.330% and 5.570%, respectively.

- The 1- to 2-year space also ended around 2 basis points (bps) higher.

- The central bank cut its policy rate by 25 bps, bringing the RRP rate to 4.25%. Market reaction was limited as the adjustment was widely expected.

- The Bureau of the Treasury closed new money subscriptions for FXTN 10-74 after raising PHP 235.0 billion, though Bond Exchange orders remain open until February 20.

PSEi rises softly on selective value-hunting

- The Philippine Stock Exchange index (PSEi) ended 12.38 higher at 6,407.15 on Thursday, as buyers gradually edged out early pressure as the Bangko Sentral ng Pilipians delivered its sixth straight rate cut.

- Market performance remained constructive at 119 advancers versus 89 decliners, pointing to selective value-hunting beneath the surface.

- On the stock front, Semirara Mining & Power Corp. (+13.53%), DMCI Holdings Inc. (+9.41%), and San Miguel Corp. (+2.36%) led the advance.

- Meanwhile, DigiPlus Interactive Corp. (-1.66%), SM Prime Holdings Inc. (-1.41%), and LT Group Inc. (-1.25%) weighed on sentiment.

- Trading activity was moderate at PHP 4.94 billion, with overseas funds accounting for 49% of total volume despite posting net outflows of PHP 95.75 million.

USD/PHP closes higher post-BSP rate cut

- The USD/PHP exchange rate opened 1.9 centavos higher at 57.88 on Thursday, and immediately rallied to the mid-57.90s following the dollar strength overnight.

- The market was initially cautious in buying as defensive sizable supply was seen at the 58.00 level.

- In the afternoon, banks bought at 58.00 after the Bangko Sentral ng Pilipinas cut key policy rates, with the market possibly pricing in one more rate cut to support growth.

- The USD/PHP exchange rate ultimately closed at 57.996, or 13.5 centavos higher day-on-day.

- The current support levels of USD/PHP are 57.50/80, while the resistance levels are 58.30/50.

Local GS sees better selling for liquidity

- Selling pressure emerged in the local government securities (GS) market on Thursday, as players reduced inventory to raise liquidity ahead of the new Fixed Rate Treasury Note (FXTN) 10-74 settlement.

- Activity was concentrated in the 3- to 5-year sector, with Retail Treasury Bond 5-18 (3Y) and FXTN 7-71 (5Y) closing at 5.330% and 5.570%, respectively.

- The 1- to 2-year space also ended around 2 basis points (bps) higher.

- The central bank cut its policy rate by 25 bps, bringing the RRP rate to 4.25%. Market reaction was limited as the adjustment was widely expected.

- The Bureau of the Treasury closed new money subscriptions for FXTN 10-74 after raising PHP 235.0 billion, though Bond Exchange orders remain open until February 20.

PSEi rises softly on selective value-hunting

- The Philippine Stock Exchange index (PSEi) ended 12.38 higher at 6,407.15 on Thursday, as buyers gradually edged out early pressure as the Bangko Sentral ng Pilipians delivered its sixth straight rate cut.

- Market performance remained constructive at 119 advancers versus 89 decliners, pointing to selective value-hunting beneath the surface.

- On the stock front, Semirara Mining & Power Corp. (+13.53%), DMCI Holdings Inc. (+9.41%), and San Miguel Corp. (+2.36%) led the advance.

- Meanwhile, DigiPlus Interactive Corp. (-1.66%), SM Prime Holdings Inc. (-1.41%), and LT Group Inc. (-1.25%) weighed on sentiment.

- Trading activity was moderate at PHP 4.94 billion, with overseas funds accounting for 49% of total volume despite posting net outflows of PHP 95.75 million.

READ MORE

READ MORE