Inflation Update: Green light for easing

DOWNLOAD

DOWNLOAD

December Economic Update: One for them, one for us

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Trade trajectories trend along

DOWNLOAD

DOWNLOAD

Debt yields dip after Q4 borrowing plan

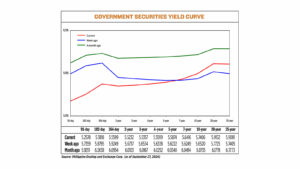

Yields on government securities traded in the secondary market mostly fell last week after the Philippines’ Bureau of the Treasury (BTr) announced a PHP 310-billion local borrowing plan for the last quarter.

Debt yields, which move opposite prices, dropped by 11.86 basis points (bps) week on week on average on Friday, based on PHP Bloomberg Valuation Service Reference Rates data posted on the Philippine Dealing System website.

The rate of the 91-, 182- and 364-day Treasury bills (T-bills) fell, while yields on the two-, three-, four- and five-year Treasury bonds dipped.

On the other hand, the rates of the seven-year T-bond, 10-, 20- and 25-year debt rose.

Volume fell to PHP 47.88 billion on Friday from PHP 113.58 billion on Sept. 20.

A bond trader said yields on seven-year T-bonds and 10- to 25-year debt increased due to some profit taking before the borrowing plan was announced.

Last week, the Treasury bureau said it would borrow PHP 310 billion from the domestic market in the fourth quarter — PHP 220 billion from T-bills and PHP 90 billion via T-bonds.

This is amid expectations of further interest rate cuts that could drive yields lower. The borrowing is less than the PHP 672.5 billion that was raised this quarter.

“The PHP 310-billion borrowing plan is significantly less than the PHP 630-billion auction size in the third quarter,” Dino Angelo C. Aquino, vice-president and head of fixed income at Security Bank Corp., said in a Viber message. “The market will likely see further buying momentum given less supply of bonds in the fourth quarter.”

He added that inflation data for September due this week would likely influence bond movements.

“Expect yields to trend lower especially with the outlook for reverse repurchase, and the announced reserve requirement ratio cut,” a bond trader said in a Viber message.

Last week, Finance Secretary Ralph G. Recto said inflation is slowing, and it would likely ease to 2.5% this month from 3.3% last month.

He added that the government remained cautious since global oil prices could go up due to worsening conflict in the Middle East.

Mr. Recto also said the Philippine central bank could match the 50-bp rate cut by the US Federal Reserve to boost growth.

The central bank in August cut the key rate by 25 bps to 6.25% from the over 17-year high of 6.5% amid an improving inflation outlook.

On Sept. 20 it said reserve requirements for universal and commercial banks would be cut by 250 bps to 7% of deposits from 9.5% on Oct. 25 to promote better pricing for financial services and intermediation costs. — Charles Worren E. Laureta

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld