Effect of the ban on POGOs on the property sector overblown

What will the effect of the POGO ban be like? Fortunately, Marcos’s POGO ban need not take the shine off the emerging opportunities.

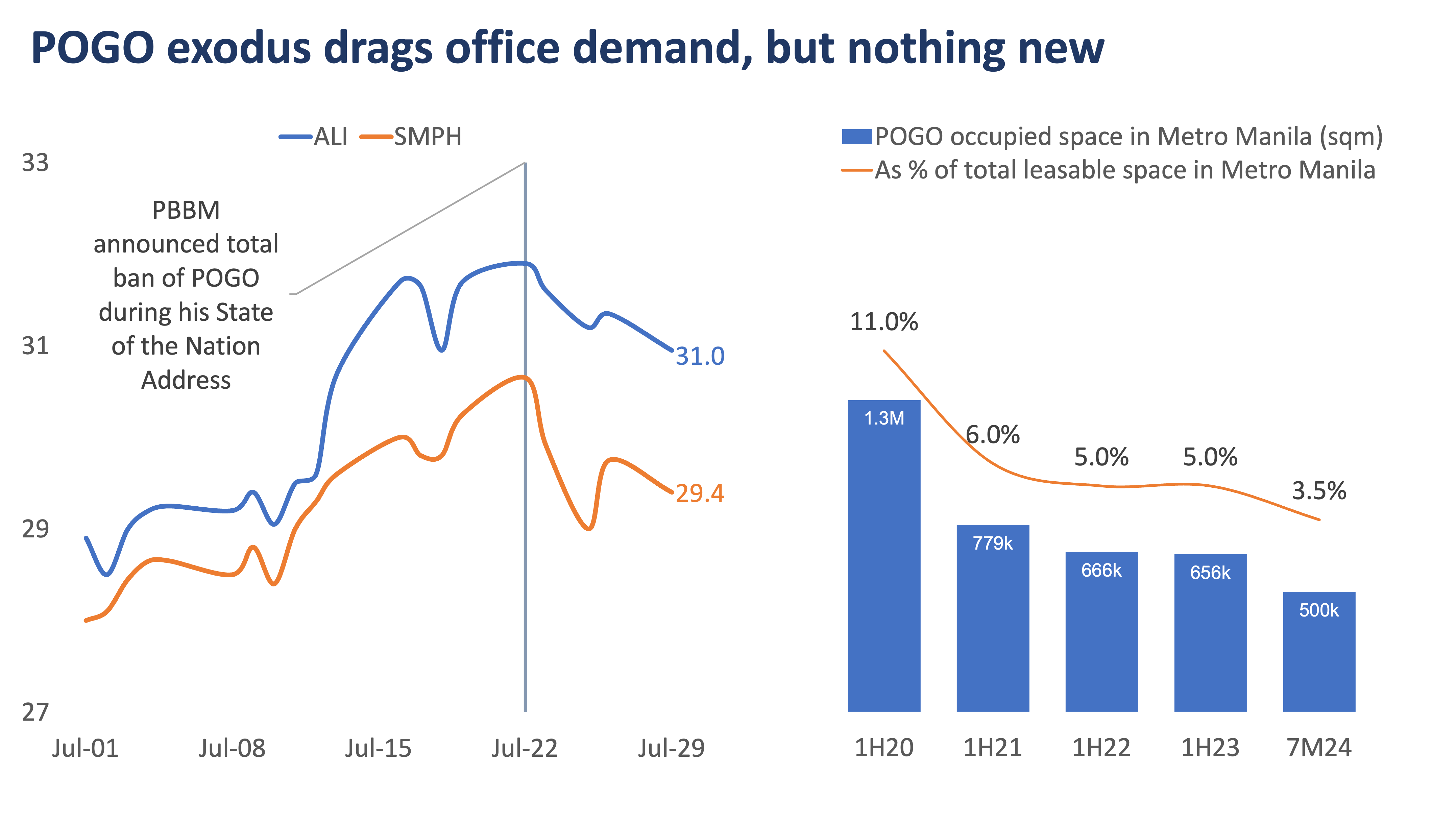

The recent announcement of the complete ban on Philippine Offshore Gaming Operators (POGOs) by President Marcos Jr. has sent ripples through the property sector. However, a closer examination reveals that its impact may be less significant than the market’s initial reaction suggests.

POGO occupancy in Metro Manila has already seen a substantial decline, dropping from 11% in 2020 to just 3.5% as of July 2024. This gradual reduction indicates that the market has been adapting to decreased POGO presence over time, softening the effects of the outright POGO ban.

Moreover, major developers like Ayala Land (ALI) and SM Prime Holdings (SMPH) have limited their POGO exposure to less than 1% of their office portfolio, with their diverse revenue streams from residential and retail segments providing a strong buffer against potential losses. We talked about this glimmer of optimism in the property sector in a separate article.

While mid-tier developers such as D.M. Wenceslao & Associates, Inc. (DMW), Megaworld, and Filinvest Land Inc. (FLI), with POGO exposures ranging from 4% to 9%, may face short-term challenges, they are likely to adapt by repurposing their assets for other growing sectors, such as BPOs and flexible office spaces catering to the evolving work environment.

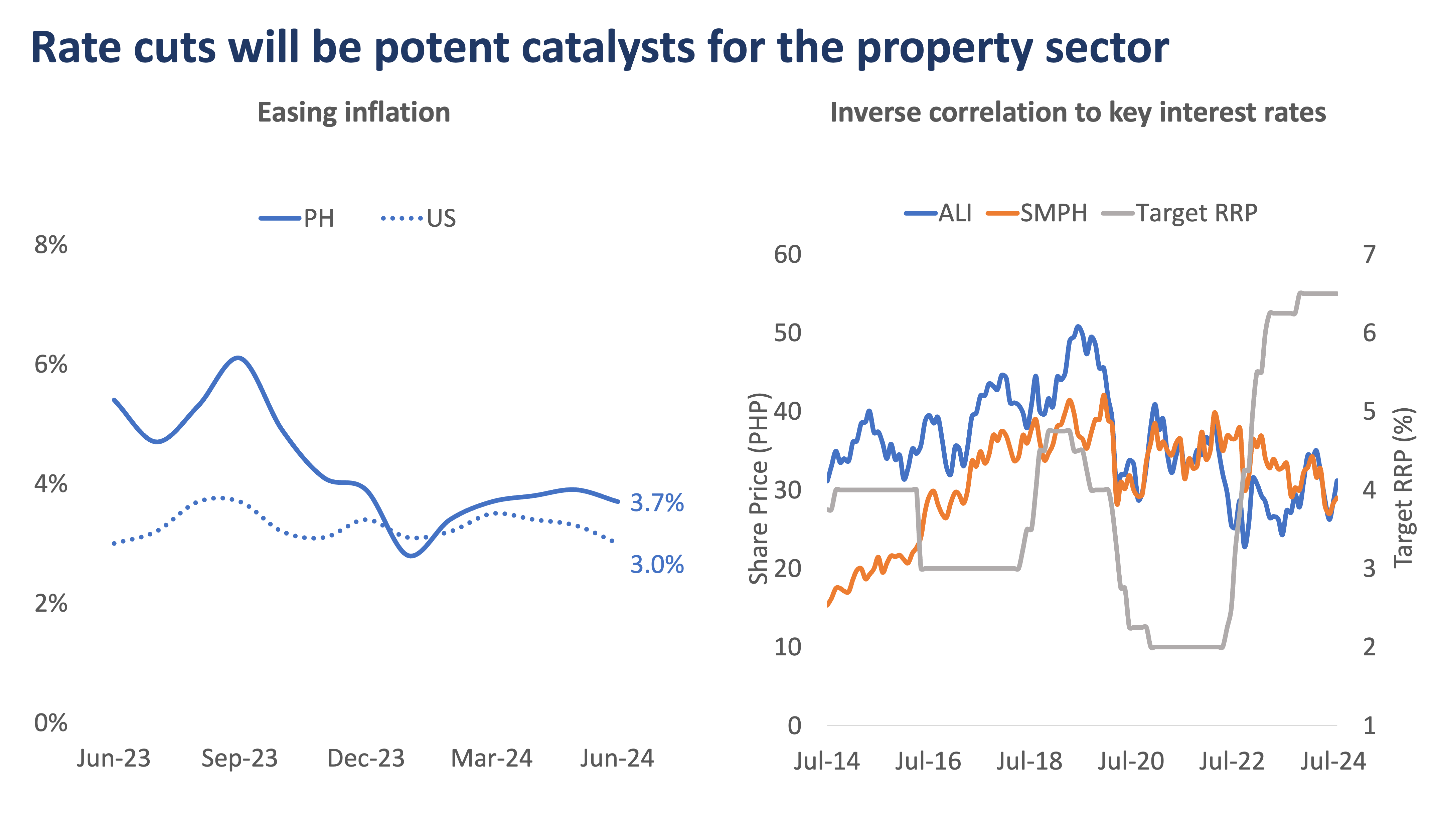

The market appears to be overlooking a more significant catalyst: the anticipated rate cuts signaled by BSP Governor Eli Remolona Jr. Historical data shows a strong negative correlation between interest rates and property stock performance. The expected rate cuts, potentially starting as early as August, could drive a substantial rally in the property sector.

Current valuations of listed property developers are trading at a notable discount to their 5-year averages, presenting an attractive entry point for investors. As the residential market adjusts to the ban on POGOS and benefits from a more favorable interest rate environment, there’s potential for significant upside in property stocks over the next 12-18 months.

Investors would do well to look beyond the short-term noise and focus on the sector’s strong fundamentals and positive macroeconomic factors that are likely to drive growth in the coming years.

GERMAN DE LA PAZ III, CFA, serves as an Equity Research Lead in the Investment Services Division of Metrobank Trust Banking Group. His coverage includes gaming, telcos, conglomerates, and utilities, as well as select offshore markets. Prior to joining the bank, he spent 9 years at Abacus Securities, starting as a Junior Investment Analyst and working his way up to Senior Investment Analyst. German holds a Bachelor’s degree in Humanities and a master’s degree in Industrial Economics from the University of Asia and the Pacific. Recently, he obtained his CFA charter and is currently pursuing additional industry certifications. In his free time, German enjoys playing sports, particularly basketball, and has a penchant for reading fiction books, watching suspenseful movies, and listening to music.

ARIZ MARCELINO is an Equity Research Analyst in the Investment Services Division of Metrobank Trust Banking Group. His local market coverage includes banks, consumer, and properties. Additionally, he monitors various sectors and investment themes in the offshore space. Previously, he was with the Markets Research Department, focusing on macroeconomic research and sector analysis. Ariz graduated from New Era University with a degree in Banking and Finance and has cleared the CFA Level 1 exam. He is a certified Financial Modelling and Valuation Analyst and a UITF Sales Person. Outside of work, he unwinds by watching popular sitcoms and anime series while enjoying a cup of hot matcha latte.

GINNY PECAÑA is the Head of Investment Services Division at Metrobank’s Trust Banking Group, overseeing markets and equities research, investment analysis, fund selection, portfolio analytics, and trade execution. Ginny has garnered multiple awards for fund management with her decades of banking experience. She holds a Bachelor’s degree in Business Management from the Ateneo de Manila University as well as various finance certifications. On weekends, Ginny plays Mom to two teenage boys and a 10-month-old corgi named Hobie.

DOWNLOAD

DOWNLOAD

By German De La Paz III, CFA, Ariz Marcelino, and Ginny Pecaña

By German De La Paz III, CFA, Ariz Marcelino, and Ginny Pecaña