Philippine Property Sector: Glimmer of optimism amid woes

We may soon see a resurgent property sector coming along with potential rate cuts and a shift in investor mood.

The property sector may look grim, especially when it has underperformed by over 10% year-to-date as of July 19.

However, recent developments suggest a potential shift in sentiment. The sector’s month-to-date outperformance of over 160 basis points hints at brewing optimism among investors. This renewed hope is largely fueled by dovish sentiments from the Bangko Sentral ng Pilipinas (BSP) and easing inflation, which strengthen the likelihood of policy rate cuts.

These potential rate cuts are expected to benefit the property sector broadly, with positive long-term implications for the residential and retail segments. Industry heavyweights like Ayala Land Inc. (ALI) and SM Prime Holdings (SMPH) are well-positioned to gain from this trend.

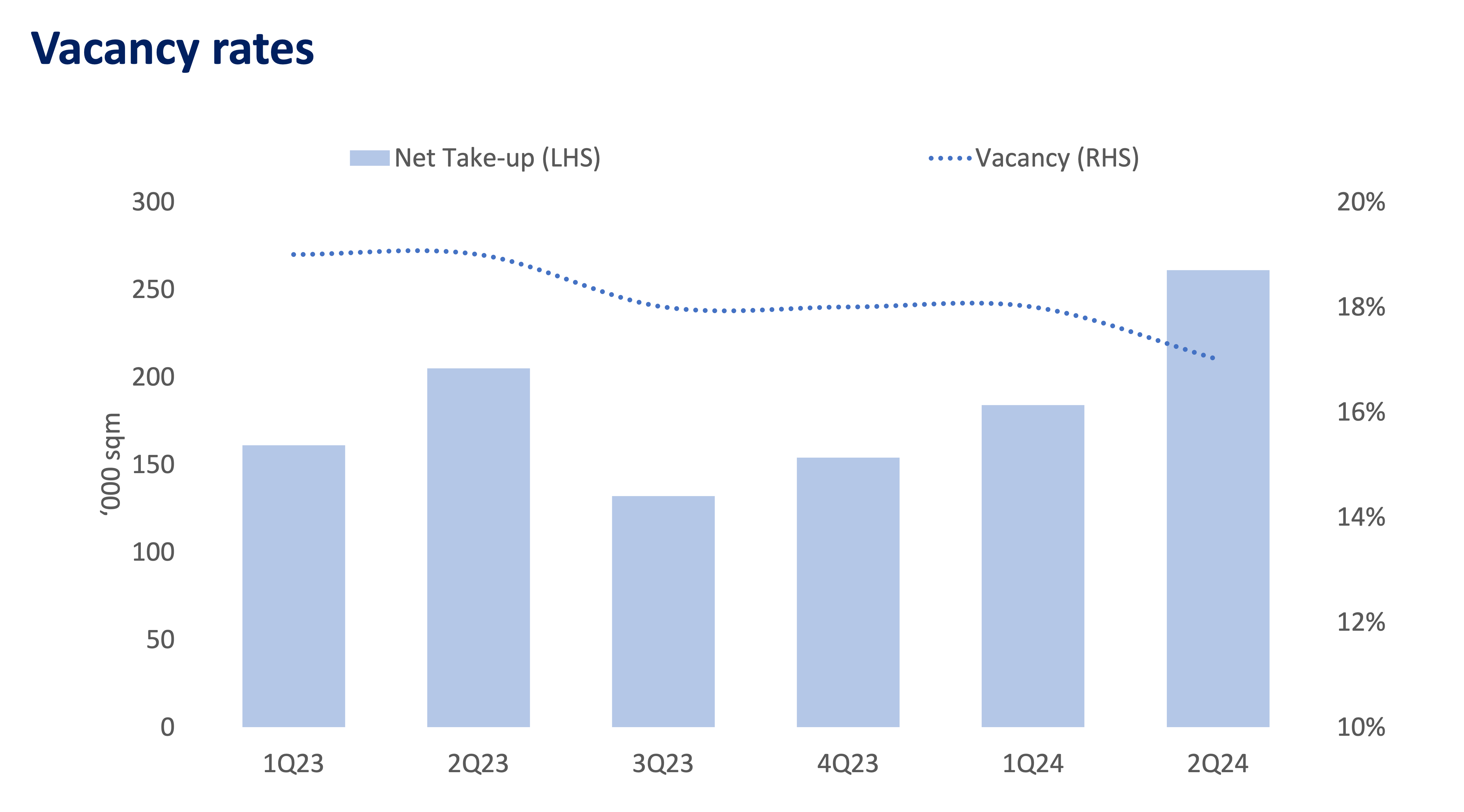

The office segment, despite its ongoing struggles, is also showing some signs of improvement. Net demand for office space in the second quarter of 2024 increased by 27% year-on-year, primarily driven by the Information Technology and Business Process Management (IT-BPM) industry. This uptick in demand has helped reduce vacancy rates by 100 basis points to 17% in Q2 2024.

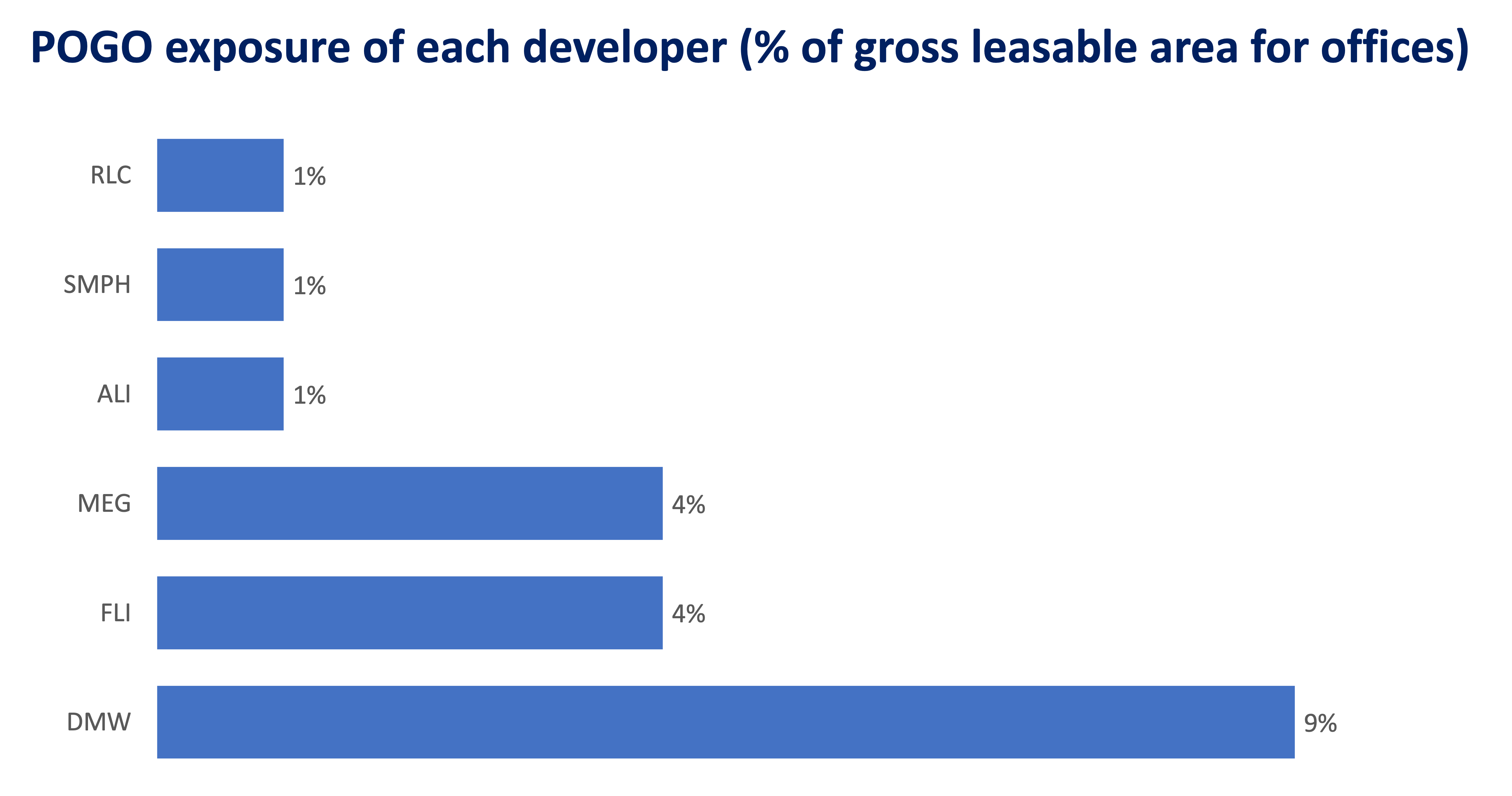

However, one major challenge emerged during President Ferdinand “Bongbong” Marcos Jr.’s recent State of the Nation Address (SONA), where he announced a total ban on Philippine Offshore Gaming Operators (POGOs).

This decision is expected to exacerbate office vacancy rates, as POGOs currently occupy 6% of the total gross leasable area. Additionally, the market anticipates an influx of 780,000 square meters of fresh supply in the second half of 2024, which could partially offset the demand growth seen in the first half.

The persistent work-from-home trend also continues to impact the market, with some BPO tenants downsizing their office spaces to accommodate a reduced on-site workforce.

Despite these challenges in the office segment, growth prospects in the residential and mall segments should not be ignored. Coupled with the prospect of a more accommodative monetary policy, the outlook for the Philippine property sector in the coming months remains cautiously positive.

(Sources: Philippine Statistics Authority, US Bureau of Labor Statistics, Leechiu Property Consultants, Bloomberg, company presentations and reports)

GERMAN DE LA PAZ III, CFA serves as an Equity Research Lead in the Investment Services Division of Metrobank Trust Banking Group. His coverage includes gaming, telcos, conglomerates, and utilities, as well as select offshore markets. Prior to joining the bank, he spent 9 years at Abacus Securities, starting as a Junior Investment Analyst and working his way up to Senior Investment Analyst. German holds a Bachelor’s degree in Humanities and a master’s degree in Industrial Economics from the University of Asia and the Pacific. Recently, he obtained his CFA charter and is currently pursuing additional industry certifications. In his free time, German enjoys playing sports, particularly basketball, and has a penchant for reading fiction books, watching suspenseful movies, and listening to music.

ARIZ MARCELINO is an Equity Research Analyst in the Investment Services Division of Metrobank Trust Banking Group. His local market coverage includes banks, consumer, and properties. Additionally, he monitors various sectors and investment themes in the offshore space. Previously, he was with the Markets Research Department, focusing on macroeconomic research and sector analysis. Ariz graduated from New Era University with a degree in Banking and Finance and has cleared the CFA Level 1 exam. He is a certified Financial Modelling and Valuation Analyst and a UITF Sales Person. Outside of work, he unwinds by watching popular sitcoms and anime series while enjoying a cup of hot matcha latte.

GINNY PECAÑA is the Head of Investment Services Division at Metrobank’s Trust Banking Group, overseeing markets and equities research, investment analysis, fund selection, portfolio analytics, and trade execution. Ginny has garnered multiple awards for fund management with her decades of banking experience. She holds a Bachelor’s degree in Business Management from the Ateneo de Manila University as well as various finance certifications. On weekends, Ginny plays Mom to two teenage boys and a 10-month-old corgi named Hobie.

DOWNLOAD

DOWNLOAD

By German de la Paz III, CFA, Ariz Marcelino, and Ginny Pecaña

By German de la Paz III, CFA, Ariz Marcelino, and Ginny Pecaña