Will the Fed still guide for rate cuts in 2024?

The world is pinning its hopes on the outcome of the upcoming US Federal Reserve meeting. Statements on the future trajectory of US interest rates will have implications on the Philippines’ own economy.

All eyes are on the US Federal Open Market Committee (FOMC) meeting on Wednesday, June 12 (June 13, 2:00 AM, PHT). In the agenda is the discussion on the interest rate cuts that everyone has been waiting for.

In the minds of our clients and our investment managers is “when and how much?” It’s all about changes in interest rates in the US and the timing of these changes.

Higher for longer US interest rates may continue to lure investors to US dollar-denominated assets and hence, the US dollar, which implies a stronger US dollar against the Philippine peso. A weaker Philippine peso will then mean the potential for “imported” inflation, given the heavy reliance of the Philippines on imports.

This high-rate environment is designed to stifle economic growth, as consumers rein-in consumption and businesses and individuals borrow less for business expansion or auto and home loans.

While US monetary officials continue to reiterate that their decisions will be based on data, we believe the easing cycle, which is when the US Federal Reserve reduces its benchmark policy rates, called the Federal Funds Rate, may occur as early as their meeting on September 18, due to:

1. Inflation has cooled down a lot.

Inflation in the US has already slowed down a lot. And that’s the number one thing.

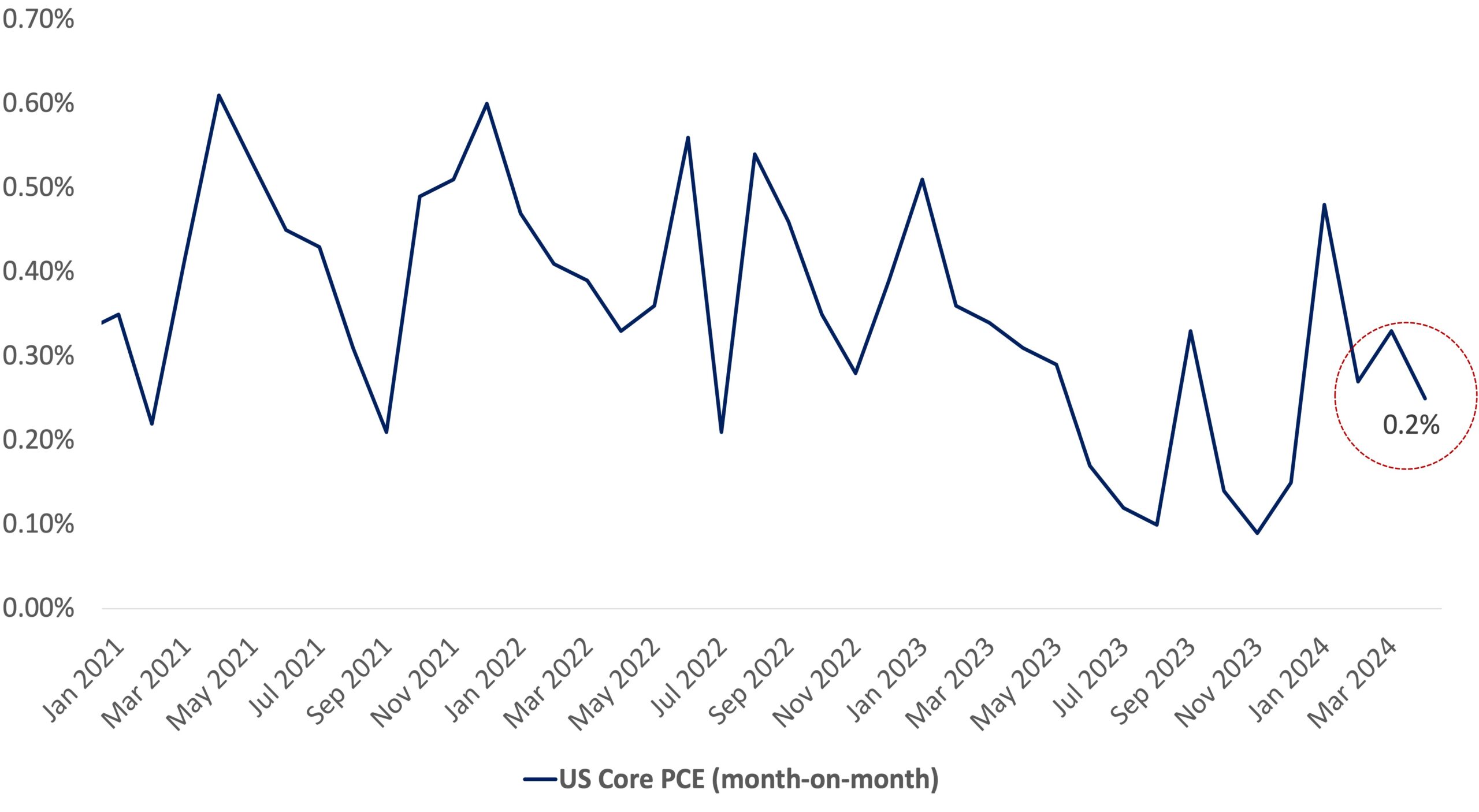

The latest core Personal Consumption Expenditures (PCE) Price Index, which excludes food and energy, or widely known as the Fed’s preferred inflation measure, rose 2.8% on a yearly basis in April (0.2% month-on-month from 0.3% in March), matching consensus estimates. Durable goods put downward pressure on overall prices, driven by motor vehicles and parts and furnishing and durable household equipment.

Shape

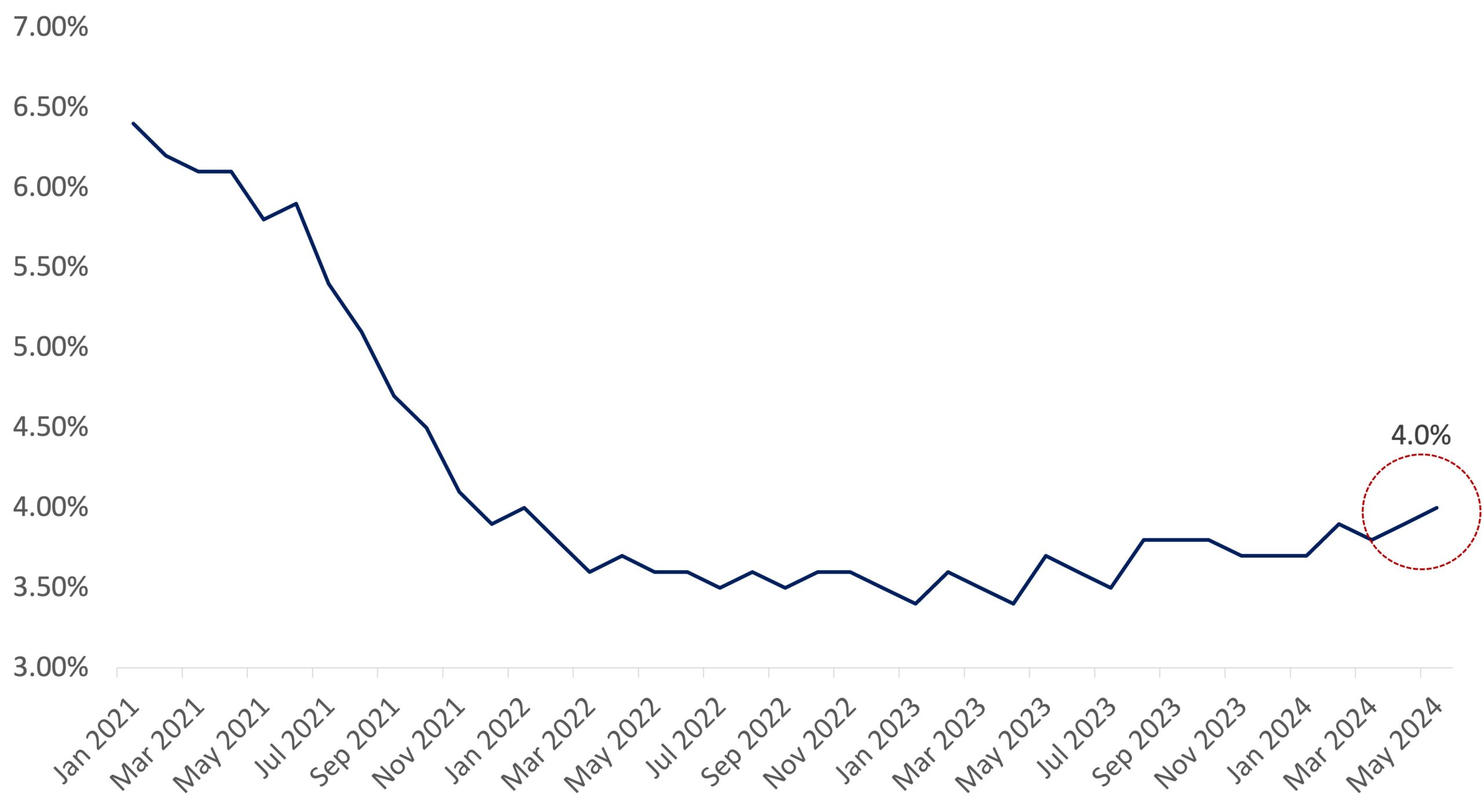

2. Jobs in the US are slowing down.

Jobs in the US have been very resilient, but they have become a little less rosy now.

This is evident in the US unemployment rate which rose by 4.0% (vs. 3.9% consensus estimates) for the first time since January 2022, up from 3.9% in April.

The Fed has managed to slow down inflation through higher for longer interest rates, but it is also wary of slowing it down too much to lead to a contraction in growth, or a recession, which will cost people their jobs.

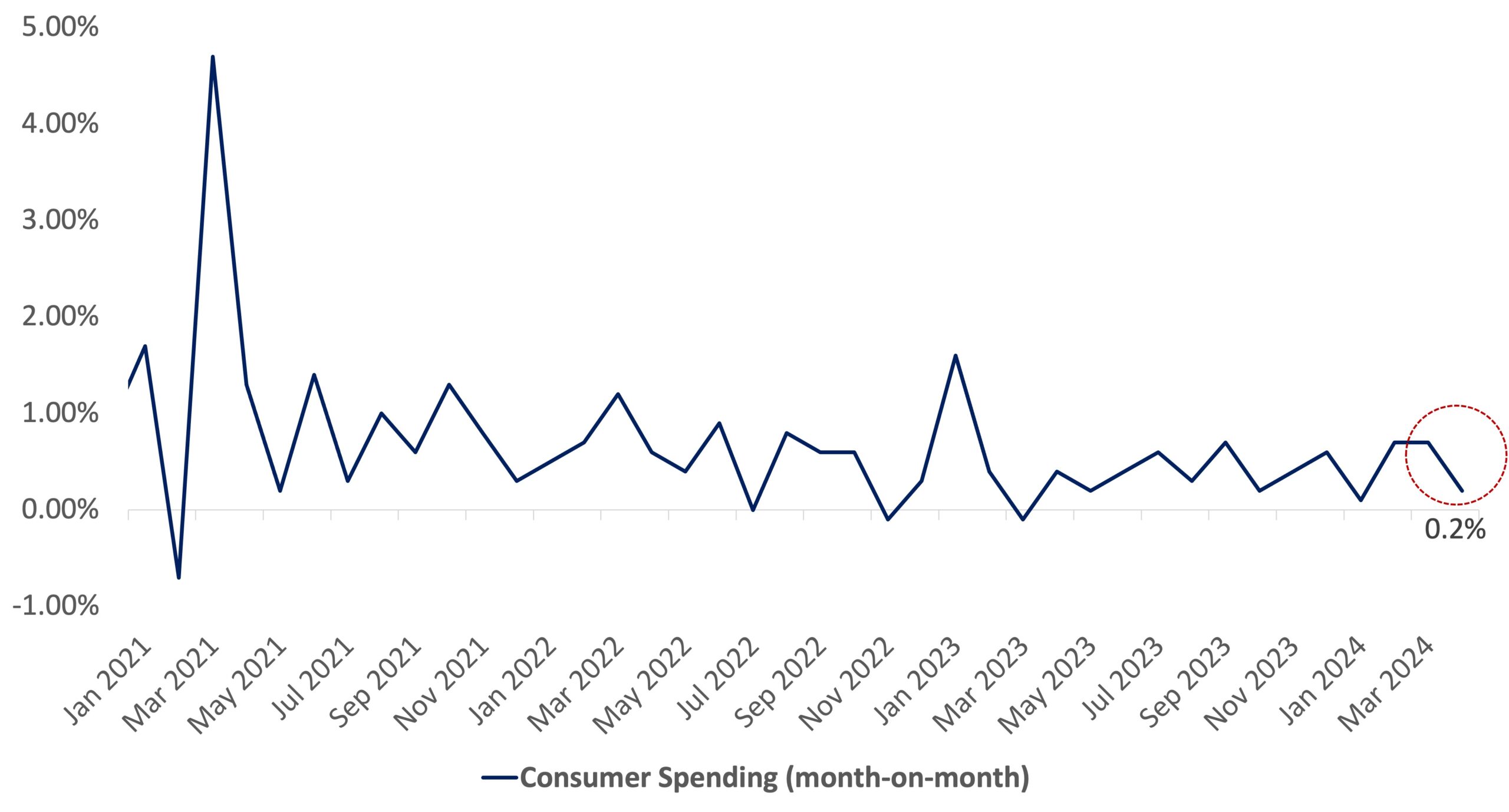

3. Consumers are spending less.

Consumer household spending in the US is also seeing some stress. People are not spending as much anymore.

The Personal Consumption Expenditures (PCE) report showed that monthly consumer spending just rose 0.2%, down from March’s downwardly revised 0.7%.

Consumer households make up 70% of the US economy and are known to be the customers of the world. If that slows down drastically, the risk is that the global economy will be dragged down as well.

Conclusion

Slowing inflation, jobs growth, and consumer spending in the US have led us to our long-held view that the Fed can and will continue to guide for lower rates ahead, but what’s become more uncertain is the timing and pace of these rate cuts.

In this week’s FOMC meeting on Wednesday (2 AM, Thursday, Philippine Time), we expect the Fed to keep current rates unchanged.

Given the surprising strength in US jobs data, particularly last Friday’s Nonfarm Payrolls (NFP) for May (272,000 from 165,000 in April, vs expectation of 185,000), we recognize the high likelihood that the Fed will revise its rate policy guidance (known as the Fed Dot Plot, published every calendar quarter) from the three rate cuts established last March, or 75 basis points (bps) of cuts, to only two rate cuts (total of 50 bps) in 2024. The risk is that guidance may be for only one rate cut in 2024, which if so, could be in their last meeting on December 19.

For the Bangko Sentral ng Pilipinas (BSP), we’ve held the view that in order to mitigate peso-dollar volatility, the BSP will hold off on its own rate cuts until after the Fed, especially with domestic inflation still hovering around the high-end of its target range (2-4%) through July, which is when our research sees the inflation peak. We therefore expect the beginning of BSP’s own rate cuts in mid-October.

(Bookmark and visit Metrobank Wealth Insights at www.wealthinsights.ph daily for investment insights and ideas. If you are a Metrobank client, please get in touch with your relationship manager or investment specialist for assistance in accessing exclusive content. Not a client yet? Please sign up here so you can begin your wealth journey with us.)

RUBEN ZAMORA is First Vice-President and Head of Institutional Investors Coverage Division, Financial Markets Sector, at Metrobank, which manages the bank’s relationships with Non-Bank Financial Institutions, including government financial institutions, insurance companies, and asset managers. He is also the bank’s Financial Markets Strategist, focusing on fixed income and rates advisory for our high-net-worth individuals and institutional clients. He holds a Master’s in Business Administration from the University of Chicago Graduate School of Business. He is also an avid traveler and golfer.

DOWNLOAD

DOWNLOAD

By Ruben Zamora

By Ruben Zamora