Exploring Fixed Income Securities: Why Invest in Bonds?

Discover the reasons you should invest in bonds and how this fixed income security can add to your portfolio. Read more here.

Fixed Income securities are a common staple in portfolios as they provide investors with returns that are generally higher than traditional deposits. Bonds and bills are classified under fixed income securities.

Investors can buy bills at a discounted price and receive the whole amount upon maturity (typically a year after issuance or less) while bonds, which have a longer maturity give out interest payments at fixed intervals.

While stocks are more commonplace in the retail space given their potential for substantial returns, bonds offer a calmer alternative.

For people who are thinking of investing in bonds, here are some things that they may need to consider.

Newly issued bonds offer attractive interest payments. Attractive interest payments, or coupons, are one of the first things that may come to mind. These are fixed upon issuance and are usually close to the interest rate that the Bangko Sentral ng Pilipinas (BSP) maintains.

With the current high interest rate of the BSP, bonds issued today will usually have high coupon rates as well. This is because when central banks increase interest rates, newly issued bonds need higher coupon rates to remain attractive.

To further understand this relationship, recall that the BSP usually increases interest rates when inflation is also high. Inflation poses a threat to a bond’s value as it erodes the purchasing power of the future payments that investors will receive from the bonds. To counteract this, bond issuers need to increase coupon rates accordingly.

The likelihood of bond prices increasing is there. Apart from this, the price of the bonds can also increase or decrease based on the economic environment and the demand-supply situation of available bonds for purchase.

Bond prices increase when interest rates go down and vice versa. Currently, markets are holding on to the view that sooner or later, the BSP will start pushing rates lower, leading to higher bond prices – a scenario most bond holders are avidly waiting for.

As such, since many investors want bonds, their prices also rise. These investors may develop this appetite for bonds due to factors such as high coupon rates, high probability of prices increasing, or as a safe haven investment in challenging times.

Bonds can be used to diversify risk. Price and return consideration are not the only thing a bond is good for. Investors who are currently holding on to just stocks may look to bonds as a way to diversify their risks and make their overall investment portfolio less aggressive.

This goes back again to the fact that certain bonds are issued by the government and that the fixed coupon payments may offset potential drops in price.

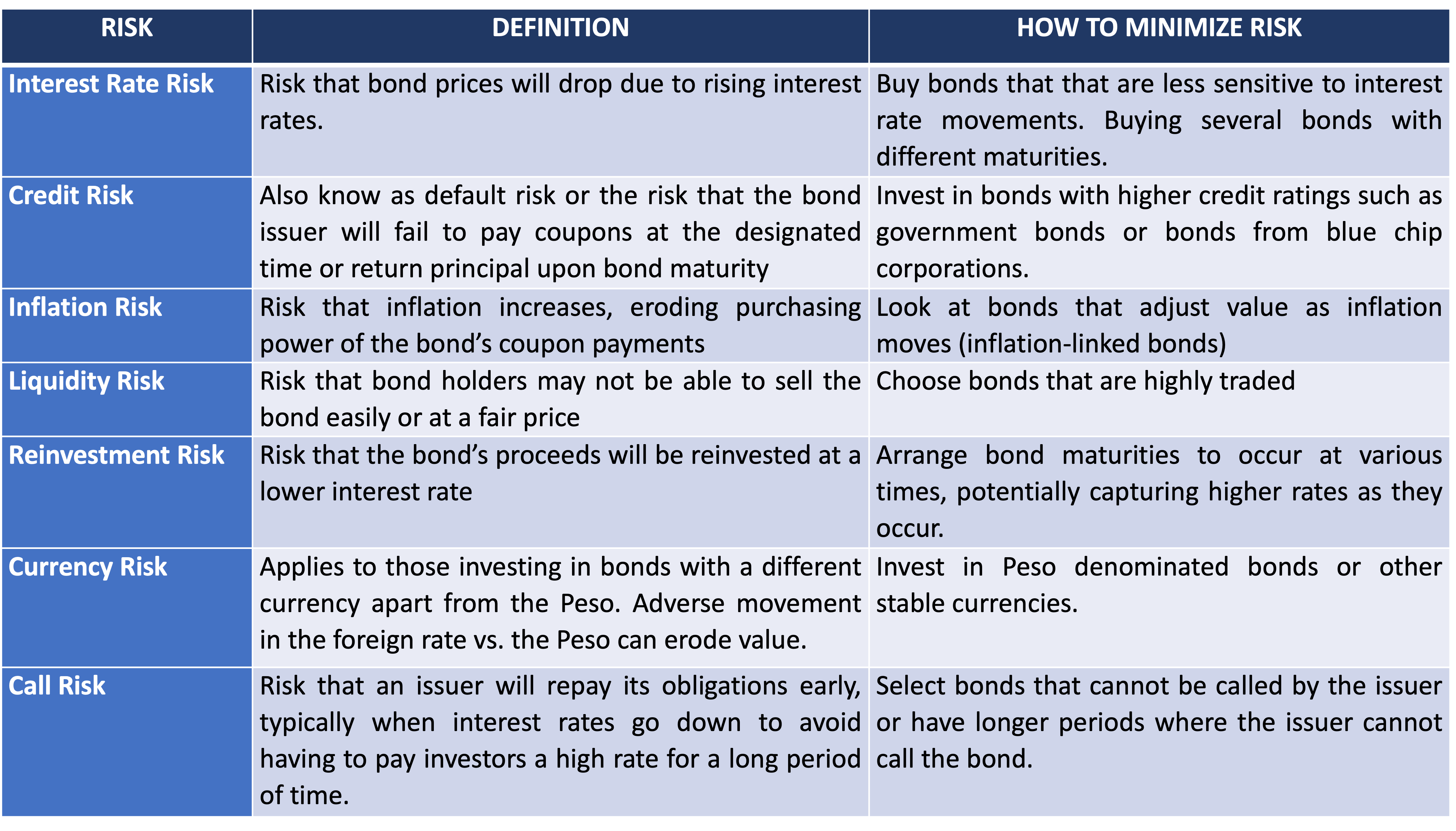

As with any investment, bonds also come with their own risks. An investment is still an investment and all investments come with potential returns and also potential risks. Some of these risks include:

Remember, understanding these risks is important for investors to craft strategies to minimize them.

How can I invest in bonds? Interested investors have several options on how to gain access to bonds. Investors can opt to go the traditional way of buying bonds individually. This will usually entail a larger sum compared to other factors.

A cost-efficient way is to purchase a Unit Investment Trust Fund (UITF) that pools together investor capital to purchase a basket of bonds with the help of a professional fund manager. Apart from diversification, these professional fund managers employ the above listed strategies to both enhance potential returns and minimize risks.

For example, Metrobank offers a host of UITF solutions that suit the goals and risk profiles of different clients.

You may find more information here:

Peso Max 3: https://www.metrobank.com.ph/articles/metro-max-3-bond-fund

Peso Max 5: https://www.metrobank.com.ph/articles/metro-max-5-bond-fund

Corporate Bond Fund: https://www.metrobank.com.ph/articles/metro-corporate-bond-fund

Metro Unit Paying Fund: https://www.metrobank.com.ph/articles/metro-unit-paying-fund

Dollar Metro Max 5: https://www.metrobank.com.ph/articles/metro-dollar-max-5-bond-fund

Asian IG: https://www.metrobank.com.ph/articles/metro-dollar-asian-investment-trade-bond-fund

We advise seeking assistance from your investment counselor before you invest to best match your investment needs with the right investment.

(Bookmark and visit Metrobank Wealth Insights at www.wealthinsights.ph daily for investment insights and ideas. If you are a Metrobank client, please get in touch with your relationship manager or investment specialist for assistance in accessing exclusive content. Not a client yet? Please sign up here so you can begin your wealth journey with us.)

JON EDISON MUNSAYAC leads the Product Management Department of Metrobank’s Trust Banking Group where he oversees the Bank’s UITF product suite. He has a little over 11 years’ worth of experience in trust banking, primarily in markets research, strategy, investment solutions, and product management. He is a storyteller at heart and an avid believer in keeping things simple when possible.

DOWNLOAD

DOWNLOAD

By Elaine Paiso and Jon Munsayac

By Elaine Paiso and Jon Munsayac