Inflation Update: Green light for easing

DOWNLOAD

DOWNLOAD

December Economic Update: One for them, one for us

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Trade trajectories trend along

DOWNLOAD

DOWNLOAD

Debt yields up on Fed minutes

Yields on government securities (GS) ended mostly higher last week as investors remained defensive following the result of the 20-year bond auction and the release of minutes of the US Federal Reserve‘s policy meeting this month.

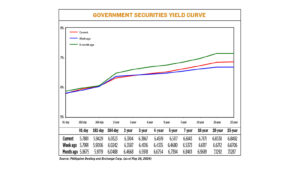

GS yields, which move opposite to prices, went up by an average of 5.11 basis points (bp) week on week at the secondary market, according to the PHP Bloomberg Valuation Service Reference Rates as of May 24 published on the Philippine Dealing System’s website.

Rates at the short end of the curve increased, with the 182- and 364-day Treasury bills (T-bill) rising by 4.23 bps and 0.81 bp to fetch 5.9429% and 6.0323%, respectively. Meanwhile, the yield on the 91-day T-bill dropped by 1.1 bps to 5.7881%.

At the belly, the four-, five-, and seven-year T-bonds saw their yields climb by 1.84 bps (to 6.4519%), 4.37 bps (6.5117%) and 7.7 bps (6.6143%), respectively, while the rates of the two- and three-year papers declined by 4.83 bps (to 6.3104%), and 1.49 bps (6.3867%).

The long end saw bigger yields movements as the 10-, 20-, and 25-year debt jumped by 10.54 bps, 16.26 bps and 17.86 bps to fetch 6.7171%, 6.8338%, and 6.8492%, respectively.

Total GS volume reached PHP 9.62 billion on Friday, lower than the PHP 14.23 billion recorded as of May 17.

“Trading last week began on a quiet note as investors opted to remain defensive following the rise in US yields and the slated new 20-year bond issuance on Tuesday. Most players opted to de-load some of their holdings in the belly and long-ends in anticipation of the new long-end issuance,” Alessandra P. Araullo, chief investment officer at ATRAM Trust Corp., said in a Viber message.

Ms. Araullo added that the weak reception for the new 20-year T-bonds auctioned off last week fueled defensiveness, causing further selling pressure especially in the five-year and 10-year tenors, and also caused market players to look at overseas developments amid a lack of catalysts.

“The release of the US Fed minutes has shown that some Fed officials are willing to hike rates if inflation doesn’t keep moving lower toward the US Fed’s 2% goal. This further caused concern among local market participants as this solidified their stance to remain defensive for the week,” she added.

The minutes of the Fed’s April 30-May 1 policy meeting affected local yield movements, Jonathan L. Ravelas, senior adviser at Reyes Tacandong & Co., likewise said in a Viber message.

“Market players will remain cautious after the Fed minutes still signalled higher rates for longer. We expect sideways to up movements in rates,” Mr. Ravelas added.

The Bureau of the Treasury (BTr) last week raised just PHP 22.717 billion via the fresh 20-year bonds it auctioned off, lower than the PHP 30-billion program, despite total bids reaching PHP 37.919 billion.

The bonds were awarded at a coupon rate of 6.875%, while accepted yields ranged from 6.6% to 6.95% for an average rate of 6.797%.

Meanwhile, Federal Reserve officials at their last policy meeting said they still had faith that price pressures would ease at least slowly in coming months, but doubts emerged about whether the current level of interest rates was high enough to guarantee that outcome and “various” officials said they’d be willing to hike borrowing costs again if inflation surged, Reuters reported.

That meeting was held before data showed the pace of consumer price increases beginning to cool again in April, yet reflected what US central bank officials since then have said is increased uncertainty about the path of inflation and monetary policy.

“Participants… noted that they continued to expect that inflation would return to 2% over the medium term,” according to the minutes of the April 30-May 1 meeting, but “the disinflation would likely take longer than previously thought.”

While the policy response for now would “involve maintaining” the Fed’s benchmark policy rate in the current 5.25%-5.5% range, “various participants mentioned a willingness to tighten policy further should risks to inflation materialize in a way that such an action became appropriate,” the minutes said, employing a modifier not included in the usual set of — like some, many, and most — used in the minutes to give a sense of how many officials voiced a particular opinion.

Fed Chair Jerome H. Powell and other policy makers have since said they feel further rate hikes are unlikely.

But the minutes released on Wednesday excluded specific reference to that notion and to the likelihood of rate cuts this year.

In place of that broad judgment, the latest minutes showed an emerging debate about just how tight monetary policy is, an important consideration that could bear on how fast inflation returns to the central bank’s 2% target — or whether it gets there at all.

For this week, Ms. Araullo said the BTr’s three-year bond auction on Tuesday will be the leading catalyst for market activity, along with data releases in the US, especially first-quarter gross domestic product data and the April personal consumption expenditure report.

“Investors will keep a close eye on where the BTr will award to get a sense if market defensiveness will continue in the short-term. This may give investors a clearer view on where they think monetary policy decisions will be headed so that they can position themselves accordingly,” she said.

Mr. Ravelas added that market will likely look ahead to the release of May Philippine inflation data on June 5. — Lourdes O. Pilar with Reuters

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld