Inflation Update: Green light for easing

DOWNLOAD

DOWNLOAD

December Economic Update: One for them, one for us

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Trade trajectories trend along

DOWNLOAD

DOWNLOAD

Government debt yields go down on profit taking

Yields on government securities (GS) mostly fell last week on profit taking amid weaker-than-expected Philippine economic growth in the first quarter.

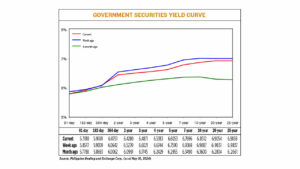

GS yields, which move opposite to prices at the secondary market, dropped by an average of 9.56 basis points (bps) week on week, based on the PHP Bloomberg Valuation Service Reference Rates as of May 10 published on the Philippine Dealing System’s website.

The short end of the curve was mixed as the 91- and 182-day Treasury bills (T-bills) fell by 7.59 bps to yield 5.7818% and by 2.28 bps (5.9081%), respectively. Meanwhile, the 364-day T-bill rose by 1.09 bps to fetch 6.0751%.

Meanwhile, yields at the belly of the curve declined across the board, with the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) dropping by 9.9 bps (to 6.428%), 11.5 bps (6.4871%), 13.61 bps (6.5383%), 15.37 bps (6.6053%), and 16.73 bps (6.7696%), respectively.

At the long end, the 10-, 20-, and 25-year papers likewise went down by 13.75 bps (to 6.8512%), 7.77 bps (6.9054%), and 7.78 bps (6.9059%), respectively.

Total GS volume traded reached PHP 8 billion on Friday, lower compared to the PHP 17.38 billion recorded on May 3.

“Profit taking, along with defensiveness towards the end of the week, capped the rally for local bonds, despite the slower-than-expected Philippine GDP (gross domestic product) growth for the first quarter,” a bond trader said in a Viber message.

The Philippine economy expanded by 5.7% in the first quarter, the local statistics agency reported on Thursday.

GDP growth in the period was faster than the 5.5% expansion logged in the fourth quarter of 2023.

However, this was slower than the 6.4% GDP growth seen in the first quarter of 2023 and was below the 5.9% median forecast of 20 economists in a BusinessWorld poll.

This also fell short of the government’s 6-7% full-year GDP growth target.

Meanwhile, Security Bank Corp. Chief Investment Officer for Trust and Asset Management Group Noel S. Reyes attributed the decline in GS yields to lower US rates and April Philippine inflation data.

“Some profit taking by the end of the week tempered the gains, but overall, the buying sentiment held even after GDP numbers came out softer at 5.7% that will ensure rates to be made steady by the BSP (Bangko Sentral ng Pilipinas) within the few months to come,” Mr. Reyes said in a Viber message.

Headline inflation picked up for a third straight month in April amid higher food and transport costs, the Philippine Statistics Authority reported on Tuesday.

The consumer price index (CPI) quickened to 3.8% year on year in April from 3.7% in March, preliminary data showed. Still, this was slower than the 6.6% print in the same month a year ago.

This was within the BSP’s 3.5-4.3% forecast for April CPI and marked the fifth straight month that inflation settled within the central bank’s 2-4% annual target range.

For the first four months, headline inflation averaged 3.4%, still below the BSP’s 3.8% full-year forecast.

The Monetary Board has kept its policy rate at a near 17-year high of 6.5% following cumulative hikes worth 450 bps from May 2022 to October 2023 to help bring down inflation.

The BSP will meet on May 16, Thursday to review its policy settings. Analysts expect the Monetary Board to hold benchmark rates steady for a fifth straight meeting as inflation remains elevated.

Meanwhile, the yield on the US 10-year note was at 4.46% on Thursday, down from 4.7% two weeks prior, Reuters reported.

“Bond bulls made a comeback, especially in the earlier part of the week, tracking the decline in US Treasury yields brought about by the weaker-than-expected non-farm payrolls report and an unexpected uptick in its unemployment rate for the month of April, adding to signs of possible cracks in the job market and indicating that the current tight monetary policy is taking effect,” the trader added.

For this week, GS yield movements will be driven by the release of US April producer and consumer inflation data and the BSP’s policy review, the analysts said.

“For the week ahead, expect choppy price action to prevail due to strong two-way interest from investors, with focus now on the 15-year auction on Tuesday, US CPI (consumer price index) on Wednesday, and leading up to the Monetary Board meeting on Thursday. These events should catalyze further movements in global and local bond yields for the week ahead,” the bond trader said. — M.I.U. Catilogo with Reuters

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld