Quarterly Economic Growth Release: More BSP cuts to come

DOWNLOAD

DOWNLOAD

Monthly Economic Update: Fed catches up

DOWNLOAD

DOWNLOAD

Inflation Update: Steady and mellow

DOWNLOAD

DOWNLOAD

Yields up as CPI tempers Fed cut bets

Yields on government securities (GS) climbed across all tenors last week following faster US consumer inflation that caused markets to scale back their expectations for Federal Reserve rate cuts.

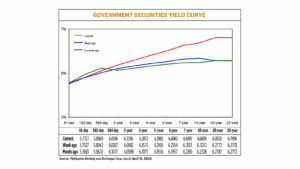

GS yields, which move opposite to prices, went up by an average of 21.94 basis points (bps) at the secondary market week on week, according to the PHP Bloomberg Valuation Service Reference Rates as of April 12 published on the Philippine Dealing System’s website.

At the short end of the curve, yields on the 91-, 182-, and 364-day Treasury bills (T-bills) went up by 2 bps (to 5.7727%), 0.27 bp (5.8969%), and 4.57 bps (6.0514%), respectively.

At the belly, the rates of the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) increased by 8.04 bps (6.1786%), 12.99 bps (6.2872%), 18.77 bps (6.3982%), 24.06 bps (6.4960%), and 30.62 bps (6.6195%), respectively.

At the long end, the 10-, 20-, and 25-year papers climbed by 34.87 bps, 52.49 bps, and 52.65 bps to yield 6.68%, 6.8021%, and 6.7996%, respectively.

Total GS volume reached PHP 14.23 billion on Friday, higher than the PHP 11.32 billion recorded as of Apr. 5.

“Yields are sharply higher because of hotter US consumer price index (CPI) data, which led to higher US Treasury yields. Traders are now forecasting less rate cuts this year,” the bond trader said in a Viber message.

US consumer prices increased more than expected in March as Americans continued to pay more for gasoline and rental housing, leading financial markets to anticipate that the Federal Reserve would delay cutting interest rates until September, Reuters reported.

The consumer price index rose 0.4% last month after advancing by the same margin in February, the Labor department’s Bureau of Labor Statistics said.

In the 12 months through March, the CPI increased 3.5%, the most since September. The CPI was also boosted by last year’s low reading dropping out of the calculation. It rose 3.2% in February. Economists polled by Reuters had forecast the CPI gaining 0.3% on the month and advancing 3.4% year on year.

The Fed last month kept its target rate at the 5.25%-5.5% range for a fifth straight meeting.

“Higher March inflation and upside risks to inflation such as El Niño, disruptions due to geopolitical factors, will tend to keep prices elevated moving forward… The Bangko Sentral ng Pilipinas (BSP) hints cuts could be pushed further in the year or in 2025,” said Jonathan L. Ravelas, senior adviser at professional service firm Reyes Tacandong & Co., added in a Viber message.

“Even in the US, with a faster than expected inflation is pushing rate cuts towards later in the year,” he added.

BSP Governor Eli M. Remolona, Jr. last week said the central bank is leaning towards being “somewhat more hawkish” as upside risks to inflation have worsened due to high food and transport prices.

The Monetary Board kept the target reverse repurchase rate steady at a near 17-year high of 6.5% at its meeting on Monday.

This is the fourth straight meeting that the BSP has kept borrowing costs unchanged since a 25-bp off-cycle rate hike in October that brought cumulative increases since May 2022 to 450 bps.

The BSP raised its baseline and risk-adjusted inflation forecasts to 3.8% and 4%, respectively, from 3.6% and 3.9% previously.

Inflation quickened for a second straight month to 3.7% in March from 3.4% in February.

For this week, the bond trader said GS yields could rise to track US Treasuries. — Lourdes O. Pilar with Reuters

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld