Inflation Update: Green light for easing

DOWNLOAD

DOWNLOAD

December Economic Update: One for them, one for us

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Trade trajectories trend along

DOWNLOAD

DOWNLOAD

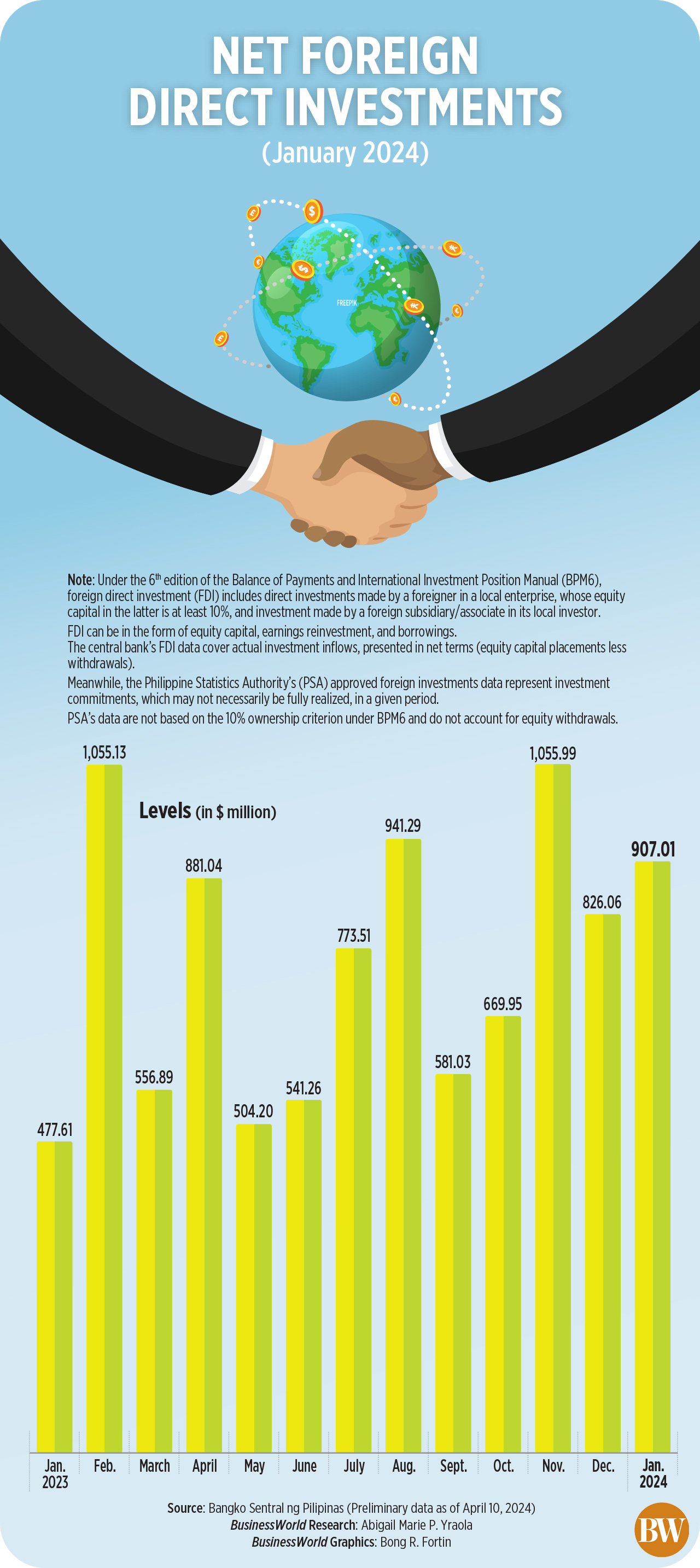

FDI net inflows surge in January

Net inflows of foreign direct investments (FDIs) into the Philippines nearly doubled in January, amid strong demand for local debt instruments, the Bangko Sentral ng Pilipinas (BSP) reported on Wednesday.

Preliminary BSP data showed that FDI net inflows surged by 89.9% to USD 907 million in January from USD 478 million in the same month in 2023.

Month on month, net inflows rose by 9.8% from USD 826 million recorded in December.

Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, Inc., said that the growth in FDI inflows in January was largely driven by the increase in net investments in debt instruments.

Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, Inc., said that the growth in FDI inflows in January was largely driven by the increase in net investments in debt instruments.

BSP data showed nonresidents’ net investments in debt instruments nearly tripled (173.2%) to USD 820 million in January from USD 300 million in the same month in 2023.

“The triple-digit growth may have come from strong demand for local debt instruments as foreign investors’ appetite grew from earlier-than-expected interest rate cuts by the US Fed and market optimism from the potential monetary policy settings pivot,” he said in a Viber message.

Back in January, markets were still expecting the US Federal Reserve to cut rates as early as March.

Now, markets are cutting their bets on future Fed rate cuts, with some now expecting easing to start in July instead of June. The Federal Open Market Committee kept its fed funds rate unchanged at the 5.25-5.5% range at its March meeting. It raised rates by a total of 525 bps from March 2022 to July 2023.

BSP data also showed net investments in equity capital other than reinvestment of earnings posted net outflows of USD 11 million, a reversal of the USD 93-million inflows a year ago.

Broken down, equity capital placements declined by 33.5% to USD 99 million from $149 million, while withdrawals jumped by 97.2% to USD 110 million from $56 million.

Reinvestment of earnings rose by 16.4% to USD 99 million from USD 85 million in January 2023.

Investments in equity and investment fund shares fell by 50.8% to USD 87 million in January from USD 178 million a year ago.

Investments in equity capital placements were mainly from Japan (69%) and the United States (19%). These were invested mostly in the manufacturing, real estate, construction and wholesale and retail trade industries.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said that the higher FDI net inflows in January could be partly attributed to improved economic and financial markets performance.

He cited the easing headline inflation trend seen in January that lifted hopes for policy rate cuts later this year.

Inflation decelerated to a three-year low of 2.8% in January, its slowest since the 2.3% print in October 2020. It was also within the central bank’s 2-4% target.

“Increased FDIs could have also partly been brought about by some realized investment commitments made for more than a year already during the various foreign trips of the administration,” Mr. Ricafort added.

For the coming months, he said that FDIs could pick up further if rate cuts materialize in the latter half of the year.

BSP Governor Eli M. Remolona, Jr. said that if inflation continues to ease and economic growth turns out weaker than expected, the Monetary Board could cut rates as early as the third quarter.

The BSP expects to record FDI net inflows of USD 9 billion at end-2024. — By Luisa Maria Jacinta C. Jocson, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld