Why unit-paying UITFs should be part of your portfolio

What is a unit-paying fund and what makes it different from a traditional UITF? Learn about them here so you can make the most of this investment vehicle.

You may already know what Unit Investment Trust Funds (UITFs) are. But there’s a type of UITF that has some special features that may be perfect for you.

Let me introduce you to the unit-paying UITF.

What is a unit-paying Unit Investment Trust Fund?

A traditional UITF is an investment vehicle that pools funds from various investors and managed by professional fund managers. The funds are invested in various financial instruments such as equities, bonds, money market securities, bills offered by the Bangko Sentral ng Pilipinas, or even exchange traded funds, or ETFs.

If there are coupons or dividends, they are reinvested back into the fund with the purpose of either beating or tracking a benchmark. Cash only leaves the fund when clients redeem units.

Unit-paying UITFs, however, prioritize maximizing payouts over immediate capital appreciation while trying to increase the UITF price over the long-term. Cash leaves the fund not only when clients redeem units, but also whenever there are payouts.

Because payouts are more or less regular, you get a regular income stream.

When are unit-paying UITFs ideal for me?

Unit-paying UITFs are ideal for clients who want to receive regular income payments and still have the opportunity to get exposure to capital appreciation. That’s when the unit price of the funds increases in value.

What happens to a UITF’s price when it gives out payouts?

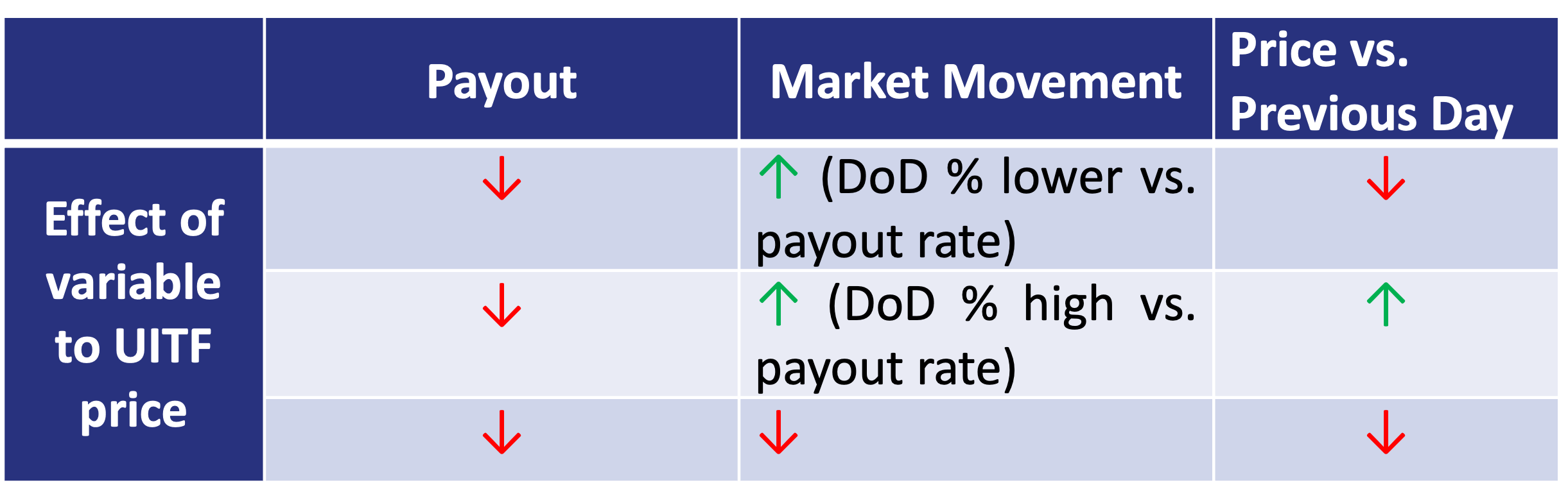

Payouts have a negative impact on UITF price simply because they represent cash going out of the fund. This, however, can be offset or amplified by market movements for that day.

Should I be concerned that UITF prices go lower when a payout happens?

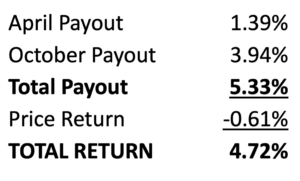

No. With all things constant, the drop in price is the result of cash being withdrawn from the UITF and distributed to eligible investors. To properly evaluate your return, it will be better to look at the total return or overall gain over a specific period, say, a year.

In the case of the Metro High Dividend Yield Unit Paying Fund for 2023, the total return is:

What are the key dates I need to take note of?

Yes, there are some important dates to remember: 1) ex-date, 2) calculation date, and 3) distribution date.

The ex-date, or ex-dividend date, refers to the time in which the investor has to be invested in the fund to qualify for the payout. The calculation date is when the amount of payout per unit is calculated. The distribution date is when the clients see the proceeds of the payout in their settlement. These dates usually occur a day after each other.

For example, the Metro High Dividend Yield Unit Paying Fund is scheduled for a payout this month. Following the calendar below, clients need to be subscribed on the ex-date to avail the next payout.

Does the amount of time invested in the unit-paying UITF affect the payout amount that I will receive?

No. What will matter will be the number of units that each investor has. The more units an investor has, the higher the amount they’ll see in their settlement account. The payout rate remains the same.

How do I invest in unit-paying UITFs?

It’s easy. You can reach out to any entity that offers UITFs, such as banks like Metrobank. There is usually a required minimum investment.

For example, for clients with a moderate risk profile, Metrobank offers the Metro Unit Paying Fund, while for clients with an aggressive risk profile, there is the Metro High Dividend Yield Unit Paying Fund. Each UITF requires a minimum initial investment of PHP 10,000 and PHP 1,000 per succeeding investment.

Should I invest now?

The wise thing to do is to seek assistance from your investment counselor or relationship manager. Ultimately, the goal is to best match your investment needs with the right investment.

(Bookmark and visit Metrobank Wealth Insights at www.wealthinsights.ph daily for investment insights and ideas. If you are a Metrobank client, please get in touch with your relationship manager or investment specialist for assistance in accessing exclusive content. Not a client yet? Please sign up here or go to any Metrobank branch so you can begin your wealth journey with us.)

JON EDISON MUNSAYAC leads the Product Management Department of Metrobank’s Trust Banking Group where he oversees the Bank’s UITF product suite. He has a little over 11 years’ worth of experience in trust banking, primarily in markets research, strategy, investment solutions, and product management. He is a storyteller at heart and an avid believer in keeping things simple when possible.

DOWNLOAD

DOWNLOAD

By Jon Edison Munsayac

By Jon Edison Munsayac