Make 2024 a year for real estate investing

Should you invest in real estate in 2024? Click here to read expert insights on why the property sector is starting to look up and what this means for investors.

We have explored before how to invest in real estate to grow your wealth. We also talked about the right time for investing in REITS or real estate investment trusts.

Is it finally the right time to give real estate another look? We believe so.

How is the property sector doing in 2024?

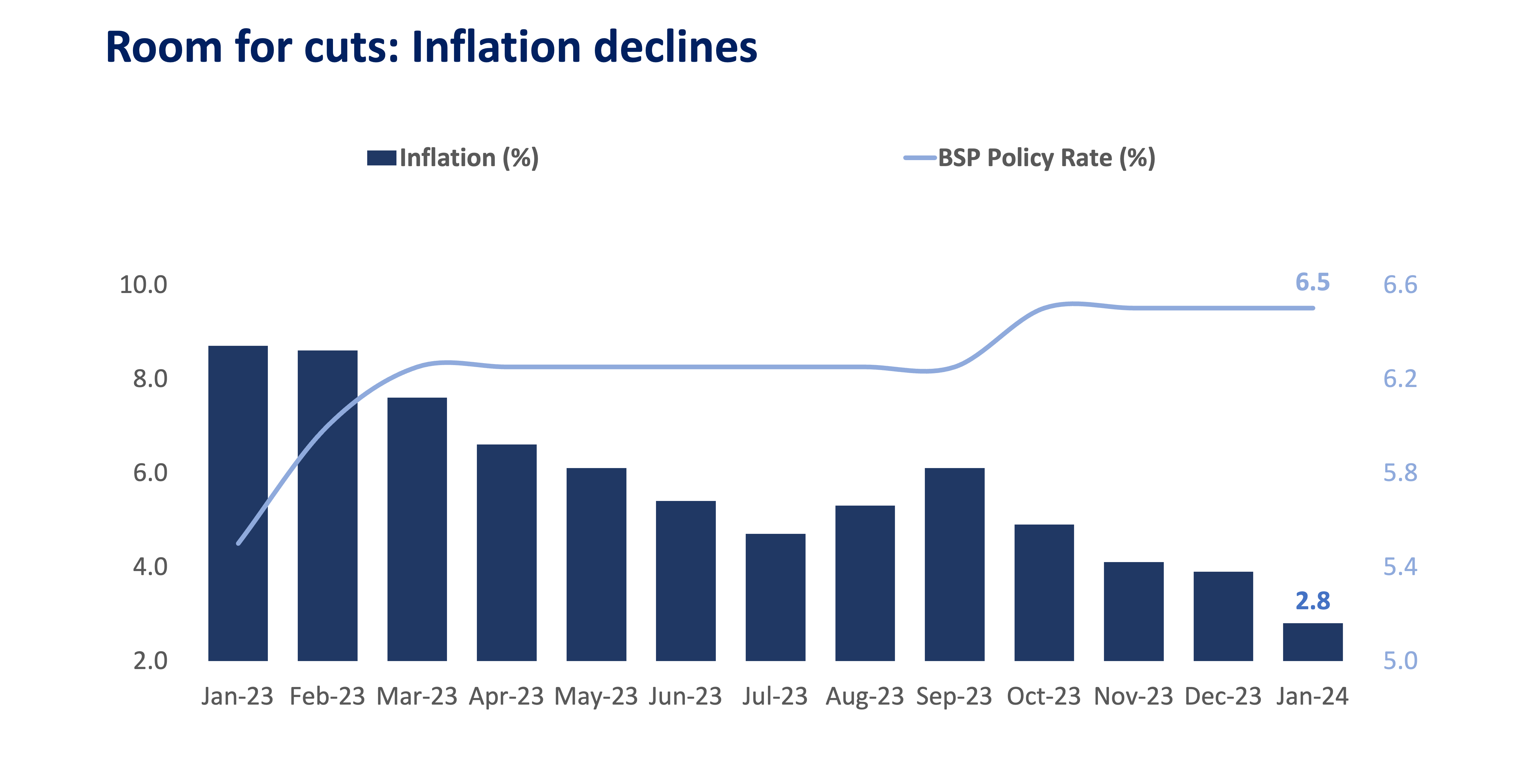

The property sector is expected to thrive this year, thanks to an improving economic backdrop, underscored by a steady drop in inflation and potential key policy rate cuts in the latter part of the year.

The residential segment is likely to see a resurgence in demand due to lower mortgage rates resulting from the anticipated rate cuts. Malls are expected to remain a strong performer due to increased discretionary spending as inflation becomes less concerning.

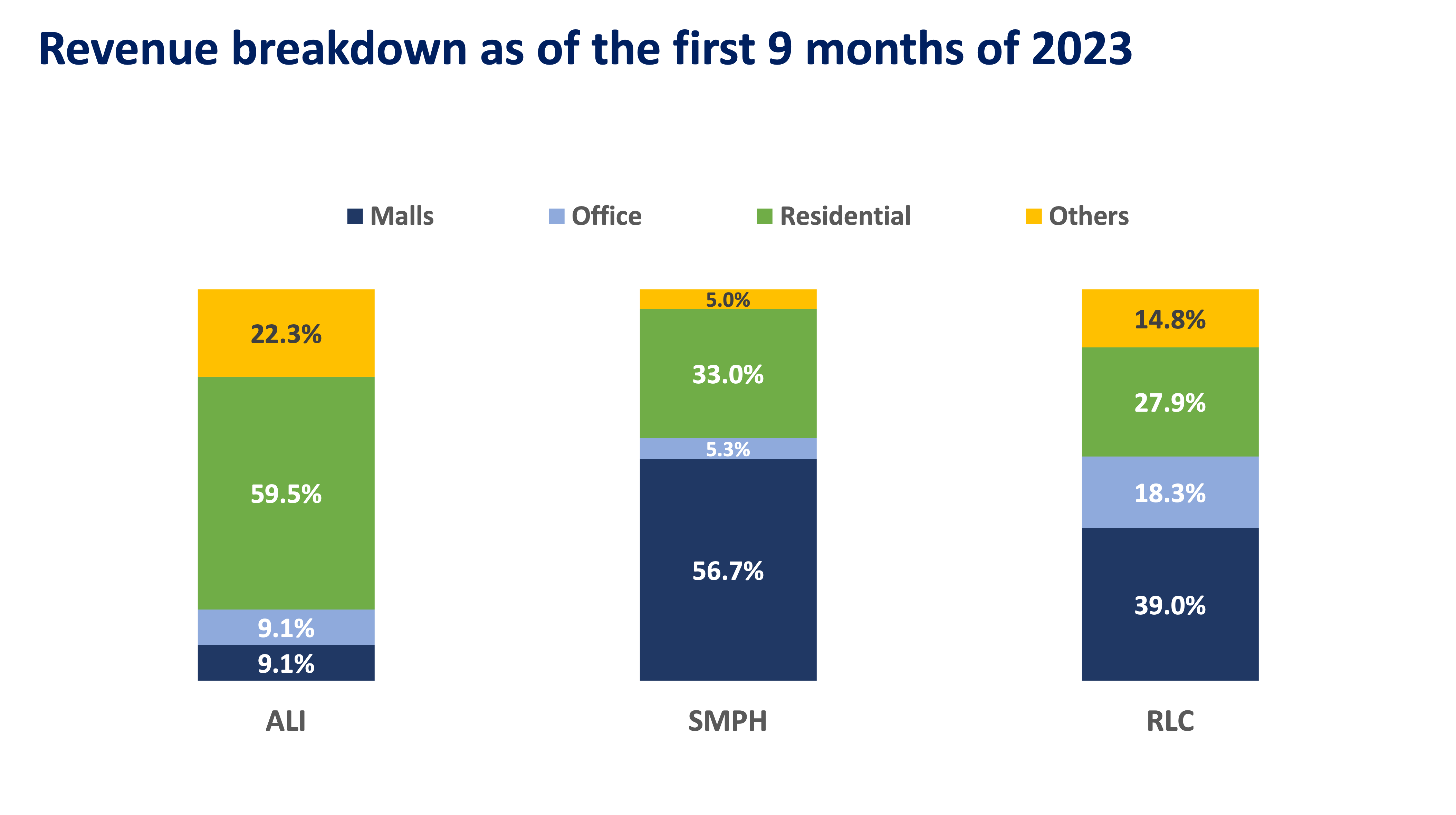

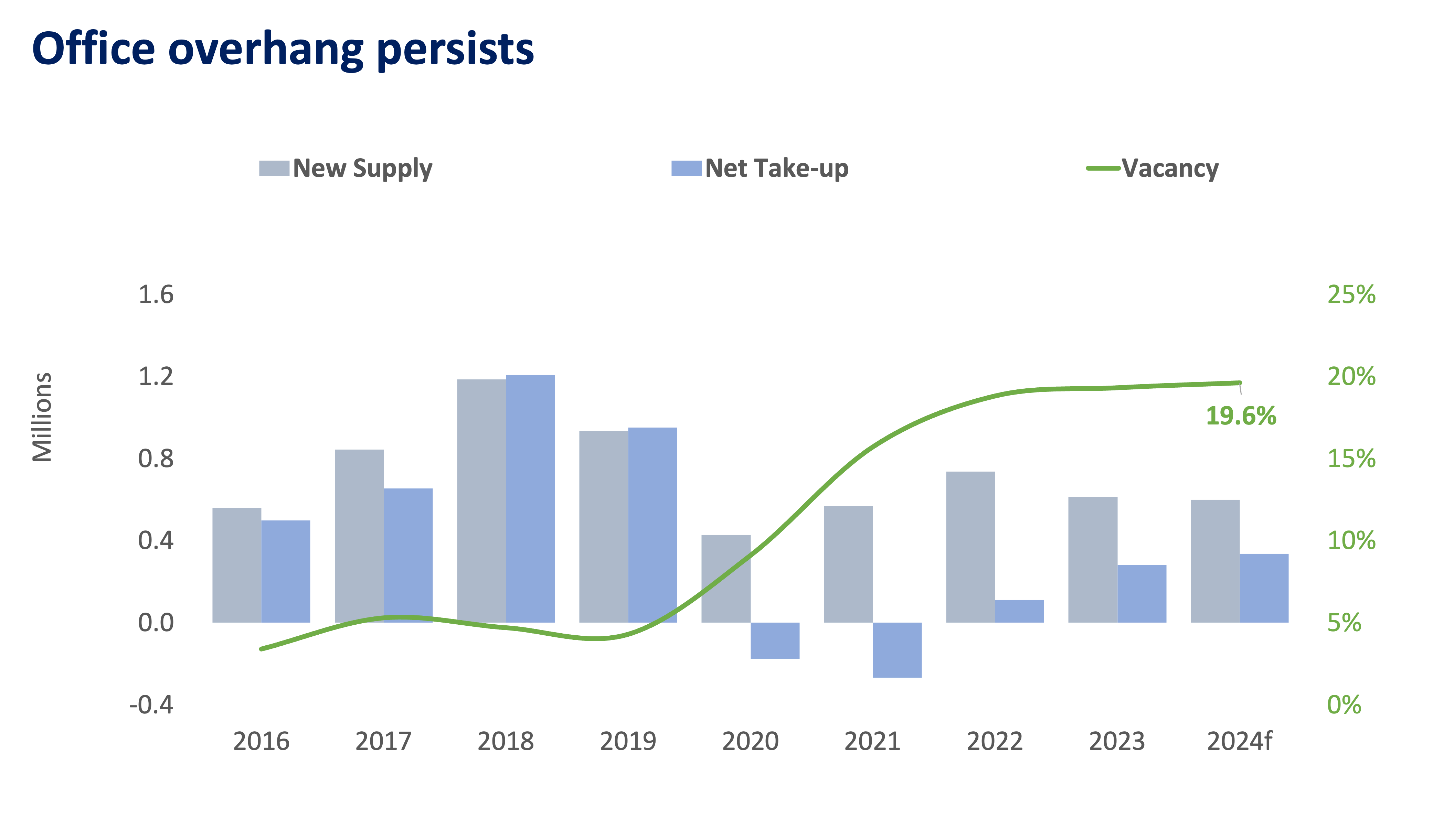

What may not do so well would be the office segment, especially those with exposure to POGOs. The overhang stemming from elevated office vacancy rates may linger due to structural shifts, such as the growing adoption of flexible work arrangements and incoming fresh supplies, which could keep rental rates subdued.

Source: Colliers Philippines

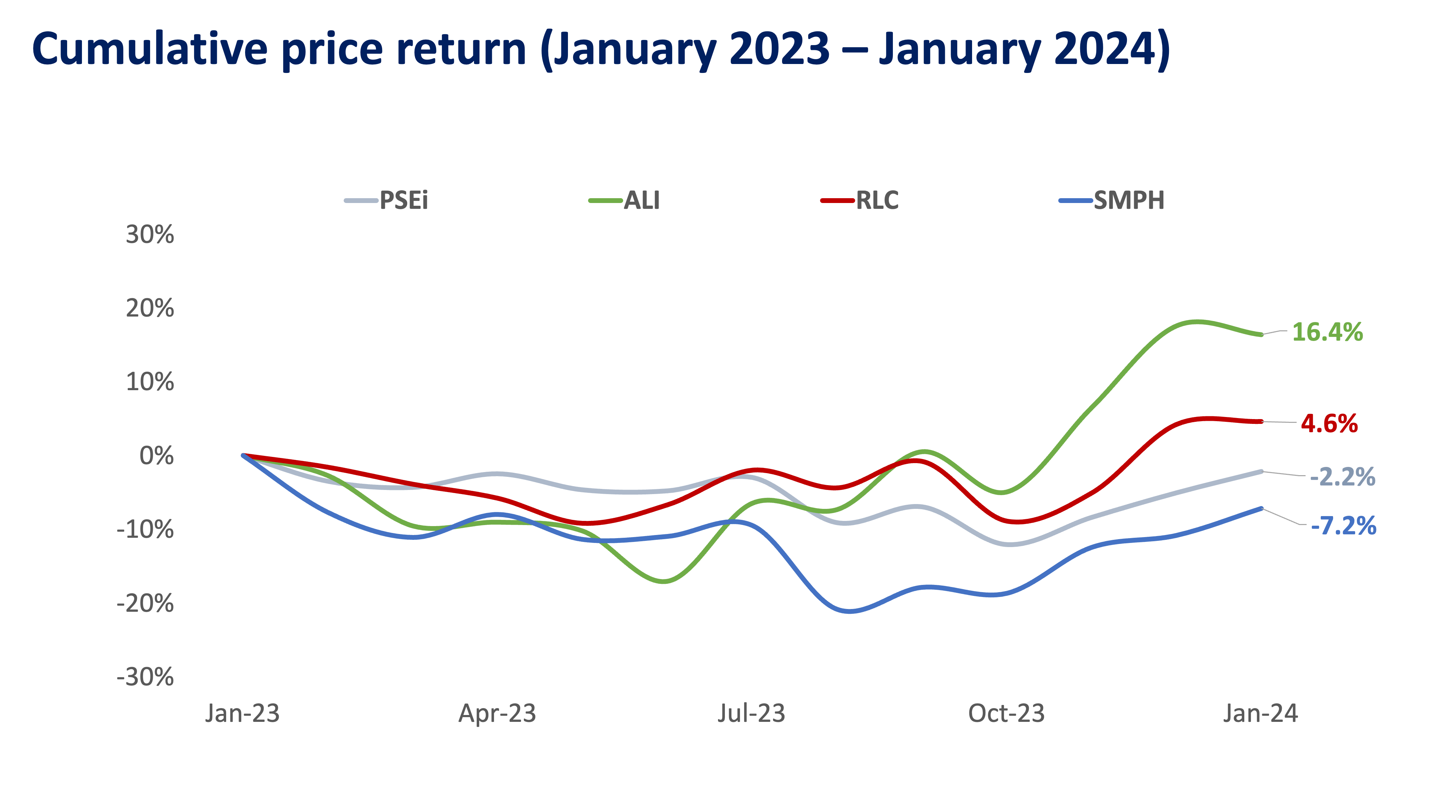

Nonetheless, negatives should have been priced in 2023, and an increasingly supportive macroeconomic landscape should prompt a reassessment.

What now for real estate investing in 2024?

Our recommendation: Accumulate shares in property names with notable revenue exposure from the residential segment. Look for those who demonstrate a track record of delivering in a timely and reasonable manner. Moreover, consider those who have successfully sustained growth and market share despite headwinds.

But there are several other options for investing in real estate in 2024 aside from direct involvement in property companies. You may invest in funds that are actively managed and positioned to benefit from the shift in overall trends such as the Metro Equities UITF of Metrobank, which is for investors with an aggressive risk profile.

If you wish to know more about considerations for real estate investing in the Philippines, it is best to consult your investment counselor.

(Bookmark and visit Metrobank Wealth Insights at www.wealthinsights.ph daily for investment insights and ideas. If you are a Metrobank client, please get in touch with your relationship manager or investment specialist for assistance in accessing exclusive content. Not a client yet? Please sign up here so you can begin your wealth journey with us.)

ARIZ MARCELINO is a Research Officer within the Equity Research Unit of Metrobank’s Trust Banking Group. His coverage includes select local large-cap index names and various sectors in the offshore space. Previously, he was with the Markets Research Department where he focused on macroeconomic research and sector analysis. Prior to joining the bank, he has held various research roles focusing on corporate strategy, competitor analysis, and evaluation of global equity fund of funds. He graduated from the New Era University, holding a degree in Banking and Finance, and has cleared the CFA Level 1. He is a certified UITF Sales Person (CUSP) and a Financial Modelling and Valuation Analyst (FMVA). Outside work, Ariz unwinds by watching popular sitcoms and anime series while sipping a cup of hot matcha latte.

ANNA DOMINIQUE CUDIA, MBA, CSS, is the Head of Markets Research at Metrobank’s Trust Banking Group, spearheading the generation and presentation of financial markets insights to internal and external clients. She used to be with Metrobank’s Investor Relations, where she brought in international awards and took part in various multi-billion peso and dollar capital raising activities. She has a Master of Business Administration (Finance) degree, with distinction, from the University of London, and a Bachelor of Science in Business Administration degree, cum laude, from the University of the Philippines. She also passed the CFA Level I exam and is a Licensed Fixed Income Market Salesman (FIMS), a Certified UITF Sales Person (CUSP) and a Certified Securities Specialist (CSS). She is a naturally curious person and likes to travel here and abroad.

CRISTINA GABALDON, or Gabs, is the Head of Investment Management Division of Metrobank Trust Banking Group. In her over 16 years of market experience, she has taken on roles such as Chief Investment Officer and head of equities in some of the country’s biggest banks and insurance companies before joining Metrobank. Gabs graduated from De La Salle University with a Bachelor’s degree in Accountancy and Economics. She is also a Certified Public Accountant (CPA) and a Chartered Financial Analyst (CFA). She previously served on the board of trustees of CFA Philippines and is currently on the board of trustees of the Fund Managers Association of the Philippines (FMAP) as president. She loves spending time with her husband and two kids. Gabs is also an avid painter and joins art exhibits from time to time.

DOWNLOAD

DOWNLOAD

By Ariz Marcelino, Anna Cudia, and Ma. Cristina Gabaldon

By Ariz Marcelino, Anna Cudia, and Ma. Cristina Gabaldon