January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

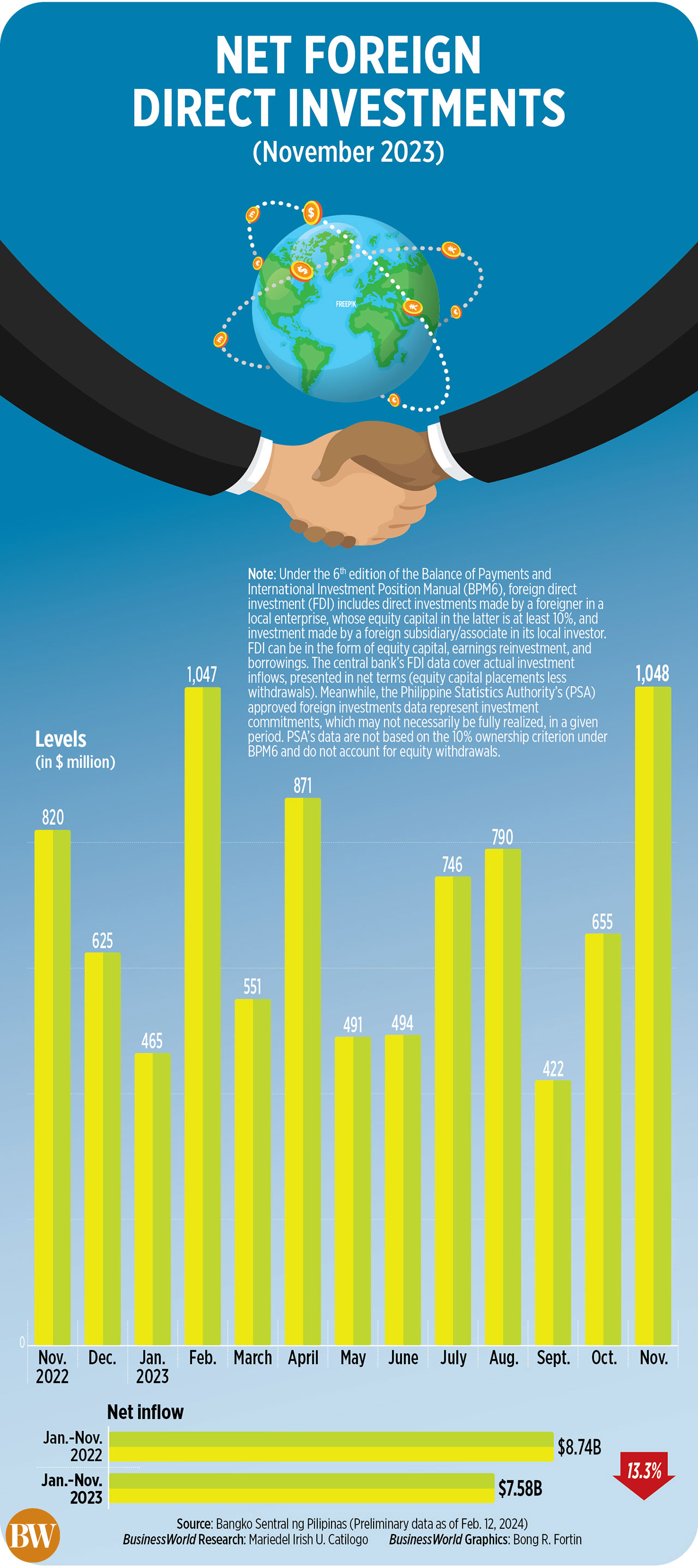

FDI net inflows rise to near 2-year high

Net inflows of foreign direct investments (FDIs) into the Philippines in November surged to its highest level in almost two years amid an improving economic outlook.

FDI net inflows rose by 27.8% year on year to USD 1.048 billion in November 2023 from USD 820 million in the same month in 2022, data released by the Bangko Sentral ng Pilipinas (BSP) on Monday showed.

This was the highest monthly FDI net inflow recorded since the USD 2.662 billion in December 2021.

Month on month, net inflows of FDIs, which are a key source of jobs and capital for the economy, surged by 60% from $655 million in October.

Month on month, net inflows of FDIs, which are a key source of jobs and capital for the economy, surged by 60% from $655 million in October.

The increase in FDI net inflows was mainly driven by the increase in investments of nonresidents in debt instruments, which offset the decline in investments in equity capital and reinvestment of earnings, the central bank said in a statement.

“FDI bounced back in November due to a pickup in net debt instruments. However, actual equity or fresh FDI slipped 39.8%,” ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said in an e-mail.

Nonresidents’ net investments in debt instruments of local affiliates grew by 57.8% to $897 million in November from USD 568 million in the same month in 2022.

Meanwhile, net investments in equity capital other than reinvestment of earnings fell by 52.5% to USD 85 million in November from USD 180 million in the same month a year prior. Broken down, equity capital placements declined by 41.3% to USD 115 million, while withdrawals climbed by 89.8% to USD 29 million.

Reinvestment of earnings likewise decreased by 8.1% to $66 million in November from USD 72 million a year prior.

Investments in equity and investment fund shares also went down by 39.8% year on year to USD 151 million in November from USD 251 million.

The equity placements were mainly from Japan and the United States. These were invested mostly in the manufacturing, real estate, and construction industries.

“Large investments in specific sectors or an overall improvement in the Philippine economic outlook (inflation control, growth projections) could have attracted investors,” Security Bank Corp. Chief Economist Robert Dan J. Roces said in a Viber message.

“Global factors, such as diversification away from volatile regions, might also have contributed,” he added.

Headline inflation cooled to a 20-month low of 4.1% in November from 4.9% in October and 8% a year ago, still above the BSP’s 2-4% target range. The consumer price index has since eased further, hitting 2.8% in January.

Meanwhile, the Philippine economy expanded by 5.6% in the fourth quarter of 2023, bringing full-year gross domestic product (GDP) growth to 5.6% last year.

The Philippines was one of the best-performing economies in Southeast Asia last year even as GDP growth fell short of the government’s 6-7% target.

SUBDUED FDI

For the first 11 months of 2023, FDI net inflows went down by 13.3% to USD 7.58 billion from USD 8.74 billion in the comparable year-ago period.

“Notwithstanding the country’s sustained economic growth, FDI remained subdued due to the lingering impact of high inflation and low growth prospects globally,” the central bank said.

BSP data showed foreign investments in debt instruments declined by 11.3% year on year to USD 5.47 billion in the January-to-November period.

Reinvestment of earnings went down by 6.5% to USD 1.01 billion in the 11 months through November 2023.

Investments in equity and investment fund shares also declined by 18.1% to USD 2.12 billion in the 11-month period.

Net foreign investments in equity capital reached USD 1.04 billion during the period, 26.4% lower than the previous year’s level. Equity capital placements decreased by 7.1% to USD 1.6 billion, while withdrawals more than doubled (118%) to USD 504 million.

Most of these placements were from Japan, the United States, Singapore, and Germany.

“Looking forward, predicting future FDI will be anchored on the actualized pledges, which now stands at 20%,” Mr. Roces said.

Around USD 14.2 billion in investments from the foreign trips of President Ferdinand R. Marcos, Jr. are now being “actualized,” the Department of Trade and Industry said over the weekend.

These investments involve 46 projects and are at about 20% of the total investment pledges of USD 72.2 billion across 148 projects.

“We could see continued high inflows if positive economic indicators and investor confidence persist,” Mr. Roces said. “As for 2024, the long-term outlook hinges on global economic stability, Philippine policy reforms, and specific investment deals.”

He added that the Philippines should maintain a stable and attractive investment environment this year to ensure sustained FDI growth.

“Hopefully, with the Philippines still posting growth, we could see FDI eventually reverse the slide in 2023,” Mr. Mapa said.

The BSP expects to record FDI net inflows of $8 billion at end-2023 and $10 billion at end-2024. – Keisha B. Ta-asan, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld