Inflation Update: Green light for easing

DOWNLOAD

DOWNLOAD

December Economic Update: One for them, one for us

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Trade trajectories trend along

DOWNLOAD

DOWNLOAD

Inflation sharply drops to 3-year low

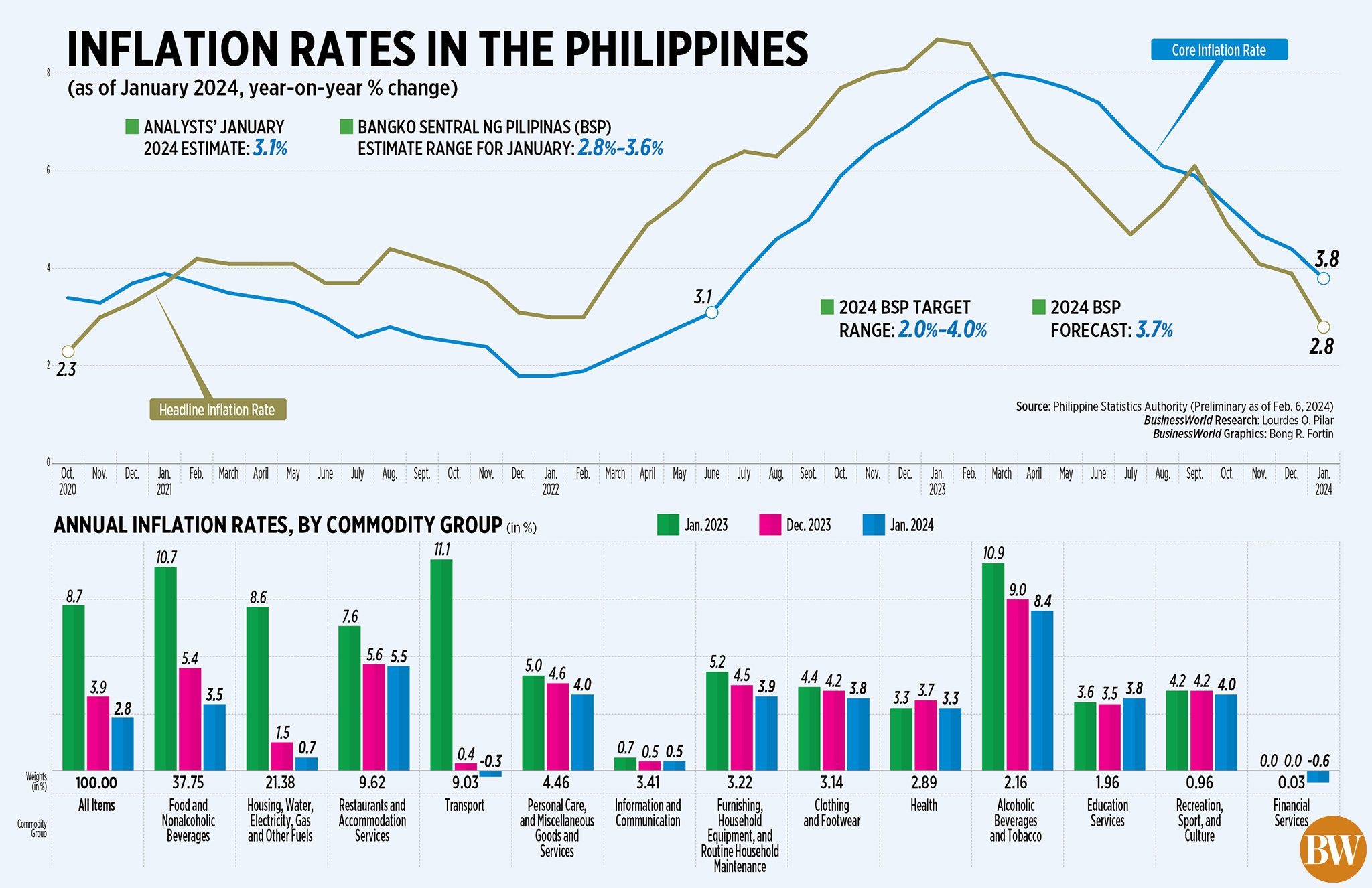

Headline inflation sharply decelerated to an over three-year low of 2.8% in January, marking the second straight month it fell within the Bangko Sentral ng Pilipinas’ (BSP) 2-4% target range.

Preliminary data from the Philippine Statistics Authority (PSA) showed the overall year-on-year increase in prices of widely used goods and services cooled to 2.8% in January from 3.9% in December and 8.7% in the same month in 2023.

This marked the slowest inflation print since the 2.3% seen in October 2020 amid the coronavirus pandemic.

The latest consumer price index (CPI) is below the 3.1% median estimate in a BusinessWorld poll last week and matched the low end of the BSP’s 2.8-3.6% forecast.

Month on month, inflation quickened by 0.6%. Stripping out seasonality factors, month-on-month inflation declined by 0.1% in January.

“This inflation outturn is consistent with the BSP expectations that inflation will likely moderate in the first quarter of 2024 due largely to negative base effects and some easing of supply constraints affecting key commodities,” the central bank said.

Core inflation, which excludes volatile prices of food and fuel, continued to ease to 3.8% in January from 4.4% in December. This is the first time that core inflation settled within the 2-4% target after 17 months and was the slowest print since 3.1% in June 2022.

At a press briefing, National Statistician Claire Dennis S. Mapa attributed the slowdown in January inflation to the 3.5% annual increase in food and nonalcoholic beverages, slower than 5.4% in December.

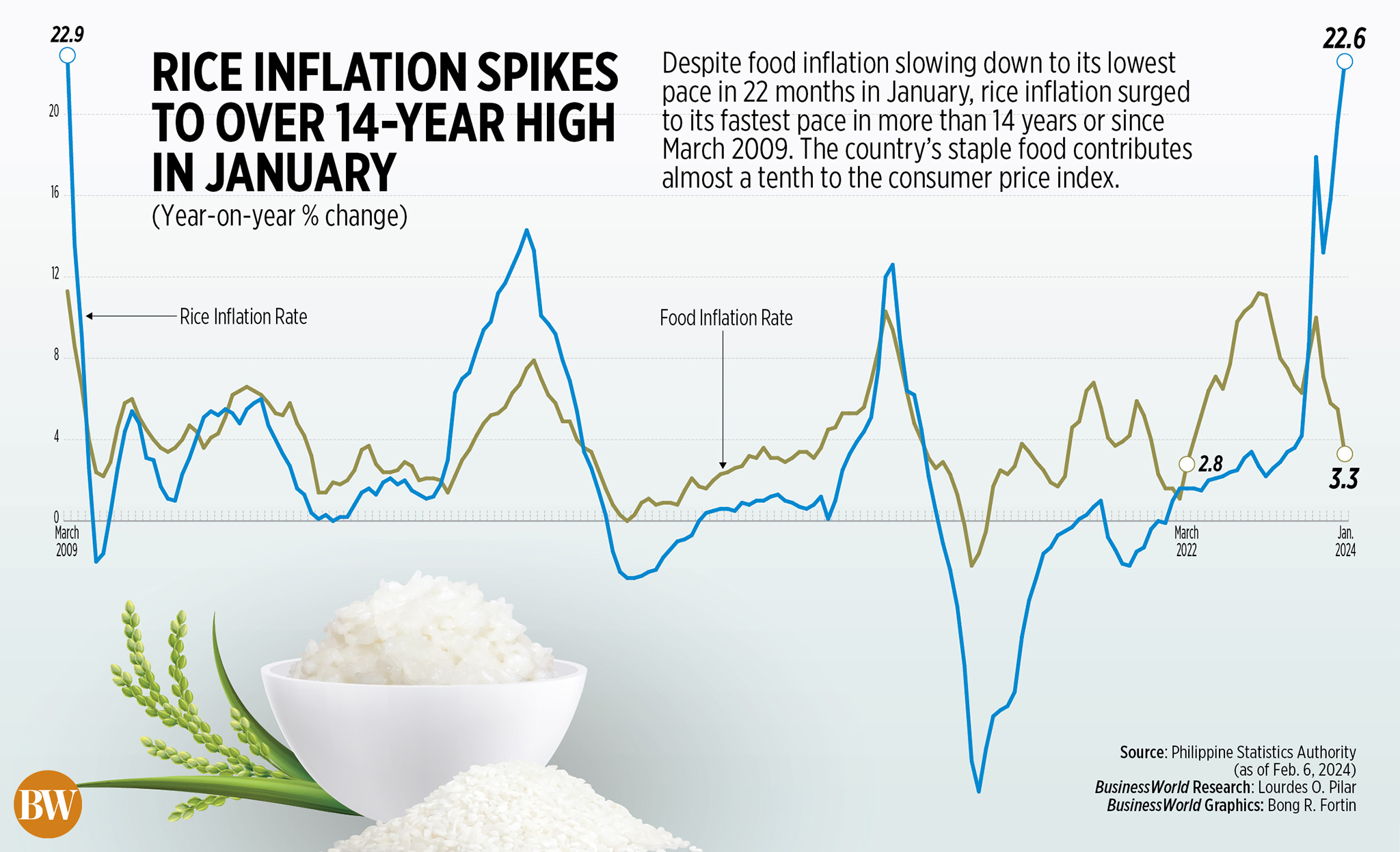

Food inflation alone eased to 3.3% in January from 5.5% in the previous month and 11.2% a year ago. It marked the slowest food inflation figure since the 2.8% in March 2022.

The deceleration of food inflation last month was due to the faster decline of vegetables, tubers, plantains, cooking bananas and pulses, which was at -20.8% from -9.2% in December.

Fish and other seafood also contributed to slower food inflation, as its inflation rate eased to 1.2% in January from 4.8% seen in December.

Inflation for meat and others dropped to -0.7% from 0.2% in December.

RICE PRICES GO UP

However, rice inflation continued to accelerate. In January, rice inflation quickened to 22.6% in January from 19.6% in December. This is the highest rice inflation in nearly 15 years or since 22.9% in March 2009.

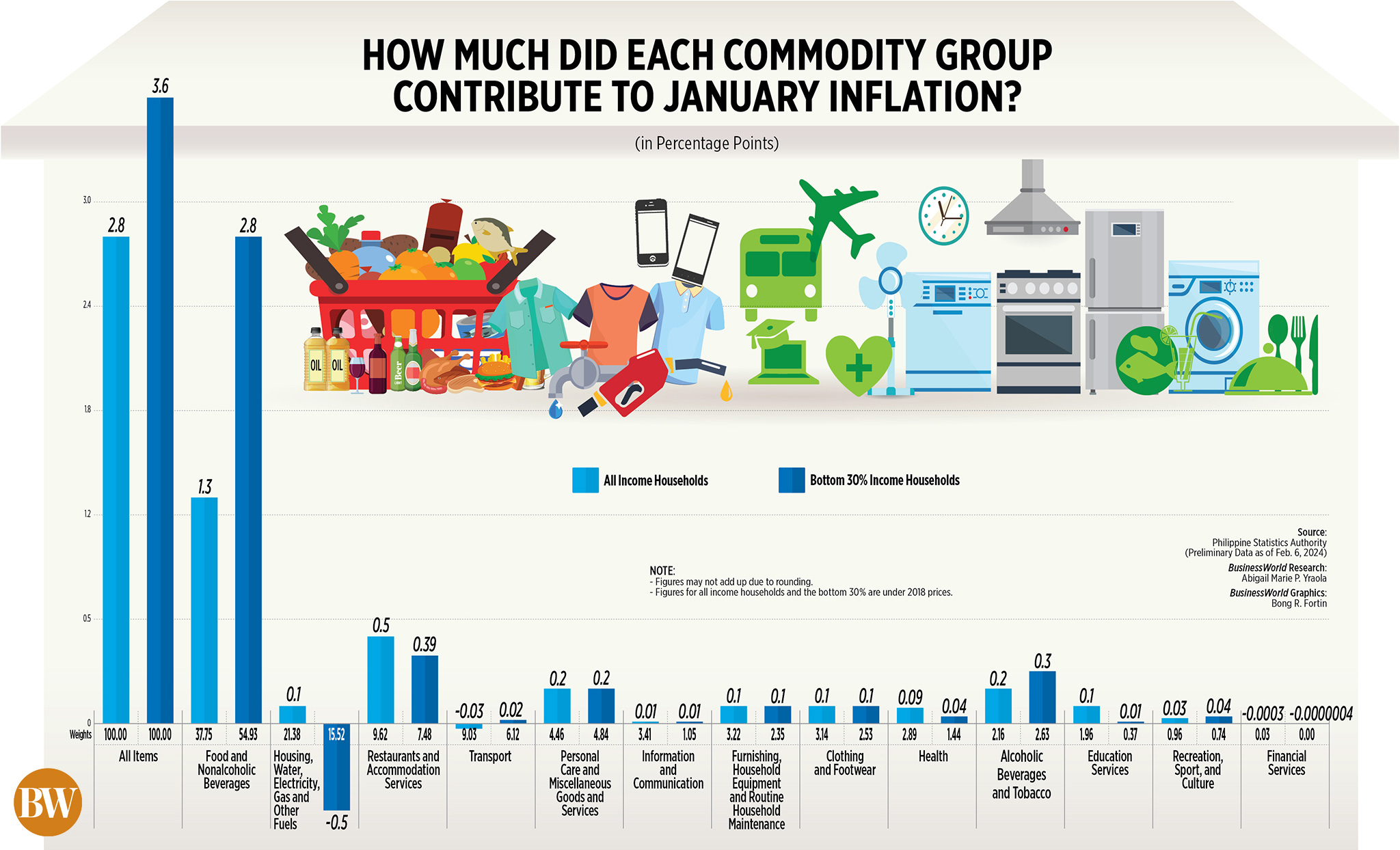

Rice was also the most significant contributor to December inflation, adding 1.3 percentage points to the 2.8% headline print. The commodity has the biggest weight in the overall CPI basket at 8.87%.

Mr. Mapa said the average price of regular milled rice jumped by 2.4% to P49.65 per kilo in January from PHP 48.48 per kilo in December. It also rose by 25.4% from the PHP 39.60 a kilo in January 2023.

The average price of well-milled rice also increased by 2% to PHP 54.91 per kilo in January from an average of PHP 53.82 per kilo a month earlier. Year on year, prices went up by 25% from PHP 43.92 a kilo.

“If we look at rice imports, the prices of rice in the world market are very high,” Mr. Mapa said in mixed English and Filipino.

He also noted that the Philippines had low inflation rates for rice in the first half of 2023 before it started to spike in August and September.

“Rice prices came from a low base last year. Our calculation shows that rice inflation may continue to rise in terms of inflation rates simply because the base is relatively low in 2023,” he said.

“If rice prices continue to remain elevated because of base effects, our expectation is that we will have a rice inflation within the vicinity of 20% or higher until July this year,” he added.

National Economic and Development Authority Secretary Arsenio M. Balisacan said the Inter-Agency Committee on Inflation and Market Outlook is closely monitoring prices of rice and other commodities to provide appropriate policy recommendations.

“We introduce stop-gap measures, as necessary, such as allowing further imports on key commodities until our supply stabilizes at prices affordable to consumers while ensuring remunerative prices for local producers,” he said.

Mr. Balisacan also noted that the Department of Agriculture will continue to monitor on-the-ground developments in addressing food production concerns.

“Rice inflation has a substantial effect (to the headline), but the headline would still depend on the movement of other components of the inflation basket,” PSA’s Mr. Mapa said.

Mr. Mapa said inflation was also driven by slower increases in housing, water, electricity, gas and other fuels, which stood at 0.7% in January, down from 1.5% in December.

He said housing rentals went down in January, in contrast to what happened last year when landlords adjusted rates higher as the economy reopened.

Meanwhile, transport inflation contracted by 0.3% in January, a turnaround from the 0.4% growth in December. Inflation for financial services also declined by 0.6% from zero percent a month prior.

Inflation in the National Capital Region (NCR) decelerated to 2.8% in January from the 3.5% print in December and 8.6% a year ago.

Outside of NCR, consumer prices slowed to 2.8% from 4% a month ago and 8.7% in January 2023.

Inflation for the bottom 30% income households eased to 3.6% in January from 5% in December and 9.7% in the same month in 2023.

“While the general trend we’re seeing is that inflation is going down, we still have threats such as rice prices. And if there are movements in the other commodity items, it could be a source of threat as well to our low inflation rate,” Mr. Mapa said.

“But right now, what we’re seeing is that the overall direction is going down,” he said.

EL NIÑO

According to the BSP, inflation could still accelerate to above the 2-4% target range in the second quarter due to the impact of the El Niño weather condition and positive base effects.

“Key upside risks are associated with potential pressures emanating from higher transport charges, increased electricity rates, higher oil prices, and higher food prices due to strong El Niño conditions,” the BSP said.

A weaker global growth and government measures to mitigate the effects of El Niño could ease some price pressures, the central bank said.

“Looking ahead, the Monetary Board deems it necessary to keep monetary policy settings sufficiently tight until a sustained downtrend in inflation becomes evident,” the BSP said.

It added that the Monetary Board will consider the latest inflation and gross domestic product (GDP) outturn at its first policy review meeting on Feb. 15.

The BSP has kept its benchmark interest rate unchanged at a 16-year high of 6.5% for two straight meetings. This was after it hiked by 450 basis points (bps) from May 2022 to October 2023 to tame inflation.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa in a note said the BSP will likely keep its hawkish tone despite the continued slowdown in headline inflation.

“BSP Governor Eli M. Remolona, Jr. indicated that he was expecting inflation to slide in the first quarter before accelerating sharply in the second quarter, justifying his outlook for rates to stay higher for longer,” he said.

Mr. Remolona had also said the Monetary Board may consider a rate cut in the second half this year, but inflation should be firmly within the 2-4% target.

“If we continue to see inflation moderate well into the second quarter, we do expect BSP to begin to change their tune to signal a pivot, possibly by June,” ING’s Mr. Mapa said.

HSBC economist for ASEAN (Association of Southeast Asian Nations) Aris D. Dacanay in a note said the BSP’s tight monetary stance is working its way through the economy, as reflected with easing core inflation.

“But a bit of caution is warranted. Favorable base effects must fade or turn unfavorable at some point,” he said. “Upside risks to inflation also linger. There are still pending petitions to hike minimum wages and transport fares, not to mention global rice prices that have yet to peak.”

The BSP is expected to keep borrowing costs steady at its meeting next week, Mr. Dacanay said.

“With growth pleasantly surprising to the upside in the fourth quarter of 2023, the BSP has the convenience of time to wait for inflation to really settle within its target band before beginning its easing cycle,” he said.

In the fourth quarter, GDP expanded by 5.6%, slower than the revised 6% GDP growth in the third quarter and the 7.1% expansion in the fourth quarter of 2022. This brought full-year GDP to 5.6% in 2023.

“We also do not think the BSP can cut ahead of the Fed. Maintaining its current rate differential with the Fed will help mitigate any volatility in the USD-PHP and prevent FX (foreign exchange) changes in re-stoking inflation,” Mr. Dacanay added.

The US Federal Reserve kept borrowing costs unchanged at 5.25-5.5% since September last year, following the 525-bp rate hikes it did from March 2022 to July 2023. – Keisha B. Ta-asan, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld