On government debt thresholds: How much is too much?

Learn how the threshold of government debt affects the country’s economy and if you should be worried about it.

Breaching debt thresholds set by external parties is not necessarily a big issue, and any discussion on debt has to be viewed within the context of the existing health crisis, the spending meltdown it has created, and the need to have government spending that (i) stimulates the economy and, more importantly, (ii) protects the population in an unprecedented pandemic. A strong fixation with debt to GDP levels may simply force a government to avoid incurring debts needed to fund vaccines or other public health measures and also leave the economy alone to its own devices and stagnate for lack of stimulus, contrary to sound economy theory and practice.

Is there an ideal debt-to-GDP ratio?

Putting debt into context

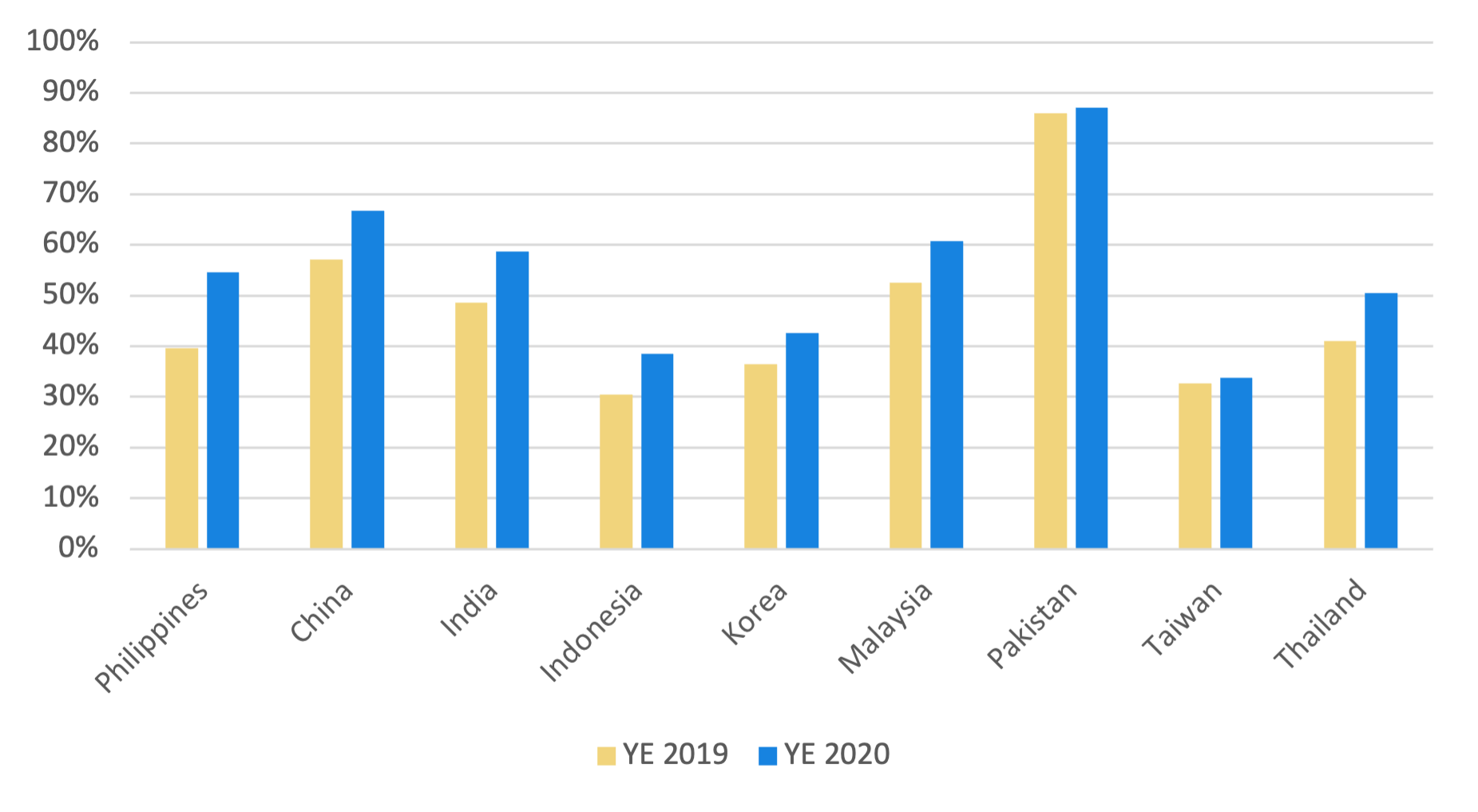

The pandemic has pushed the public debt ratio closer to the 60% threshold that was previously considered as dangerous or high-risk for many emerging markets (EMs) including Philippines, India, and Indonesia. Across EMs in Asia, the average debt/GDP ratio rose to 55% in YE 2020 from 47% before the pandemic.

The GDP massively fell so that by itself increases the debt/GDP ratio. Furthermore, given the need to keep the economy afloat via massive stimulus spending, it is only natural that debt would rise.

Chart 1: Debt to GDP Ratios: Emerging Markets

Why is there a sixty percent threshold?

A 60% threshold was the limit set by the European governments at the onset of 1990s for developed countries to prepare for economic and monetary union and the eventual formation of the euro zone. These thresholds were later adopted by global credit rating agencies, that if breached, could prompt a credit rating downgrade.

It should be noted though that the 60% debt level was imposed on EU countries that would adopt the euro as its official currency to replace their own currencies (deutschmark, francs, etc.). Such countries could not “print euros” upon monetary union and in this sense, the euro is like a foreign currency to them. Thus, the 60% debt to GDP ceiling for the euro zone should be treated as a “foreign currency debt” or “external debt” ceiling for such countries as they could not print their own currency to pay their way out of debt denominated in euros.

However, for countries that borrow in their own currency, that is, in currencies they themselves create, such as in Japan and the US, their debt to GDP ratios are way higher than 60%, with Japan at 237%, the US at more than 106%, and even Singapore at more than 109%.* Yet these countries are by no means basket cases and continue to thrive despite their high debt loads mainly denominated in their own currencies.

Why breaching the 60% debt limit is not worrisome?

The Philippine public debt is projected to hover around 60% of GDP in the medium-term which is still considered manageable and sustainable for the reasons below.

- Majority of the debt is sourced domestically which is a more sustainable borrowing mix in relation to foreign borrowings. This is so because peso debt is just paid in the currency that the country creates. Foreign debt, on the other hand, requires a foreign exchange buffer that is accumulated by earning and building foreign reserves (called GIR- see below), as the country cannot print such currencies on its own.

- Healthy gross international reserves (GIR) level ($106.5 Bn fx reserves as of end-July) that are bigger than the external debt (more below). This means there won’t be any balance of payment crisis since the external debt can be easily paid from existing reserves.

- Manageable external debt ($97 bn as of March). As a solvency indicator, external debt-to-GDP ratio went up to 27.2% in the Q1 2021 vs 21.4% in 2020 and is projected to decline to below 23% in the medium term. The country’s external debt-to-GDP ratio is one of the lowest in ASEAN. As reported by BSP, we are still in a healthy position to service foreign borrowings in the medium to long-term amid the pandemic.

- Low borrowing costs and longer horizon debt, for both domestic and foreign debt, the longer debt horizons to avoid short term cash crunches and thus, problematic liquidity calls.

- Expected economic rebound and fiscal consolidation would lower the debt burden as GDP goes back up.

- Still have fiscal space. As of March 2021, World Bank and IMF sets the public debt threshold at 70% of GDP for advanced and emerging market economies. Debt stock as of end-June 2021 stood at 60.4% from 39.6% pre-pandemic.

Should there be a limit in the first place?

Putting a cap on debt is counterproductive, especially when the pandemic is still upon us, i.e., there is already a crisis and a premature withdrawal of proactive fiscal expansions could put us in an even much worse position.

In essence, debt accumulation is not worrisome as long as interest rates were fixed at low rates, the debt is used for productive capacity (infra projects and yes, health measures to protect the country’s biggest asset, its people), external debt is balanced off by FX flows and GIR, and the projected economic targets are achieved. These should help bring down debt to GDP levels gradually over time, and more importantly, bring about progress for the country.

An International Monetary Fund (IMF) study emphasized that the so-called ‘debt limit’ “is not an absolute and immutable barrier nor should the limit be interpreted as being the optimal level of public debt”. Breaching ‘debt limits’ is not necessarily an indication that a financial crisis is imminent and should not be interpreted too narrowly. The overall context is even more important than these limits, which mean nothing by themselves.

*https://worldpopulationreview.com/countries/countries-by-national-debt.

DOWNLOAD

DOWNLOAD

By Marc Bautista, CFA

By Marc Bautista, CFA