Inflation Update: Green light for easing

DOWNLOAD

DOWNLOAD

December Economic Update: One for them, one for us

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Trade trajectories trend along

DOWNLOAD

DOWNLOAD

Yields on government debt end mixed after US GDP

Yields on government securities (GS) were mixed last week after the Treasury said it plans to issue retail bonds and following the release of US gross domestic product (GDP) data.

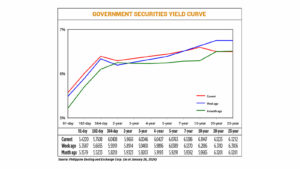

GS yields, which move opposite to prices, went up by an average of 0.18 basis point (bp) week on week, according to the PHP Bloomberg Valuation Service reference Rates as of Jan. 26 published on the Philippine Dealing System’s website.

Rates at the short-end of the curve increased as yields on the 91-, 182-, and 364-day Treasury bills (T-bills) went up by 6.33 bps (to 5.422%), 8.53 bps (5.7508%), and 4.17 bps (6.0408%), respectively.

Yields at the belly likewise climbed, with the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) rising by 7.47 bps (to 5.9661%), 6.46 bps (6.0046%), 5.31 bps (6.0427%), 3.74 bps (6.0763%), and 0.16 bp (6.1286%), respectively.

Meanwhile, tenors at the long end saw their rates decline. Rates of the 10-, 20-, and 25-year debt papers fell by 2.39 bps (to 6.1947%), 18.85 bps (6.1225%), and 18.94 bps (6.1212%), respectively.

Total GS volume reached PHP 19.39 billion on Friday, higher than the PHP 12.43 billion on Jan. 19.

“We saw mainly sideways trading [last] week, with traders grappling between the timing of possible rate cuts here and abroad as well as overall expectation of an RTB (retail Treasury bond) issuance after the DoF (Department of Finance) announced its intention to issue,” a bond trader said in a text message.

DoF Secretary Ralph G. Recto said the government plans to issue the 30th tranche of RTBs within this quarter.

In February 2023, the government raised PHP 283.711 billion from its offering of the 29th tranche of 5.5-year RTBs with a coupon rate of 6.125%.

Lower US Treasury yields due to better-than-expected GDP data there affected GS trading last week, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said.

“The benchmark 10-year US Treasury bond yields corrected lower to 4.1%, still among 1.5-month highs, down from the week’s high of 4.2% posted on Jan. 19,” Mr. Ricafort said in a Viber message.

The US economy grew faster than expected in the fourth quarter amid strong consumer spending, and shrugged off dire predictions of a recession after the Federal Reserve aggressively raised interest rates, with growth for the full year coming in at 2.5%, Reuters reported.

Gross domestic product increased at a 3.3% annualized rate last quarter after advancing at a 4.9% pace in the third quarter, the Commerce Department’s Bureau of Economic Analysis said.

Economists polled by Reuters had forecast GDP rising at a 2% rate. Estimates ranged from a 0.8% rate to a 2.8% pace. The economy is expanding at a pace above what Fed officials regard as the non-inflationary growth rate of 1.8%.

Growth last year accelerated from 1.9% in 2022, and was the fastest in two years. From the fourth quarter of 2022 through the fourth quarter of 2023, the economy grew 3.1%, blowing away economists’ estimates for a 0.1% contraction back in December 2022.

For this week, the market will continue to digest the US GDP data as these could affect the Fed’s next move, the trader said.

Market traders are expecting an 89% chance of rate cut in May as the Fed is believed to keep its rates at its policy meeting on Jan. 30-31, according to the CME FedWatch Tool.

The Fed raised borrowing costs by 525 bps to 5.25-5.5% from March 2022 to July 2023.

The release of Philippine GDP data this week may affect GS yield movements, Mr. Ricafort added.

“If GDP data [is] softer, then there is need for earlier and more local policy rate cuts amid easing inflation data and triggered by Fed rate cuts that would be matched locally,” he added.

The Philippine Statistics Authority is set to release fourth quarter and full-year 2023 GDP data on Wednesday. — M.I.U. Catilogo with Reuters

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld