January 2024 Inflation Updates: Staying the course in early 2024

In our 2024 inflation update, we expect USD/PHP to decline as global markets anticipate Fed rate cuts. Learn more about it here.

A key development in our January 2024 economic update has emerged: The Philippines headline inflation dropped to 3.9% year-on-year in December 2023 from 4.1% in November (+0.16% month-on-month), mainly driven by a slower annual increase in the prices of electricity, LPG, and rentals, followed by lower inflation on vegetables, meats, and coffee and coffee substitutes.

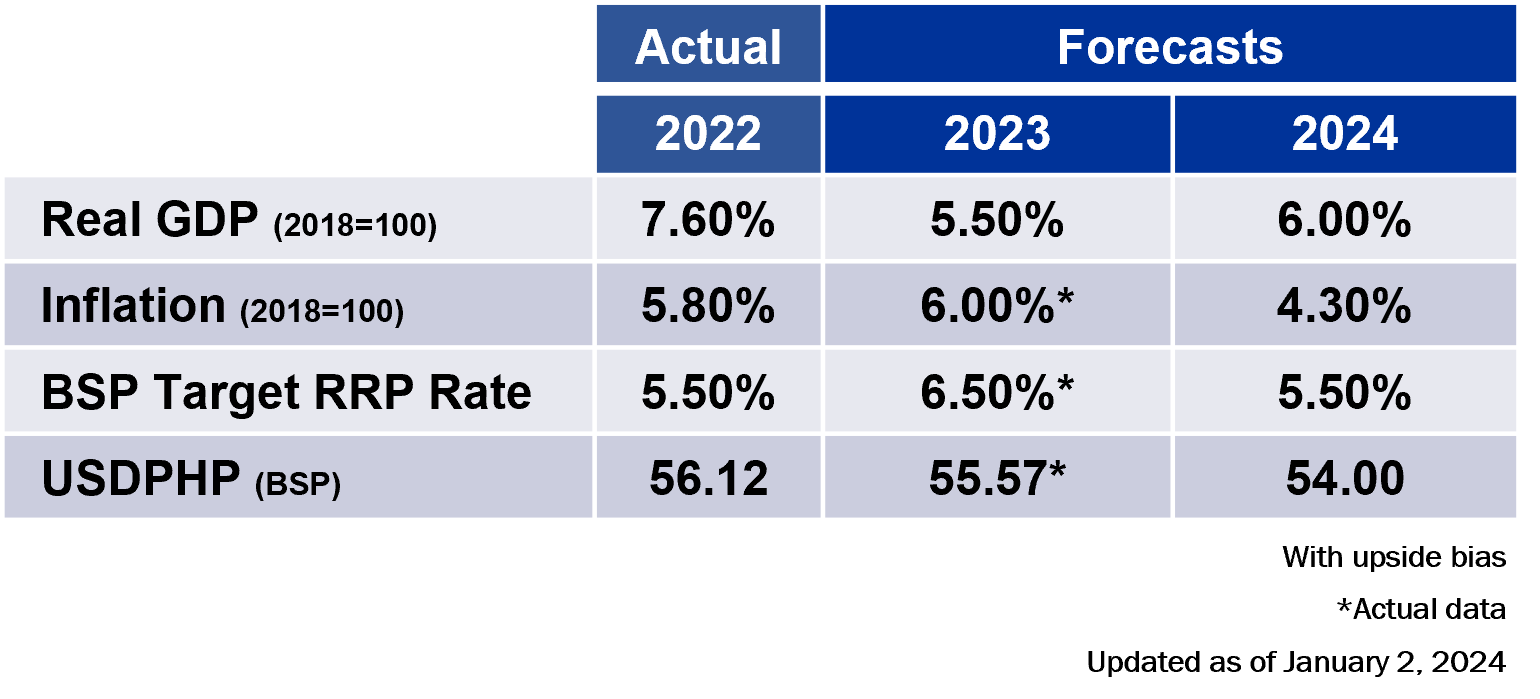

The latest headline print brings full-year 2023 average headline inflation to 6%, noting the highest recorded inflation for the year of 8.7% in January and the lowest recorded inflation for the year in December.

Keeping track of inflation, our January 2024 economic update analysis shows that headline inflation in the Philippines will remain above the BSP’s target band from 2Q2024 onwards, we think that dissipating price pressures in other non-volatile commodity prices as indicated by the move lower in core inflation (from 4.7% in November to 4.4% in December), will make the case for the Bangko Sentral ng Pilipinas (BSP) to consider lowering rates as early as June.

This shift from inflation to disinflation—a slowing rate of price increases—is a positive development for the economy. However, it’s crucial to monitor the situation closely to determine if this trend will persist and potentially lead to deflation, a broad decline in prices.

For more information on the performance and outlook for several macroeconomic indicators, as well as local macroeconomic news, please download the full report below:

January 2024 Updates: Staying the course in early 2024

Continued recoveries in certain industries, in addition to reforms to attract more foreign investments are some of the bright spots that could push the Philippines to a high-growth trajectory.

DOWNLOAD

DOWNLOAD

By Metrobank Research

By Metrobank Research