The Philippines’ finance problems awaiting Ralph Recto in 2024

The new finance secretary Ralph Recto must lead the country to overcome its various financial problems in 2024. How will he size up against this challenge?

A prestigious job often comes with huge challenges. No doubt, as the new finance chief, Ralph Recto instantly gained unparalleled prestige. But after all the praise and applause, he faces three formidable Philippines finance problems.

We list them here, along with what he said he would do to conquer these challenges in the Philippine economy.

The Philippines’ financial problems in 2024

Elevated inflation

Inflation remains a problem, despite its deceleration in recent months. How can Recto help bring the inflation rate to the government’s target of 2-4%. The year 2023 closed with a December inflation rate of 3.9%, which brought down the full-year average headline inflation to 6%, with the highest recorded inflation for the year in January at 8.7%.

The government’s target of at most 4% is going to be a challenge given that we are expecting the risk of upward pressure on rice prices. Rice-exporting countries such as Thailand and Vietnam have said that dry spells and flash floods last year will affect harvests through 2024.

Given the elevated levels of inflation, Secretary Recto committed to protecting consumers, especially the vulnerable, from the impact of elevated prices through the implementation of reform laws that will attract investments in the country.

The law amending the Retail Trade Liberalization Act (RTL), the Foreign Investments Act (FIA), the Public Services Act (PSA), and the Public-Private Partnership (PPP) Code are all expected to attract investments in infrastructure, industry, and services to boost economic growth by 6-7% in 2024.

Growing government debt

The latest government data as of November 2023 show that government debt has risen to PHP 14.5 trillion, which is higher than the PHP 13.8 trillion debt in 2022. The national government’s domestic debt amounted to PHP 10.02 trillion, according to the latest data, while foreign debt reached PHP 4.48 trillion.

The government will be relying largely on Secretary Recto’s leadership to manage government debt through good fiscal management. He said the Department of Finance (DOF) is currently developing a roadmap and a Philippine medium-term debt management strategy (MTDS) aimed at developing a domestic debt market.

Given the high levels of inflation, which exacerbate government debt, he is expected to boost economic resilience.

Boosting government revenues

The government aims to increase government revenues to PHP 4.3 trillion to fund government projects and programs to help the country recover from the finance problems in the Philippines caused by the pandemic. This is 16% higher than the target for 2023.

Since the beginning of the current administration, the government has been ramping up government revenue collection by implementing stricter tax administration measures and introducing digitalization measures for easier tax remittances, especially with the appointment of Romeo Lumagui, Jr., as the chief of the Bureau of Internal Revenue (BIR).

As of November 2023, the government revenue collection has already reached almost PHP 3.6 trillion, just a little short of the annual target of PHP 3.7 trillion pesos. Without the actual figures for December 2023 yet, the government is expecting total revenue collections for the year to reach PHP 3.85 trillion.

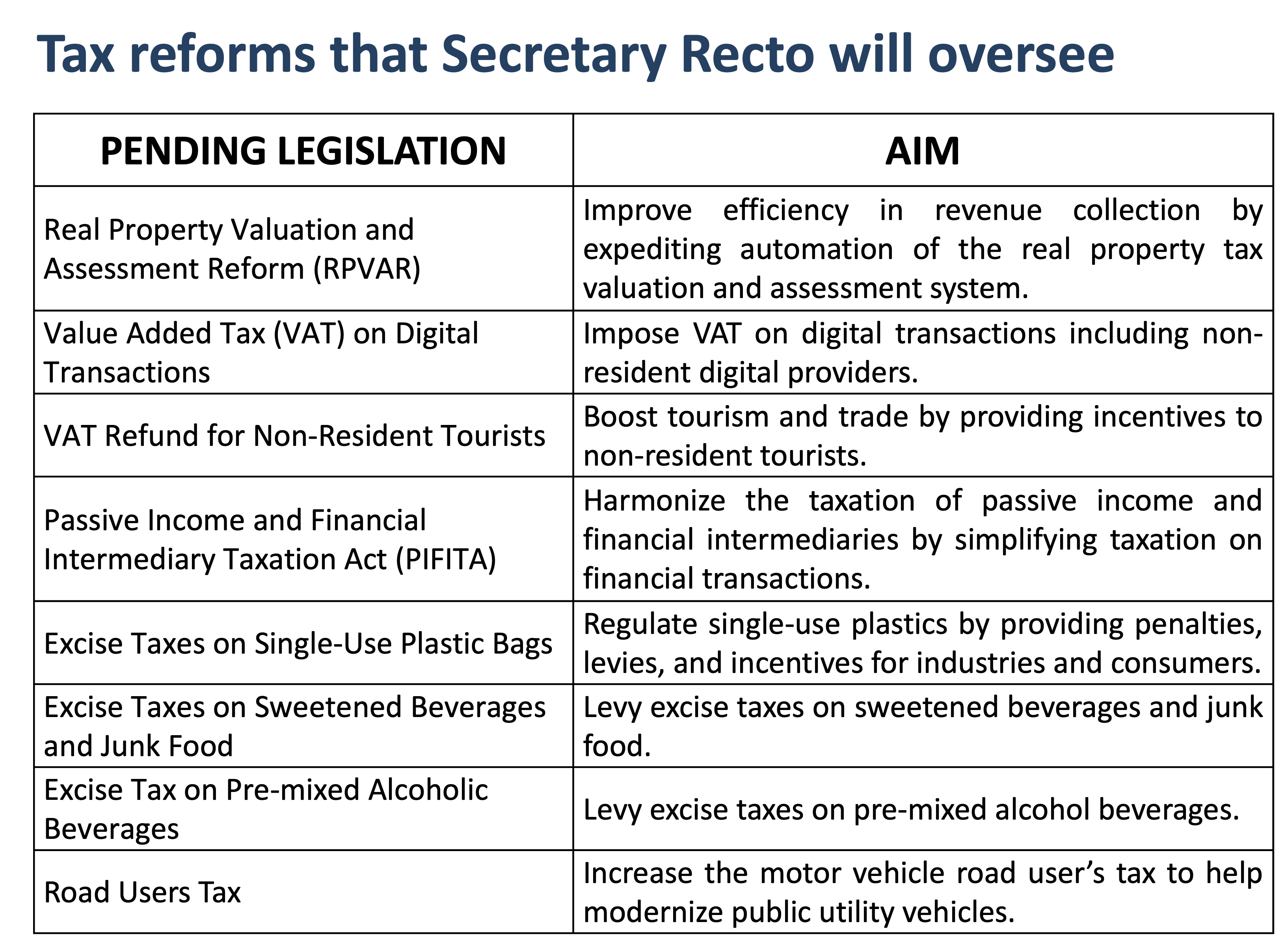

There are pending tax reforms that the DOF has been advocating under former Finance Secretary Benjamin Diokno. However, higher taxes may compel businesses to pass on the tax burden to consumers. With the high level of inflation in 2023, Filipinos may suffer from a double whammy: more taxes that will cut their earnings and higher inflation.

Bringing his experience, qualifications into his role

These challenges may be formidable, but Secretary Recto is bringing with him a wealth of experience and a good dose of optimism.

He is a seasoned government servant with more than three decades of service in both the legislative and executive offices, making him beyond familiar with the Philippines’ finance problems. He has crafted and evaluated laws related to fiscal policies, in particular government revenue generation.

He led relevant committees in Congress, including the Committee on Ways and Means in the Senate and the Committee on Economic Affairs in the House of Representatives. He authored and co-authored various tax measures, including, but not limited to, the Tax Reform for Acceleration and Inclusion (TRAIN) (RA 10963), the Law Increasing the Excise Tax Rates on Alcohol and Tobacco Products (RA 9334), the Amendments to the National Internal Revenue Code (RA 9337) – Reformed VAT & Increase in Corporate Income Tax, and the Tax Amnesty Act (RA 11213).

As a legislator and a public servant, Recto has tried to balance the need for government revenues with his commitment to help ease the tax burden on Filipinos, especially the poor.

That delicate balance is what the Filipino people are looking for.

(Bookmark and visit Metrobank Wealth Insights at www.wealthinsights.ph daily for investment insights and ideas. If you are a Metrobank client, please get in touch with your relationship manager or investment specialist for assistance in accessing exclusive content. Not a client yet? Please sign up here so you can begin your wealth journey with us.)

MARIAN MONETTE FLORENDO is a Research and Business Analytics Officer of the Financial Markets Sector at Metrobank. She provides macroeconomic research for the bank. Her academic background is in Mathematics and Economics. She loves solving puzzles and watching mystery movies.

DOWNLOAD

DOWNLOAD

By Marian Monette Florendo

By Marian Monette Florendo