Monthly Economic Update: Fed catches up

DOWNLOAD

DOWNLOAD

Inflation Update: Steady and mellow

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Growing exports lead to stronger trade balance

DOWNLOAD

DOWNLOAD

More support needed for infrastructure’s post-pandemic recovery

By Luisa Maria Jacinta C. Jocson, Reporter

THE government will need to create a more enabling environment for investments to support the infrastructure sector’s post-pandemic recovery, analysts said.

“On the national front, hard-earned gains might still be lost and global opportunities missed. For instance, our failure to build the manufacturing sector, made worse by the government’s inability to lower energy costs and cut the bureaucratic red tape, has made a lot of investors look elsewhere for opportunities,” Megaworld Corp. First Vice-President for Marketing and Sales Noli D. Hernandez said in a Viber message.

Infrastructure development is one of the Marcos administration’s priority areas. The government is targeting to spend 5-6% of gross domestic product (GDP) on infrastructure annually.

This year, the government plans to spend 5.3% of GDP on infrastructure, equivalent to about P1.29 trillion.

From 2010 to 2018, developing countries used only about 70% of infrastructure investment budgets, according to the World Bank.

A recent note by Nomura Global Markets Research said Philippine infrastructure development is seen to accelerate in the medium term.

“We remain optimistic that infrastructure development in these countries will accelerate in the next few years. Despite the recent improvement, there remains substantial scope for more progress, and governments are setting more ambitious targets to narrow this gap, building on earlier successes,” Nomura said.

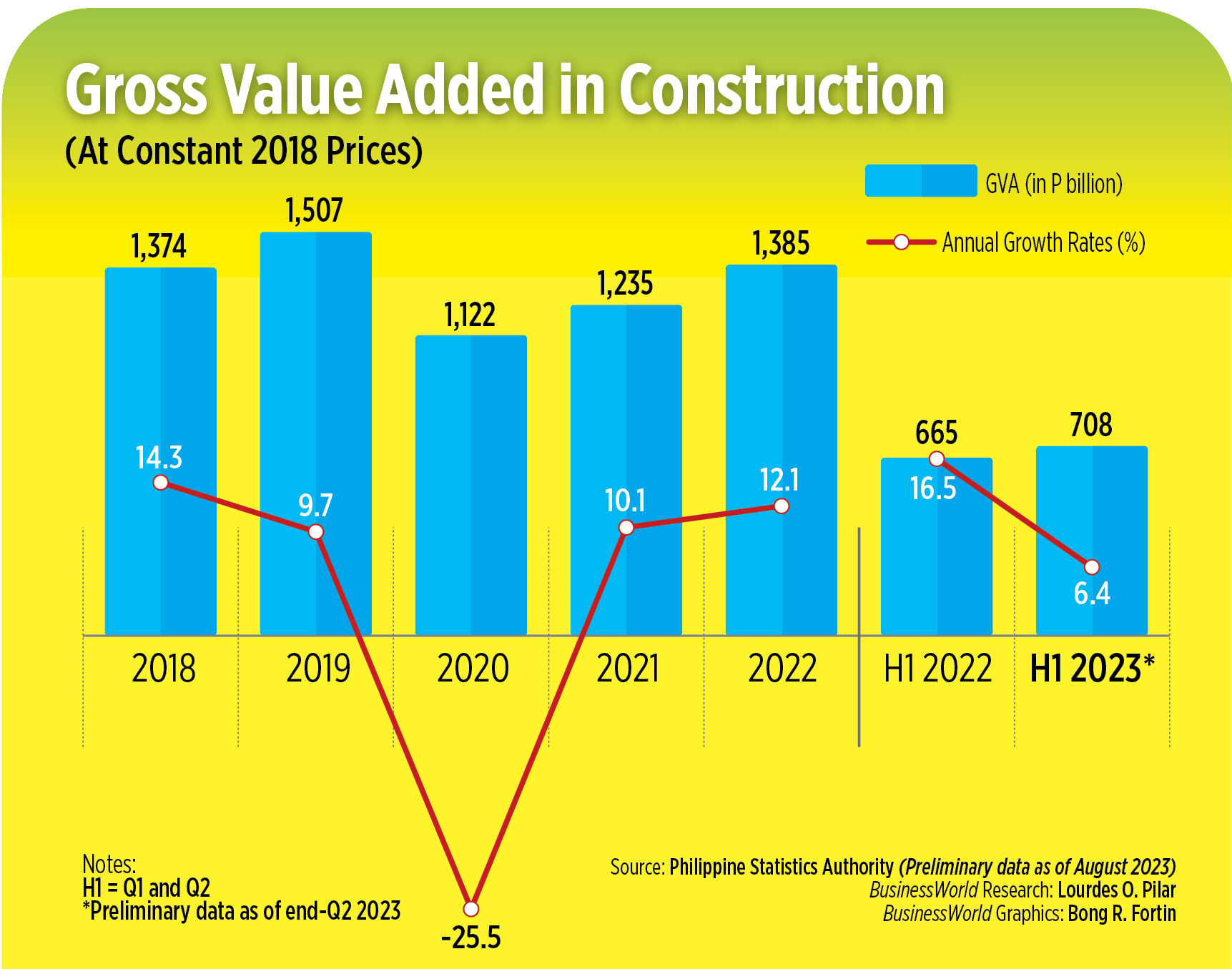

Colliers Philippines Research Director Joey Roi H. Bondoc said the construction sector has yet to return completely to pre-pandemic levels.

“Construction activities have yet to revert to pre-pandemic levels but we are definitely seeing glimmers of hope. In our view, return to pre-pandemic construction levels will likely hinge on interest rate movements, prices of construction materials,” he said in an e-mail.

Mr. Bondoc said that external headwinds will also continue to have an impact on the recovery of construction activities.

“Colliers also believes that overall recovery in demand will also partly rely on sustained business and consumer confidence across the Philippines. The country’s growth trajectory presents enormous opportunities for developers with office, residential, retail, and leisure footprint,” he added.

SUPPORT NEEDED

Sustained growth in government spending will be crucial for the rebound for the sector.

“The most important underlying reason for the recovery of the infrastructure sector has been the sustained and broadening government spending on public infrastructure in the last few years,” Terry L. Ridon, a public investment analyst and convenor of think tank InfraWatch PH, said in an e-mail.

Infrastructure spending rose by an annual 7.8% to P507.2 billion in the first half. Overall infrastructure disbursements in the first six months were equivalent to 5.3% of GDP.

“Despite the coronavirus pandemic and economic headwinds, the government has continued to spend on new roads, bridges and flood control projects in various parts of the country,” he added.

Under the proposed 2024 National Expenditure Plan, the “Build, Better, More” program has been allocated P1.418 trillion. The bulk will go to physical connectivity infrastructure such as seaports, airports, and mass transport.

The National Economic and Development Authority (NEDA) Board has approved 197 flagship infrastructure projects worth P8.71 trillion.

“The government’s massive infrastructure program should benefit the Philippine property market and developers should seize opportunities by strategically launching more office projects, residential enclaves, and hotels in major growth areas,” Mr. Bondoc said.

However, the government’s massive infrastructure commitments are not enough to support the rest of the construction sector.

There is still a need to expedite permitting processes, cut red tape, and create a more enabling environment for investments.

“The challenge of the government is not about allocating the budget, but I think it’s implementation of projects. Some of the projects we are doing today were approved even during Marcos Sr.’s time, and we’re only doing it now,” Phinma Corp. Executive Vice-President Eduardo A. Sahagun said in a Zoom call interview.

“If it takes the same amount of time to do it, we will lag behind. I hope that’s where the bottlenecks must be addressed, how to speed up implementation of projects,” he added.

MORE PPP PROJECTS

The government should pursue more public-private partnerships (PPPs) and joint ventures (JVs) to accelerate the implementation of projects.

“The openness towards public-private partnerships has been an important reform in the infrastructure sector. It is bearing fruit today with the decision to implement a P170-billion solicited bidding for the rehabilitation of the Ninoy Aquino International Airport (NAIA),” Mr. Ridon said.

The government recently invited local and foreign investors to bid for the PPP project to upgrade and operate the NAIA. This will be under a rehabilitate-operate-expand-transfer arrangement, as provided for under the Build-Operate-Transfer Law.

“Local developers should explore firming up JVs with other homegrown players or even foreign property firms. In our view foreign players benefit from their partnership with local players given the latter’s experience in tapping and catering to the preferences of the domestic market,” Mr. Bondoc said.

“What’s notable is that these JVs are likely to result in a more competitive Philippine property landscape, eventually benefiting Filipino investors and end-users,” he added.

The government is hoping to attract more foreign investments after recent economic reforms allowed full foreign ownership in telecommunications, airlines, railways and renewable energy projects.

POST-PANDEMIC STRATEGIES

Meanwhile, companies involved in infrastructure are looking to revamp their internal processes to integrate post-pandemic strategies.

“One of the lessons we’ve learned coming out of the recent downturn, indeed coming out of all the previous downturns, is the primacy of a resilient, innovative, customer-centric and forward-thinking company culture, which fosters not just the aggressive seeking of opportunities but the creation of those opportunities where they seem nonexistent,” Megaworld’s Mr. Hernandez said.

Phinma’s Mr. Sahagun said firms should decentralize their decisions.

“We have to develop internal capabilities. As a company, we have to be agile in adapting to change. The first thing we did was to delegate authorities in different areas so they could make decisions on their own. If you’re just centralized in (one) office, you have no people on the ground, it will be difficult for you to continue doing business,” he added.

The shift to digitalization is also key in the post-pandemic recovery.

“Like most companies, we believe that the only way forward is to leverage our strengths with more human innovation and technological adoption and advances, either by leaps or small increments,” Mr. Hernandez said.

“The advent of artificial intelligence (AI) will definitely and definitively revolutionize and transform not just the way we do things, but ultimately determine exactly what things we are able to do and to what degree of sophistication. In the end however, AI or any other systems or technologies will only always be a tool. The key will always be the company’s culture,” he added.

CLIMATE RESILIENCE

The impact of climate change should also be considered in infrastructure planning, according to Institute for Climate and Sustainable Cities Director for Urban Development Maria Golda P. Hilario.

“The Philippine infrastructure industry must proactively address the risks and projected impact of climate change in its entire supply and value chain. It is important to not only acknowledge the threats posed by extreme weather events — such as typhoons — but also to factor in the creeping impacts of slow onset events — such as sea level rise and increasing temperature,” she said in an e-mail.

The Philippines is among the most disaster-prone countries in the world, experiencing typhoons, flash floods, earthquakes and volcanic eruptions. The Philippines ranked first globally in terms of disaster risk, based on the World Risk Index 2022.

A study by the Asian Development Bank (ADB) showed that developing Asia will need to invest $26 trillion from 2016 to 2030, or $1.7 trillion annually in infrastructure to maintain its growth momentum, eradicate poverty, and adapt to climate change.

“Infrastructure designs especially in urban areas must also be responsive to the risks and projected creeping impacts of slow onset events. Infrastructure development must already look at innovative and sustainable solutions such as green and energy efficient buildings and build around nature-based solutions, such as trees as temperature regulators to trap urban heat, and sinks to arrest flooding,” Ms. Hilario added.

The public, particularly the most at-risk and vulnerable to climate change, should also be included in the process of designing resilient infrastructure.

“The industry must also welcome the voice and participation of the public, especially the most vulnerable and most affected sector in the design, as well as be more responsive in ensuring that infrastructure projects contribute to the broader goal of connecting more people, rather than creating barriers,” she said.

“Sustainability can only be fostered through partnerships not just between the industry, private sector, and the government, but with the buy-in of the Filipino public, who are the main users of infrastructure projects in the long-run,” she added.

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld